In the fast-paced world of cryptocurrency trading, futures trading has emerged as a popular way for traders to maximize their profits and hedge against market volatility. Among the leading platforms for futures trading is Bybit, a user-friendly and highly secure exchange that offers a wide range of tools and features for both beginners and experienced traders. In this article, we’ll dive deep into Bybit futures trading, covering everything from how to trade futures on Bybit to advanced strategies, fees, and even the Bybit Futures API. Whether you’re a seasoned trader or just starting, this guide will equip you with the knowledge you need to succeed in the world of Bybit futures.

What Are Bybit Futures?

Futures trading is a financial contract that allows traders to buy or sell an asset at a predetermined price and date in the future. Unlike spot trading, where you own the asset immediately, futures trading lets you speculate on an asset’s price movement without actually owning it. Bybit futures are particularly popular in crypto because they offer high leverage, allowing traders to amplify their potential gains (and losses).

Bybit offers a variety of futures contracts, including perpetual contracts (which have no expiration date) and quarterly futures (which expire every three months). These contracts are available for major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and more.

How to Trade Futures on Bybit: A Step-by-Step Guide

If you’re new to futures trading or just getting started on Bybit, this step-by-step guide will walk you through the process of trading futures on the platform.

Step 1: Create a Bybit Account

- Visit the Bybit website and click on “Sign Up.”

- Enter your email address and create a strong password.

- Complete the verification process by entering the code sent to your email.

Step 2: Deposit Funds

- Log in to your Bybit account and navigate to the “Assets” section.

- Select “Deposit” and choose the cryptocurrency you want to deposit (e.g., BTC, ETH, USDT).

- Copy the deposit address and transfer funds from your external wallet to your Bybit account.

Step 3: Navigate to the Futures Trading Page

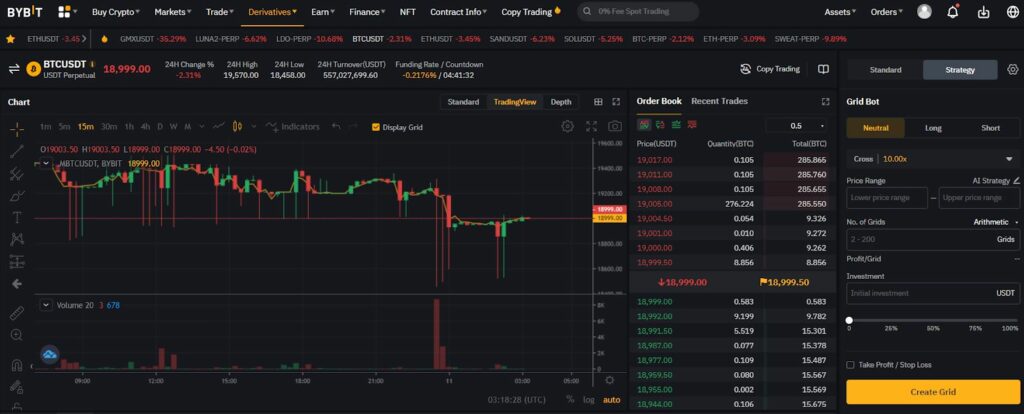

- Once your funds are deposited, go to the “Futures” section on the Bybit platform.

- Choose between USDT Perpetual, Inverse Perpetual, or Inverse Futures contracts, depending on your trading preferences.

Step 4: Set Up Your Trade

- Select the contract you want to trade (e.g., BTCUSD).

- Choose your leverage (up to 100x) and decide whether to go long (buy) or short (sell).

- Enter the amount you want to trade and set your stop-loss and take-profit levels to manage risk.

Step 5: Monitor and Close Your Position

- Keep an eye on the market and your open positions using Bybit’s advanced charting tools.

- When you’re ready to close your position, click on “Close Position” and confirm the transaction.

Understanding Bybit Futures Fees

One of the key advantages of trading futures on Bybit is its competitive fee structure. Here’s a breakdown of Bybit futures fees:

- Taker Fees: 0.075% of the transaction value (charged when you place an order that is immediately matched with an existing order).

- Maker Fees: -0.025% (yes, negative! Bybit rewards makers with a rebate for adding liquidity to the market).

- Funding Fees: These are periodic payments between long and short traders to keep the contract price close to the spot price. Funding fees are typically exchanged every 8 hours.

Bybit’s low fees and maker rebates make it an attractive option for high-frequency traders and those looking to minimize trading costs.

Advanced Bybit Futures Trading Strategies

To succeed in Bybit futures trading, it’s essential to have a solid trading strategy. Here are some popular strategies used by professional traders:

Hedging

Hedging involves opening opposite positions in the spot and futures markets to protect against potential losses. For example, if you hold Bitcoin in your spot wallet, you can open a short futures position to hedge against a potential price drop.

Scalping

Scalping is a short-term trading strategy that involves making multiple trades throughout the day to capture small price movements. This strategy requires quick decision-making and a deep understanding of market trends.

Arbitrage

Arbitrage involves taking advantage of price differences between different markets or exchanges. For example, if Bitcoin is trading at a lower price on Bybit than on another exchange, you can buy on Bybit and sell on the other exchange for a profit.

Trend Following

This strategy involves identifying and following market trends. Traders using this strategy will go long in an uptrend and short in a downtrend, aiming to ride the trend for as long as possible.

Leveraging the Bybit Futures API

For advanced traders and developers, the Bybit Futures API offers a powerful way to automate trading strategies and access real-time market data. Here’s how you can use the Bybit API:

- Automate Trading: Use the API to create bots that execute trades based on predefined criteria, such as price movements or technical indicators.

- Access Market Data: Retrieve real-time data on prices, order books, and trading volumes to inform your trading decisions.

- Manage Risk: Set up automated risk management tools, such as stop-loss orders, to protect your positions.

Bybit’s API is well-documented and supports multiple programming languages, making it accessible to developers of all skill levels.

Tips for Successful Bybit Futures Trading

- Start Small: If you’re new to futures trading, start with a small amount of capital and gradually increase your position size as you gain experience.

- Use Leverage Wisely: While high leverage can amplify profits, it also increases the risk of significant losses. Always use leverage cautiously.

- Stay Informed: Keep up with the latest market news and trends to make informed trading decisions.

- Practice Risk Management: Use stop-loss orders and never risk more than you can afford to lose.

- Learn from Mistakes: Analyze your trades to identify what worked and what didn’t, and use this knowledge to refine your strategies.

Bybit futures trading offers a world of opportunities for traders looking to capitalize on the volatility of the cryptocurrency market. With its user-friendly platform, competitive fees, and advanced trading tools, Bybit is an excellent choice for both beginners and experienced traders. Whether you’re interested in learning how to trade futures on Bybit, exploring advanced strategies, or leveraging the Bybit Futures API, this guide has provided you with the essential knowledge to get started.

Remember, success in futures trading requires a combination of knowledge, strategy, and discipline. Start small, stay informed, and always prioritize risk management. Ready to take your trading to the next level? Sign up on Bybit today and unlock the full potential of futures trading!