Regulated

Regulated

Kucoin

Open Account ReviewContact

- Updating...

- Updating...

- Updating...

- https://cryptoexlist.com/go/kucoin

About Kucoin

KuCoin is a centralized cryptocurrency exchange established in 2017 and registered in Seychelles. Currently, it offers 904 cryptocurrencies and 1,264 trading pairs. The 24-hour trading volume on KuCoin is reported to be $1,908,846,675, with a 43.78% increase in the past 24 hours. KuCoin holds $3,103,124,337 in exchange reserves. The most actively traded pair is BTC/USDT, with a 24-hour trading volume of $550,483,509.| Website | kucoin.com |

| Community | Twitter, Reddit, Telegram, Instagram |

| Address | - |

| # Coins | 891 |

| # Pairs | 1,251 |

| Year Established | 2017 |

Fees

| Deposit | Free |

| Fees | 0.1% |

| Fiat Deposit | AED, ARS, AUD, BGN, BRL, CAD, CHF, COP, CZK, DKK, DZD, EUR, GBP, HKD, HRK, IDR, ILS, INR, JPY, KRW, MXN, MYR, NGN, NOK, NZD, PHP, PLN, RON, RUB, SAR, SEK, SGD, THB, TWD, UAH, USD, VND, ZAR |

| Withdrawal | KCS 2 BTC 0.0005 USDT 10 ETH 0.005 LTC 0.001 NEO Free GAS Free KNC 0.5 BTM 5 QTUM 0.1 EOS 0.5 CVC 3 OMG 0.1 PAY 0.5 SNT 20 BHC 1 HSR 0.01 WTC 0.1 VEN 2 MTH 10 RPX Free REQ 20 EVX 0.5 MOD 0.5 NEBL 0.1 DGB 0.5 CAG 2 CFD 0.5 RDN 0.5 UKG 5 BCPT 5 PPT 0.1 BCH 0.0005 STX 2 NULS 1 GVT 0.1 HST 2 PURA 0.5 SUB 2 QSP 5 POWR 1 FLIXX 10 LEND 20 AMB 3 |

| Accepted Payment Methods | P2P, Apple Pay, Bank Transfer |

| Margin Trading | Yes |

| Market With Fees | Yes |

| Liquidity: | 3 |

| Scale: | 1.0 |

| Cybersecurity: | 1.5 |

| API Coverage: | 0.5 |

| Team: | 0.5 |

| Incident: | 1.0 |

| PoR: | 1.0 |

Liquidity

| Reported Trading Volume: | $1,907,494,508 |

| Normalized Trading Volume: | $1,907,494,508 |

| Reported-Normalized Volume Ratio: | 1.0 |

| Average Bid-Ask Spread: | 0.743 |

Scale

| Normalized Volume Percentile: | 97 |

| Combined Orderbook Percentile: | 94 |

Cybersecurity

| Penetration Test | ✔ |

| Proof of Reserves Audit | ✔ |

| Bug Bounty | ✔ |

Last Updated: 17/12/2024 | Data provided by cer.live

API Coverage

| Grade | A |

| Tickers Data | ✔ |

| Historical Trades Data | ✔ |

| Orderbook Data | ✔ |

| Trading via API | ✔ |

| OHLC Data | ✔ |

| Websocket | ✔ |

| Public Documentation | ✔ |

Last Updated: 19/08/2023

Team

| Team is public | ✔ |

| Team profile page | ✔ |

Advantages / Disadvantages Kucoin

Advantages

- Wide Selection of Cryptocurrencies: Offers trading for over 700 cryptocurrencies, catering to diverse investment needs.

- Low Trading Fees: Competitive fees starting at 0.1% for spot trading, with discounts for using KCS tokens.

- User-Friendly Interface: Intuitive platform for beginners, combined with advanced features for experienced traders.

- Staking and Lending: Earn passive income through staking and crypto lending programs.

- High Liquidity: Ensures smooth and efficient trading for most pairs.

- Global Availability: Accessible in many countries worldwide with no strict KYC requirements for basic features.

- KuCoin Futures: Supports leverage trading for experienced traders.

Disadvantages

- KYC Optional: While convenient, this may raise concerns for users who prioritize stringent compliance.

- High Volatility in Low-Cap Coins: Many lesser-known tokens listed, which can be risky for new investors.

- Limited Fiat-to-Crypto Options: Fewer direct fiat deposit options compared to competitors like Binance or Coinbase.

Finding a reliable exchange can be challenging. Cryptocurrency trading can be an overwhelming space for beginners, but KuCoin exchange simplify the process. Known for its rich feature set and user-centric design, it is a reliable choice for traders at any level. In this guide, we’ll uncover everything you need to know about it, from its features to expert tips, helping you trade with confidence. It has established itself as a trusted platform for both beginners and seasoned traders. With its extensive features, user-friendly interface, and commitment to innovation, it provides an exceptional trading experience. This article dives into all aspects of it, helping you make informed decisions and leverage its tools effectively.

Information You Need to Know About KuCoin Exchange

Since its establishment in 2017, it has grown to serve more than 25 million users in over 200 countries. Its multilingual platform supports traders worldwide, with services tailored to cater to regional needs. KuCoin has positioned itself as an accessible platform for everyone, from beginners dipping their toes into crypto to experienced traders looking for advanced tools.

The exchange’s commitment to inclusivity is evident in its onboarding process. Users can start trading with minimal deposits, making it a go-to platform for those who want to explore the market without a large initial investment.

- KuCoin’s Global Presence: It is available in over 200 countries and supports a multilingual platform, catering to a diverse user base. Its robust infrastructure ensures reliable uptime, even during peak trading periods. For instance, in 2022, it reported handling over $1 trillion in trading volume, reflecting its popularity and trustworthiness.

- Security Measures: Security is a priority for trading on any exchange platform. The exchange employs advanced encryption protocols, multi-factor authentication (2FA), and cold storage to protect user assets. Additionally, its Safeguard Program compensates users in case of any unforeseen security breaches, ensuring peace of mind for traders.

KuCoin’s combination of low fees, extensive features, and a robust community distinguishes it from other exchanges. Unlike platforms that focus solely on trading, it aims to provide an all-encompassing experience that caters to diverse needs. Moreover, KuCoin’s proactive approach to user feedback ensures constant improvements. Whether it’s adding new cryptocurrencies, enhancing security measures, or introducing innovative tools, it remains at the forefront of the crypto industry.

Trading Products and Services

KuCoin offers a broad range of products, making it a one-stop platform for diverse trading needs:

- Spot Trading: Trade over 700 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The platform supports various trading pairs, such as BTC/USDT and ETH/USDC.

- Futures Trading: KuCoin Futures allows traders to speculate on price movements with leverage up to 100x, amplifying potential gains and risks.

Staking and Lending: Users can earn passive income through staking popular tokens like DOT and ATOM or participate in the KuCoin Earn program to lend assets and earn interest. - Trading Bot: KuCoin’s AI-powered trading bots help automate trades, making it easier for beginners to execute strategies like grid trading.

For example, a trader using the Trading Bot in 2023 reported an average profit increase of 15% by automating buy-low, and sell-high strategies. - Community and Rewards: KuCoin’s commitment to community building is another factor that sets it apart. Through initiatives like KuCoin Earn, users can stake or lend their assets to generate passive income. For example, staking KCS (KuCoin Token) not only reduces trading fees but also offers an annual yield, rewarding long-term holders.

The platform also runs regular promotions, airdrops, and competitions, fostering engagement and providing additional earning opportunities.

KuCoin’s Fee Structure

Understanding fees is vital for managing trading costs effectively. It adopts a tiered fee structure based on a user’s 30-day trading volume and KCS holdings.

- Spot Trading Fees: Start at 0.1% for both makers and takers. Users holding KCS can enjoy a 20% discount, reducing fees to 0.08%.

- Futures Fees: Futures trading fees are slightly lower, with maker fees starting at 0.02% and taker fees at 0.06%.

- Withdrawal Fees: These vary depending on the cryptocurrency. For example, the Bitcoin withdrawal fee is 0.0005 BTC.

For high-volume traders, its VIP program offers even lower fees, competitive with top exchanges like Binance and Coinbase.

Simple Guide to Getting Started with KuCoin

Navigating KuCoin for the first time? Follow these steps to start trading seamlessly:

- Create an Account: Visit the KuCoin website or download the mobile app. Sign up using your email or phone number.

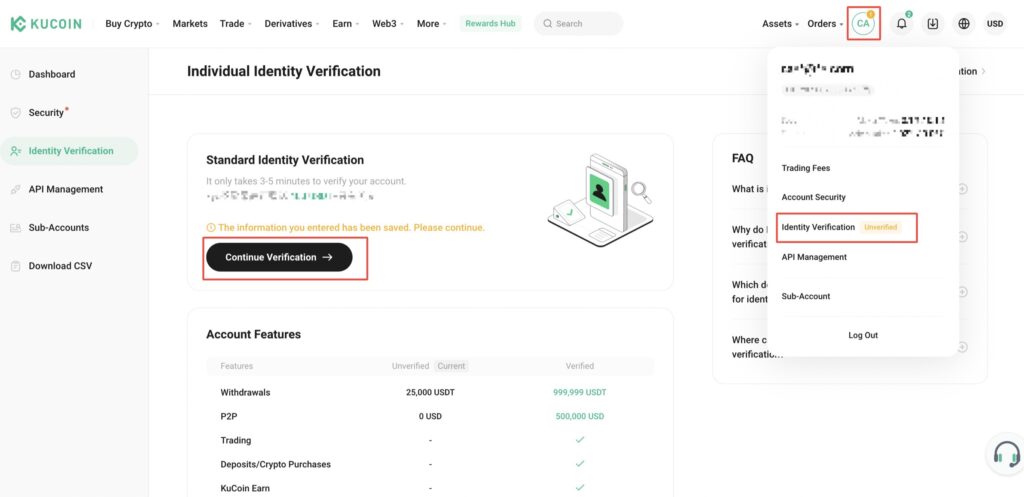

- Complete Identity Verification: For enhanced security and access to features like higher withdrawal limits, complete the KYC process by submitting your ID and proof of residence.

- Deposit Funds: Add assets to your account via bank transfer, credit card, or cryptocurrency deposits. For instance, you can deposit USDT to trade with multiple pairs.

- Explore the Dashboard: Familiarize yourself with its interface. The dashboard offers an overview of markets, open orders, and trading history.

- Start Trading: Select a trading pair, analyze the chart, and place your order. You can choose between market, limit, or stop-limit orders.

Pro Tip: Use the Demo trading feature to practice strategies without risking real money.

Some Beginner Tips for Trading on KuCoin

If you’re new to KuCoin, adopting the right strategies can significantly enhance your trading experience and profitability. Here are detailed and practical tips to help you get started:

Set a Clear Budget and Trading Goals

- Start Small: Begin with an amount you can afford to lose, such as $50-$200. This allows you to familiarize yourself with the platform without undue stress.

- Establish Goals: Define your objectives. Are you trading for short-term profits or long-term investments? Clear goals will guide your decisions and prevent impulsive actions.

For example, a beginner might allocate $100 to experiment with low-risk trades while using $50 for higher-risk options like futures.

Utilize Risk Management Strategies

- Set Stop-Loss and Take-Profit Orders: Protect your investments by automating exits. For example, if you buy Bitcoin at $30,000, set a stop-loss at $29,000 to limit losses and a take-profit at $32,000 to secure gains.

- Follow the 1% Rule: Avoid risking more than 1% of your trading capital on a single trade to minimize potential losses.

Example: With a $500 portfolio, limit your risk to $5 per trade by adjusting your position size or stop-loss distance.

Diversify Your Portfolio

- Balance Your Investments: Avoid concentrating all your funds in one asset. Diversify across stablecoins, high-cap cryptocurrencies like Ethereum, and promising altcoins.

- Allocate Based on Risk: Consider allocating 50% to established coins, 30% to mid-cap coins, and 20% to speculative assets.

Example: A diversified portfolio could include Bitcoin (50%), Solana (30%), and a smaller allocation to emerging tokens like APT (20%).

Use KuCoin’s Advanced Tools

- Leverage Trading Bots: Its trading bots, like the Spot Grid or DCA bot, automate strategies to maximize returns in volatile markets.

- Stake and Earn: Use KuCoin Earn to generate passive income through staking and flexible savings.

Example: A user staking Polkadot (DOT) through KuCoin Earn might earn an annual yield of 15%, supplementing their trading profits.

Educate Yourself Continuously

- Explore Educational Resources: It offers tutorials, blogs, webinars, and even demo accounts for practice.

- Follow Market Trends: Stay informed about the crypto landscape by reading reputable sources like CryptoExlist and CoinTelegraph.

- Understand Technical Analysis: Learn to read charts, identify trends, and use indicators like RSI or MACD for better decision-making.

Frequently Asked Questions

New users often have queries about the platform. This section answers the most common questions to provide clarity and confidence in using KuCoin. It is a powerful platform with a wide range of features that can sometimes leave new users with questions. Below, we address unique and in-depth queries to guide you through your trading journey.

1. What Makes KuCoin Different from Other Exchanges?

This platform stands out for its extensive range of trading pairs, low fees, and innovative features. With over 700 cryptocurrencies supported, it is one of the most diverse exchanges globally. In addition, it offers unique services like trading bots, an integrated peer-to-peer marketplace, and access to early-stage crypto projects through KuCoin Spotlight.

2. Can I Use This Exchange as a Beginner?

Yes, it is beginner-friendly thanks to its intuitive interface and educational resources. The platform features:

- Demo Trading Accounts: Practice trading with virtual funds to gain confidence.

- Beginner’s Zone: Tutorials, step-by-step guides, and FAQs designed to help new users navigate the platform.

- One-Click Buy: Purchase crypto with just a few clicks using fiat currencies.

3. How Does The Platform Handle Security Breaches?

It has a proven track record of resolving security incidents. For instance, during the 2020 breach where $280 million in assets were compromised, it recovered 84% of the stolen funds and covered the remaining losses using its insurance fund. Such measures have solidified its reputation as a secure platform.

4. What is KuCoin’s Trading Bot, and How Does It Work?

It offers built-in trading bots for automated strategies. Users can choose from preset bots or customize their own, including:

- Spot Grid Bot: Buys and sells automatically based on price fluctuations.

- Futures Grid Bot: Focuses on futures contracts to maximize profits in volatile markets.

- Dollar-Cost Averaging Bot: Automates regular investments, perfect for long-term strategies.

Example: A user sets a Spot Grid Bot to trade Bitcoin within a $30,000-$35,000 range, earning profits from small price fluctuations.

5. Can I Earn Rewards Through KuCoin’s Referral Program?

Yes, its referral program allows users to earn up to 40% of the trading fees paid by their referrals. By sharing a unique referral code or link, you can build a network of traders and receive passive income as they trade.

KuCoin stands out as a versatile and user-friendly crypto exchange, catering to traders of all levels. Its robust security, diverse trading options, and community-driven approach make it a preferred choice among cryptocurrency enthusiasts. By following this comprehensive guide, you’re well-equipped to explore KuCoin’s offerings and make informed trading decisions. Whether you’re a beginner or a seasoned trader, it provides the tools and resources to enhance your crypto trading experience.