-

- Powerful trading system for fast and accurate transactions

- No KYC required for trading

- Leverage trading up to 125x

- Multi-platform support

- High security with cold wallet storage and data encryption

- Low trading fees

-

- Emphasizes social trading features like copy trading, making it easy to follow experienced traders.

- Wide range of derivatives

- Provides competitive fees and discounts for using their native token, BGB.

- Growing ecosystem with features like launchpads

- Offers a clean and intuitive interface for both web and mobile platforms.

- Employs multiple security measures, including cold storage and 2FA

- Provides helpful customer support channels

-

- Multi-platform support: Web, mobile app (iOS, Android), and API.

- High liquidity

- Wide variety of cryptocurrencies

- Top-notch security

- Low trading fees

- Margin trading with leverage up to 125x

- Fiat trading options

-

- Competitive trading fees

- High leverage of up to 100x

- Smart trading tools like Copy Trading, TradeGPT, and TradingBot

- Bybit Learn - a comprehensive knowledge platform for traders

- 24/7 customer support

- Attractive promotional programs

-

- The world's largest cryptocurrency exchange by trading volume

- Competitive trading fees, further reduced with their native token, BNB.

- Supports spot trading, margin trading, futures, NFTs, staking, and more.

- Provides a wide range of charting tools, technical indicators, and order types

- Available in numerous languages and caters to users worldwide.

- Employs robust security measures

- Continuously introduces new features, products, and services

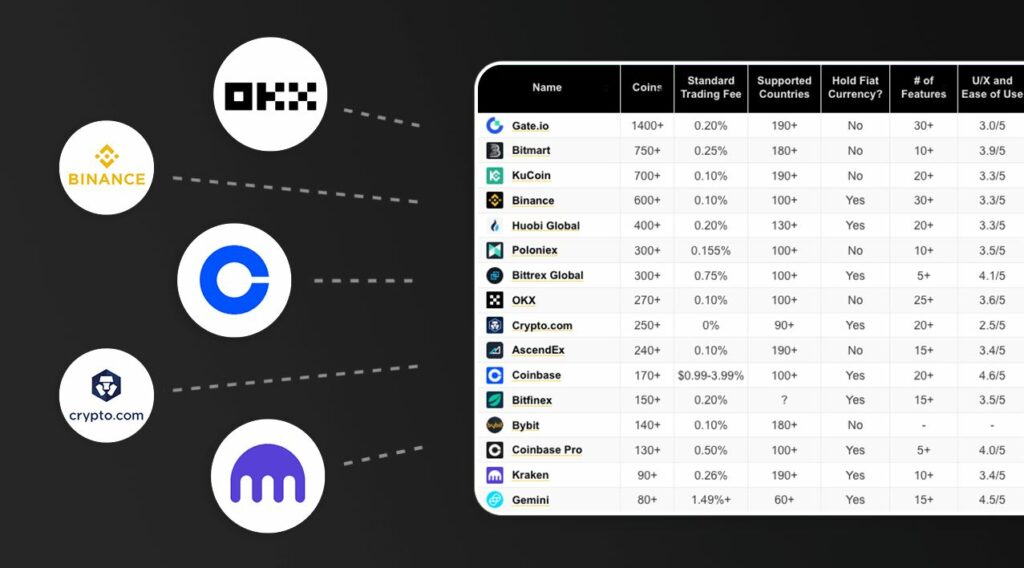

The cryptocurrency market is experiencing explosive growth with millions of people worldwide investing in digital assets such as Bitcoin and Ethereum. This growth has led to a surge in platforms for buying and selling cryptocurrencies. Choosing the right exchange is crucial to ensure a safe and efficient trading experience. This article reviews 20 of the best crypto exchanges in the world, providing detailed insights into their features, trading fees, security measures, and unique services.

Criteria for Evaluating Crypto Exchanges

Selecting a reliable crypto exchange is crucial for both beginner and experienced traders. The right platform ensures the safety of your funds, smooth trading, and a seamless user experience.

The review by CryptoExlist was researched and conducted by financial expert Eric Tang, who has many years of experience in blockchain technology and cryptocurrencies. Mr. Tang and the expert team are committed to providing objective reviews based on key criteria to ensure accuracy and transparency, such as:

Security – The Foundation of Trust

Security should always be the top priority when choosing a crypto exchange. With the increasing number of cyberattacks in the cryptocurrency space, a platform must employ robust security measures to protect users’ funds and personal information. Here are essential security features to look for:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring two forms of verification before account access.

- Cold Storage Solutions: Reputable exchanges store the majority of users’ funds in offline, cold wallets, minimizing the risk of hacks.

- Data Encryption: Strong encryption protocols ensure that sensitive information, such as personal details and transaction history, is protected from breaches.

- Proof of Reserves (PoR): Exchanges that provide transparent audits of their reserves demonstrate accountability and ensure solvency.

- Track Record: Choose platforms with a history of no major security breaches or fraud incidents.

High Trading Volume – Ensuring Liquidity

High trading volume is another critical factor. It reflects the platform’s popularity and trust among traders, ensuring liquidity and efficient transactions. A liquid market minimizes slippage—the difference between expected and actual trade execution prices—allowing users to buy and sell assets quickly and at fair prices. High trading volumes also indicate a broad range of participants, making it easier to execute large trades without impacting market prices.

Transparency

Transparency is essential for building trust between the exchange and its users. Reliable platforms openly share information about their operations, team members, and financial practices. Here’s what to look for:

- Public Leadership: Exchanges that disclose the names and profiles of their founders, CEOs, and key team members are generally more accountable.

- Proof of Compliance: Reliable exchanges adhere to regulatory standards and make their licenses publicly available.

- Clear Terms and Policies: Look for platforms that provide detailed guides on fees, trading rules, and withdrawal processes.

- Regular Audits: Exchanges that undergo frequent third-party security and financial audits demonstrate their commitment to transparency.

User Experience

A well-designed user experience is essential, particularly for beginners. Intuitive interfaces make it easier for new traders to navigate the platform, while advanced features like customizable charts and technical analysis tools cater to experienced users. Mobile apps are equally important, providing flexibility for users to trade on the go. Platforms that support multiple languages and local currencies offer added convenience for global traders.

Other Factors

Finally, there are some other factors to consider:

- Trading Fees: Exchanges charge fees for various activities, such as trading, depositing, and withdrawing funds. Lower fees can significantly impact your profitability.

- Cryptocurrency Variety: A diverse list of coins allows you to explore different investment opportunities and diversify your portfolio.

- Unique Features: Some exchanges offer unique features like staking, margin trading, or advanced order types that can enhance your trading experience. You can clearly see how our CryptoExlist team evaluates reputable crypto exchanges through the published “Evaluation Process”.

- Customer Support: In the fast-paced cryptocurrency market, responsive and effective support can prevent costly mistakes or delays. Reliable exchanges provide 24/7 live chat or phone support to address urgent issues. Comprehensive help centers, FAQs, and tutorials empower users to resolve problems independently.

You can clearly see how our CryptoExlist team evaluates reputable Crypto exchanges through the published Evaluation Process.

Review of the Top 20 Best Crypto Exchanges

Whether you’re a seasoned trader or just starting your crypto journey, this review of 20 top exchanges will help you find the platform that best suits your needs:

Binance

Binance is the world’s leading crypto exchange with the highest trading volume and a massive user base of over 235 million registered users across 180 countries. Founded in 2017 by Changpeng Zhao, Binance quickly gained popularity due to its low fees, fast transaction processing speeds, and extensive crypto listings. Remarkably, Binance became the world’s largest crypto exchange within just six months of its launch and has maintained its leading position ever since.

Binance does not have an official headquarters, having moved its operations from China to Japan and then Malta.

Key Features:

- Spot Trading: Binance offers both basic and advanced spot trading platforms, catering to both beginners and experienced traders.

- Futures Trading: Users can trade futures contracts with leverage of up to 125x.

- Margin Trading: Borrow funds to amplify your trading positions.

- Staking: Earn passive income by staking your cryptocurrencies.

- Binance Earn: Explore various options to earn passive income, including flexible savings and fixed-term deposits.

- Binance Visa Card: Spend your cryptocurrencies at millions of retailers worldwide.

Trading Fees:

Binance stands out with its significantly lower trading fees compared to other exchanges, making it a popular choice for investors. Currently, it charges a standard trading fee of 0.1% for regular users. VIP users can enjoy lower fees based on their trading volume and BNB balance. Using BNB to pay fees offers a 25% discount. Binance is known for having some of the lowest cryptocurrency trading fees and provides discounts for users paying with BNB.

Bybit

Bybit is a popular crypto exchange known for its advanced trading tools, user-friendly interface, and focus on derivatives trading.Founded in 2018 by Ben Zhou, Bybit has quickly become a favorite choice for both beginners and experienced traders.

In the past year, Bybit’s registered user base has tripled from 20 million to nearly 60 million, a testament to the platform’s ability to attract and retain a rapidly growing global user base. Bybit currently averages $33 billion in daily trading volume in the past quarter. It focuses heavily on crypto derivatives, supporting various flexible trading methods, including futures, perpetual contracts, and options, with leverage up to 100x. The exchange continually develops tools to help users optimize their strategies and enhance trading efficiency. Notable tools include TradeGPT, Copy Trading, and TradingBot.

Key Features:

- Derivatives Trading: Bybit offers a range of derivatives products, including perpetual contracts, futures, and options.

- Spot Trading: Trade various cryptocurrencies at market prices.

- Copy Trading: Follow and copy the trades of successful traders.

- NFT Marketplace: Buy, sell, and trade NFTs.

Trading Fees:

Bybit uses a maker-taker fee model. For spot trading, both maker and taker fees are 0.1%. For perpetual and futures trading, the taker fee is 0.055% and the maker fee is 0.02%. Options trading has a taker fee of 0.02% and a maker fee of 0.02%.

OKX

OKX, formerly known as OKEx, is a Seychelles-based crypto exchange founded in 2017. The exchange offers a wide range of trading products and services, catering to both individual and institutional investors. OKX exchange services are provided by entities established in Seychelles and registered in the Bahamas.

Key Features:

- Spot Trading: Trade various cryptocurrencies with basic and advanced order types.

- Derivatives Trading: Access margin trading, futures, perpetual swaps, and options.

- OKX Earn: Earn passive income through savings, staking, and DeFi products.

- OKX Wallet: A multi-platform wallet to store and manage your digital assets.

- NFT Marketplace: Buy, sell, and trade NFTs.

Trading Fees:

OKX users are divided into two main groups: Regular Users and VIP Users. With Regular ones, OKX fees depend on the number of OKB tokens held, while VIP users are categorized by their total assets and trading volume over the past 30 days. And if users qualify for multiple levels, they are automatically assigned the most favorable fee rate.

We’ll take an example of spot trading fees on OKX:

- Regular Users: Fees for Makers range from 0.06% to 0.08%, and for Takers, 0.06% to 0.1%, depending on the number of OKB tokens held.

- VIP Users: Fees for Makers range from 0.02% to 0.045%, and for Takers, 0.015% to 0.05%. High-volume traders (over $500M in 30 days) may receive fee discounts or even cashback.

Bitget

Founded in 2018 by Sandra Lou (CEO & Co-founder), Bitget is for its innovative features, strong security measures, and competitive fees. Headquartered in Seychelles, it is recognized as a leading platform for futures trading. Bitget offers a range of trading and earning features suitable for both novice and professional traders.

With over 400 cryptocurrencies and numerous trading pairs available, Bitget has become a trusted choice for both beginners and experienced traders. The platform boasts more than 8 million registered users and an average daily trading volume of $10 billion.

Key Features:

- Spot and Futures Trading: Bitget allows users to easily buy and sell crypto with low fees, especially when using its native token, BGB. It also offers futures trading with leverage of up to 125x.

- Copy Trading: This is one of Bitget’s standout features, allowing users to copy the trades of other successful traders. The platform offers four main types of copy trading: futures trading, spot trading, copy trading bots created by experts, and skilled traders can create and rent out their own trading bots.

- Margin Trading: Bitget allows margin trading with various cryptocurrencies.

- Staking: Users can earn passive income by staking BGB tokens or participating in structured products like Dual Investment, SharkFin, and Range Sniper.

- Launchpad, Savings, and Earn: Bitget offers a Launchpad platform for investing in new cryptocurrency projects, flexible and fixed savings products, as well as attractive affiliate/referral programs.

Trading Fees:

Bitget uses a maker-taker fee model. Spot trading fees are 0.1% for both makers and takers. Futures trading fees are 0.02% for makers and 0.06% for takers. Users can get an additional 20% discount when paying fees with BGB tokens.

Especially, ioining copy trading on Bitget is free of charge. Up to 10% of the profits earned is allocated to the trader being followed. The exact percentage depends on the amount of BGB held and locked by the trader.

MEXC

MEXC is a global cryptocurrency exchange established in 2018, offering a wide range of trading features and options. The platform is known for its user-friendly interface, strong security measures, and low fees. MEXC is one of the few crypto exchanges that complies with both GDPR and Fincen regulations. It has also developed an advanced risk management system and anti-DDoS measures to prevent cyberattacks.

Currently, the platform handles a trading volume of $1 billion, with an impressive order matching speed of 1.4 million transactions per second, serving over 7 million users worldwide. These features make MEXC a secure and reliable choice for trading.

Key Features:

- Spot and Futures Trading: MEXC supports spot and futures trading with leverage of up to 200x.

- Extensive Cryptocurrency Support: MEXC offers trading for over 2,500 coins and over 2,900 trading pairs.

- Copy Trading: Allows users to easily copy the trades of experienced investors.

- Launchpad: MEXC Launchpad provides users with early investment opportunities in new projects.

- Staking: Users can stake their cryptocurrencies to earn passive income.

Trading Fees:

MEXC has very competitive trading fees. Maker and taker fees for spot trading are 0%. For futures trading, the maker fee is 0% and the taker fee is 0.01%. Users holding MEXC’s MX token can enjoy trading fee discounts of up to 50%.

Additionally, MEXC sets a clear daily trading limit of up to 5 BTC. Users can trade without needing to complete KYC verification, providing a convenient option for participants. This feature highlights MEXC’s commitment to making trading more accessible.

Gate.io

Gate.io is a long-standing crypto exchange established in 2013, offering a variety of advanced trading features and a wide range of DeFi options. The exchange is headquartered in the Cayman Islands and supports over 2,500 cryptocurrencies with over 4,235 trading pairs.

Gate.io is one of the largest exchanges globally, with impressive trading volumes. In 2019, the platform raised $83 million through an ICO with its GT token.

Key Features:

- Spot, Futures, and Margin Trading: Gate.io offers spot trading with leverage of up to 10x for some assets, futures trading with both perpetual and delivery contracts, and margin trading.

- Copy Trading and Trading Bots: Gate.io provides copy trading tools and automated trading bots to help users optimize their trading strategies.

- NFT Marketplace: Users can buy, sell, and trade NFTs on Gate.io’s NFT marketplace.

- Staking: Gate.io offers flexible and fixed staking options for users to earn passive income.

- Pre-Market Trading: Allows users to trade new tokens before they are officially listed on the exchange.

Trading Fees:

Gate.io uses a maker-taker fee model. The standard spot trading fee is 0.2% for both makers and takers. For futures, the maker fee is 0.02% and the taker fee is 0.05%. Users can get fee discounts by using Gate.io’s GT token or participating in the VIP program.

Gate.io has the following trading fees for other popular services:

- P2P trading: Free, with the seller setting the fee.

- Margin trading fee: 0.02 – 0.1% depending on leverage.

- Trading fees for options, perpetual contracts, and CBBC: Listed separately.

- Gate.io also offers various payment options to help users optimize their trading costs.

BitMart

BitMart is a centralized crypto exchange founded in 2017, offering digital asset trading and investment services to over 9 million users globally. The exchange is registered in the Cayman Islands and provides a variety of features for its customers, including staking, lending, savings products, derivatives contracts, and extensive spot trading options.

It is a popular choice for many traders because it does not require Know Your Customer (KYC) verification, allowing users to trade with privacy. Despite this, BitMart ensures security, so users can be confident they are trading on a safe and reliable platform.

Users can buy, sell, and trade more than 1,500 coins and tokens, which is three times more than major exchanges like Binance and Coinbase. BitMart also offers access to perpetual tokens, non-fungible tokens (NFTs), and other earning products.

Key Features:

- Spot, Margin, and Futures Trading: BitMart offers spot trading with over 1,000 digital assets and over 700 trading pairs, margin trading with leverage of up to 5x, and futures trading with over 100 contracts.

- Copy Trading: Allows users to copy the trades of other successful traders.

- NFT Marketplace: BitMart has its own NFT marketplace where users can explore, buy, and trade premium NFT collections worldwide.

- Staking and Savings: BitMart offers flexible and fixed staking and savings products for users to earn passive income from their digital assets.

- Fiat Payments: Users can purchase cryptocurrencies using credit/debit cards, bank transfers/wire transfers, or Apple Pay.

Trading Fees:

BitMart has a tiered fee structure that utilizes a Maker-Taker model. Fees start from 0.25% for both makers and takers. Trading fees are based on 30-day trading volume (denominated in BTC) and BMX balance. For spot trading, the average user (LV1) will pay a basic fee. There are different asset types, such as Type A, B, and C, each with its own fee. For example, if you are a LV1 user and do not hold BMX, the maker fee for BTC/USDT (Type A) is 0.09% and the taker fee is 0.1%. If you hold BMX, the maker fee is reduced to 0.068% and the taker fee to 0.075%.

Futures trading fees are much lower and competitive, with a maker fee of 0.04% and a taker fee of 0.06%. Additionally, holding BitMart’s BMX token gives users a 25% discount on fees.

Remitano

Remitano is a peer-to-peer (P2P) crypto exchange founded in 2014, allowing users to buy and sell cryptocurrencies directly with each other. The platform is known for its user-friendly interface, simple registration process, and focus on emerging markets. Remitano is headquartered in Seychelles and supports a variety of fiat currencies and cryptocurrencies.

Key Features:

- P2P Trading: Users can buy and sell cryptocurrencies directly with each other using various payment methods, including bank transfers, cash, and mobile wallets.

- Swap: The Swap function allows users to quickly convert between different cryptocurrencies or between crypto and fiat currencies.

- Remitano Wallet: Remitano provides a multi-currency crypto wallet to store and manage digital assets.

- Invest: Users can invest in altcoins through Remitano’s Invest feature.

- Advanced Charts: Remitano integrates advanced charts from TradingView to provide users with technical analysis tools.

Trading Fees:

Remitano does not charge fees for fiat currency deposits and withdrawals. Trading fees range from 0.25% to 1%. The Bitcoin withdrawal fee is 0.0001 BTC.

The withdrawal fees vary depending on the coin:

- BTC: 0.0002 BTC

- ETH: 0.005 ETH

- USDT: 5 USDT (ERC-20) and free (TRC-20)

- BCH: 0.0001 BCH

- XRP: 0.000010

- LTC: 0.0005 LTC

The fixed swap fee is 0.25% of the total transaction value, which is quite low compared to other professional swap services. This fee is deducted directly from the estimated value when you initiate a Swap order.

The investment fee ranges from 0% to 1% of the total amount invested. This fee is only charged when you make a profit from your investment. The amount of USDT after the fee will not be lower than the amount you initially invested.

Upbit

Upbit is the largest crypto exchange in South Korea, established in 2017 by Dunamu, the parent company of the messaging app Kakao Talk. The platform offers over 180 cryptocurrencies and 300 trading pairs, serving users in South Korea and other Asian markets such as Singapore, Indonesia, and Thailand.

The exchange prioritizes security, transparency, and reliability, with ISMS-P and ISO/IEC security certifications, a 24/7 AI-powered FDS system, and a dedicated AML team. Upbit is committed to protecting users’ information and assets.

Key Features:

- Spot Trading: Upbit focuses on spot trading, offering a wide variety of cryptocurrencies and trading pairs.

- NFT Marketplace: Upbit has its own NFT marketplace where users can buy, sell, and trade NFTs.

- Staking: Upbit offers “Upbit Staking” services for users to earn passive income by staking their cryptocurrencies.

- Upbit Open API: Allows developers to integrate the platform’s functionalities into their applications.

- Mobile App: Upbit provides a mobile app for Android and iOS so users can trade anytime, anywhere.

Trading Fees:

Upbit charges both maker and taker fees, ranging from 0.25% to 0.2% depending on the market and currency being traded. There are no deposit fees, but withdrawal fees vary depending on the cryptocurrency.

Kraken

Kraken is one of the oldest and most respected cryptocurrency exchanges in the world. Founded in 2011 by Jesse Powell and based in San Francisco, California, it has built a reputation for security, reliability, and a strong focus on regulatory compliance. The platform follows strict AML/KYC regulations to ensure user safety. Kraken offers a wide range of features and services, making it a solid choice for both beginners and experienced traders.

Currently, Kraken serves over 6 million users in more than 190 countries and territories. The exchange supports trading for over 200 coins, including Bitcoin, Ethereum, USD Coin, Tether, XRP, and many other popular coins.

In March 2021, Kraken made headlines by signing a contract with Bloomberg, becoming the first crypto exchange to provide data to the Bloomberg Terminal system.

Key Features:

- Spot and Futures Trading: Kraken provides access to a diverse selection of cryptocurrencies for spot trading, along with futures contracts for those seeking leveraged trading opportunities.

- Margin Trading: Amplify your trading potential with margin trading, allowing you to borrow funds to increase your position size.

- Staking: Earn passive income by staking your coin holdings on Kraken. The platform supports various Proof-of-Stake (PoS) coins.

- Kraken Pro: For advanced traders, Kraken Pro offers a sophisticated trading interface with advanced charting tools, order types, and market data.

Trading Fees:

For transactions involving less than 50,000 coins, the selling fee is 0.16%, and the buying fee is 0.26%. These fees apply to trades involving Bitcoin and currencies like USD, EUR, JPY, GBP, and CAD. Similar fees apply to most altcoins, such as DASH/USD or DASH/EUR.

For volumes greater than 50,000 coins, the fees drop to 0.14% for sellers and 0.24% for buyers. The fees continue to decrease as the volume increases, with a fee of 0% for sellers and 0.10% for buyers on trades over 10 million coins. Many users have rated Kraken’s fees as quite reasonable.

Fees are calculated based on each individual transaction, with the trading volume over the past 30 days used to determine the applicable fees.

Bitfinex

Bitfinex is another veteran crypto exchange, established in 2012. Based in Hong Kong, Bitfinex has evolved into a sophisticated platform offering a wide array of trading tools, advanced order types, and a high degree of customization. It’s a popular choice among experienced traders and professionals.

Key Features:

- Spot, Margin, and Derivatives Trading: Bitfinex provides a comprehensive trading experience with spot markets, margin trading with high leverage, and derivatives products like perpetual swaps and futures contracts.

- Paper Trading: Practice your trading strategies risk-free with Bitfinex’s paper trading feature, which allows you to simulate trades in a real-time market environment without using real funds.

- Advanced Order Types: Execute complex trading strategies with a variety of advanced order types, including limit orders, stop orders, trailing stops, and more.

- Customizable Interface: Tailor your trading experience to your preferences with Bitfinex’s highly customizable interface.

Trading Fees:

Bitfinex uses a maker-taker fee model, with fees decreasing based on your 30-day trading volume. High-volume traders can benefit from significantly reduced fees. The spot trading fees for makers and takers are based on the trading volume. The higher the transaction value, the lower the fee. The maximum fee is 0.1% for makers and 0.2% for takers when the transaction is under $500,000.

Similar to spot trading, the maximum derivatives trading fee is 0.02% for makers and 0.065% for takers when trading under $2,000,000.

KuCoin

KuCoin is a global crypto exchange that has gained popularity for its wide selection of altcoins, user-friendly interface, and innovative features. Launched in 2017, KuCoin is often referred to as “The People’s Exchange” and caters to a diverse range of traders.

Key Features:

- Extensive Altcoin Selection: KuCoin is known for listing a large number of altcoins, providing access to emerging and lesser-known cryptocurrencies.

- Spot and Futures Trading: Trade a variety of cryptocurrencies on spot markets or engage in leveraged trading with futures contracts.

- Margin Trading: Borrow funds to increase your trading positions and potential profits.

- KuCoin Earn: Explore various ways to earn passive income on your crypto holdings, including staking, lending, and participating in promotional offers.

- KuCoin Trading Bot: Automate your trading strategies with KuCoin’s user-friendly trading bot, which allows you to create and customize trading bots without coding knowledge.

Trading Fees:

KuCoin has a competitive fee structure, with a tiered maker-taker model. For spot trading, the fee is set at a fixed rate of 0.1%. Additionally, the fee decreases as the 30-day trading volume increases. If users choose to use the KCS token, they can enjoy even lower fees compared to the standard fixed rate.

CoinUp.io

CoinUp.io is a relatively new crypto exchange that aims to provide a simple and secure trading experience for users of all levels. Launched in 2021, CoinUp.io focuses on providing a streamlined platform with a curated selection of popular cryptocurrencies.

Key Features:

- User-Friendly Interface: CoinUp.io boasts a clean and intuitive interface designed to be easy to navigate, even for beginners.

- Spot Trading: Trade popular coins with ease on CoinUp.io’s spot markets.

- Mobile App: Access your CoinUp.io account and trade on the go with their mobile app, available for both Android and iOS devices.

- 24/7 Customer Support: CoinUp.io provides round-the-clock customer support to assist users with any questions or issues.

Trading Fees:

CoinUp.io has a transparent and competitive fee structure, with a flat fee for all trades. This simplifies fee calculations and makes it easy for users to understand the costs involved.

ONUS

ONUS, formerly known as VNDC, is a Vietnamese crypto exchange that has gained significant traction in Southeast Asia. Launched in 2019, ONUS offers a mobile-first platform with a focus on providing easy access to cryptocurrencies for users in the region. The ONUS app was launched in March 2020 and has since gained over 4 million users across 20 countries, with a large number of them being from Vietnam. This success has helped ONUS establish itself as a trusted player in the cryptocurrency investment sector.

With the rapid growth of blockchain technology, ONUS has leveraged these advancements to build a platform that goes beyond just trading. It also offers services in areas like cryptocurrency investment, stocks, and more.

Key Features:

- Mobile-First Platform: ONUS is primarily designed for mobile devices, with a user-friendly app available for Android and iOS.

- Fiat Gateway: Easily buy and sell cryptocurrencies with Vietnamese Dong (VND) and other local currencies.

- Staking: Earn passive income by staking your crypto holdings on ONUS.

- ONUS Earn: Explore various opportunities to earn interest on your crypto, including fixed-term deposits and flexible savings products.

Trading Fees:

ONUS offers competitive trading fees, with a tiered structure based on your 30-day trading volume.

Crypto.com

Crypto.com is a global trading platform that has gained significant recognition for its ambitious marketing campaigns and wide range of products and services. Founded in 2016, this crypto exchange aims to accelerate the world’s transition to cryptocurrency. With over 50 million users from more than 90 countries, it allows trading of over 250 coins and 20 different fiat currencies.

Crypto.com offers a variety of services, including credit cards, wallets, NFT trading, swaps, earnings, and research. Users can stake their assets and earn up to 14.5% profits, or up to 8.5% with stablecoins. The platform also has its own blockchain called “Crypto.com.org Chain.”

Key Features:

- Crypto.com App: A user-friendly mobile app that provides access to a variety of crypto services, including buying, selling, trading, and earning.

- Crypto.com Exchange: A separate platform for more advanced traders, offering spot and derivatives trading with advanced order types and charting tools.

- Crypto.com Visa Card: Spend your crypto holdings with the Crypto.com Visa Card, which offers cashback rewards and other perks.

- Crypto.com DeFi Wallet: A non-custodial wallet that gives you full control over your private keys.

Trading Fees:

Crypto.com uses a maker-taker fee model, with fees decreasing based on your 30-day trading volume and CRO token holdings (Crypto.com’s native token). For spot and margin trading, the maker fee ranges from 0.075% to 0%, while the taker fee ranges from 0.075% to 0.05%. For derivatives, the maker fee ranges from 0.017% to 0%, and the taker fee ranges from 0.034% to 0.026%. VIP members can trade for free as makers, while takers pay a fee between 0.04% and 0.025% based on their trading volume.

Deepcoin

Deepcoin is a cryptocurrency derivatives exchange that focuses on providing a professional trading experience for experienced traders. Founded in 2018, Deepcoin offers a variety of advanced trading tools and features designed for high-frequency trading and sophisticated strategies.

Key Features:

- Derivatives Trading: Deepcoin specializes in derivatives products, including perpetual contracts, futures, and options.

- High Leverage: Trade with high leverage, up to 100x, to amplify your trading potential.

- Advanced Order Types: Execute complex trading strategies with a variety of advanced order types, such as limit orders, stop orders, and iceberg orders.

- API Access: Integrate your trading algorithms and bots with Deepcoin’s API.

Trading Fees:

Deepcoin uses a maker-taker fee model, with fees decreasing based on your 30-day trading volume. The taker fee is set at 0.06%, while the maker fee is 0.04%.

Toobit

Toobit is a relatively new crypto exchange that aims to provide a user-friendly and secure trading experience for both beginners and experienced traders. Launched in 2021, Toobit offers a variety of features and services, including spot trading, futures trading, and copy trading.

Key Features:

- Spot and Futures Trading: Trade a variety of cryptocurrencies on Toobit’s spot and futures markets.

- Copy Trading: Follow and copy the trades of successful traders to potentially improve your own trading performance.

- Toobit Earn: Explore various ways to earn passive income on your coin holdings, including staking and lending.

- Mobile App: Access your Toobit account and trade on the go with their mobile app, available for both Android and iOS devices.

Trading Fees:

Toobit has a competitive fee structure, with a tiered maker-taker model. Fees decrease based on your 30-day trading volume and TOO token holdings. TOO is Toobit’s native token.

Gemini

Gemini is a US-based crypto exchange that prioritizes security and regulatory compliance. Founded in 2014 by by Cameron and Tyler Winklevoss, Gemini is known for its focus on institutional investors and its commitment to building a trusted and regulated crypto ecosystem. The Winklevoss twins became well-known after winning a lawsuit against Mark Zuckerberg and Facebook in 2009 for stealing their idea, which resulted in a $65 million settlement, including $20 million in cash and 1.25 million shares. In 2013, they began investing in Bitcoin and currently own 1% of the total Bitcoin supply in the world.

Key Features:

- Spot Trading: Trade a variety of cryptocurrencies on Gemini’s spot markets.

- Gemini ActiveTrader: A platform for active traders, offering advanced charting tools, order types, and market data.

- Gemini Earn: Earn interest on your crypto holdings by lending them out through Gemini’s Earn program.

- Gemini Custody: A secure custody solution for institutional investors to store their digital assets.

Trading Fees:

Gemini’s fee structure is different from most exchanges, with fees calculated based on the order size and trading activity. The basic fee for all transactions on Gemini is 0.25%. However, if a buyer and seller frequently trade with each other, Gemini adjusts the fee based on the total trading volume between them over a 30-day period. In such cases, the fee could drop to as low as 0.1%.

There are no fees for depositing funds, whether in Bitcoin or USD. For withdrawals, the fees depend on the number of transactions you make in a month. If you make fewer than 10 transactions per month, there is no withdrawal fee. If you make more than 10 transactions, the withdrawal fee is 0.002 BTC for Bitcoin or 0.001 ETH for Ethereum. Bank withdrawals are free, regardless of the number of transactions made.

HTX

HTX, formerly known as Huobi Global, is a Seychelles-based crypto exchange that offers a wide range of trading products and services. Founded in 2013, HTX caters to a global user base and provides access to a diverse selection of cryptocurrencies and trading pairs.

In the third quarter of 2023, to celebrate its 10th anniversary, Huobi rebranded as HTX. The new name stands for “H” representing Huobi, “T” for TRON, and “X” for the exchange. “X” also symbolizes the 10 years of operation and growth for the platform. The exchange also recommended users convert their HT tokens to HTX tokens for future purposes.

Key Features:

- Spot and Futures Trading: Trade a variety of coins and tokens on HTX’s spot and futures markets.

- Margin Trading: Borrow funds to increase your trading positions and potential profits.

- HTX Earn: Explore various ways to earn passive income on your crypto holdings, including staking, lending, and participating in promotional offers.

- HTX NFT: A platform for buying, selling, and trading non-fungible tokens (NFTs).

Trading Fees:

For Spot Trading:

- Regular users (holding less than 1,000 BTC)

- Using a currency other than HTX: 0.2% transaction fee.

- Using HTX: Transaction fees range from 0.18% to 0.07% depending on how many HTX tokens are held.

- Professional users (holding 1,000 BTC or more):

- Maker fee: Ranges from 0.0097% to 0.0362%.

- Taker fee: Ranges from 0.0193% to 0.0462%.

- Fee levels: There are 9 different fee levels based on the combination of BTC and HTX holdings.

For Futures Trading:

- Maker: 0.02% (for the person placing the order).

- Taker: 0.04% (for the person fulfilling the order).

Deposit and Withdrawal Fees:

- Deposit: Free. HTX does not charge deposit fees for most cryptocurrencies, which is a major advantage compared to many other exchanges.

- Withdrawal: The withdrawal fee varies by the coins. Currently, the BTC withdrawal fee is 0.0004 BTC.

Bitstamp

Bitstamp is one of the oldest and most established crypto exchanges, founded in 2011 and gained significant recognition by competing with the Mt. Gox exchange at the time. Bitstamp was founded by Nejc Kodric and Damijan Merlak in Slovenia. In 2013, the exchange moved some of its operations to London.

It is considered a reputable and popular platform in the crypto market. It was granted a license to operate in April 2016 in Luxembourg and is fully compliant with local financial regulations. Additionally, it holds licenses to operate in all 28 countries of the European Union.

Key Features:

- Spot Trading: Trade a variety of cryptocurrencies on Bitstamp’s spot markets.

- Advanced Order Types: Execute complex trading strategies with a variety of advanced order types, including limit orders, stop orders, and market orders.

- API Access: Integrate your trading algorithms and bots with Bitstamp’s API.

- Institutional Services: Bitstamp offers tailored services for institutional investors, including custody solutions and OTC trading.

Trading Fees:

The fees on Bitstamp are standardized and depend on the user’s trading volume. There are no spread fees since orders are placed and matched directly with its order book.

- For market makers, fees range from 0.3% (for monthly trading volumes between $1,000 and $10,000) to 0.00% (for volumes over $1 billion).

- For market takers, fees range from 0.4% (for monthly trading volumes between $1,000 and $10,000) to 0.03% (for volumes over $1 billion).

- For stablecoin pairs, both the maker and taker fees are 0.00% and 0.01%, respectively.

Bitstamp does not charge any fees for depositing cryptocurrencies. However, for withdrawals, you will incur network fees or standard withdrawal fees, depending on where you’re transferring your cryptocurrency. Bitstamp also charges fees for deposits, withdrawals, and processing times, depending on the payment method used.

Choosing the right exchange is a crucial step for anyone looking to enter the world of digital asset trading. The 20 exchanges reviewed in this article offer a diverse range of features, catering to various trading styles and needs.

When selecting an exchange, it’s essential to consider various factors. You should remember to always conduct your own research and due diligence before choosing an exchange. With the right crypto exchange and a cautious approach, you can confidently navigate the exciting and evolving world of cryptocurrency trading.