The world of cryptocurrency trading has evolved rapidly in recent years, with more traders venturing into the exciting but volatile space. As cryptocurrency platforms grow in popularity, ensuring the safety of your funds and managing the risks associated with spot trading become crucial factors for every investor. One of the leading platforms for trading cryptocurrencies is Bybit, offering users advanced features and tools designed to enhance both security and risk management.

However, while Bybit provides robust security features, traders must also take responsibility for their actions. Understanding how to protect your account and manage market risks is essential in this fast-paced industry. In this article, we will explore the key strategies for secure trading and managing risks on Bybit, focusing on both security measures and market risk management practices. With a growing number of users flocking to Bybit in 2025, understanding these concepts will make you a better-equipped and more informed trader.

Best Practices for Secure Trading

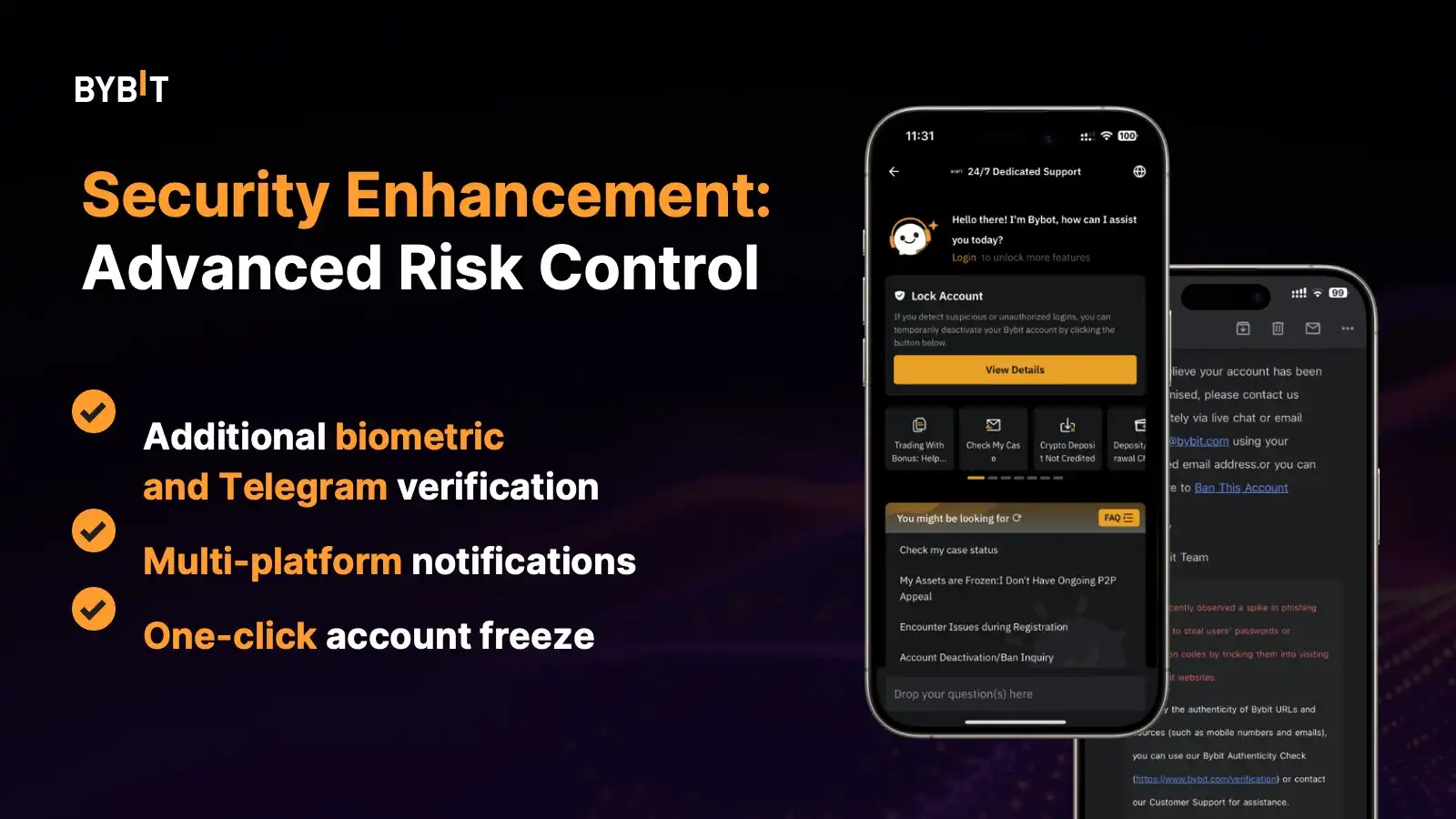

Security is arguably the most important aspect of cryptocurrency trading, as the digital nature of assets makes them highly susceptible to cyber-attacks. In recent years, cryptocurrency exchanges have been targeted by hackers seeking to steal funds from users’ accounts. As a trader on Bybit, understanding the platform’s security features and taking proactive steps to safeguard your assets are fundamental to ensuring a safe trading experience.

Enable Two-Factor Authentication (2FA)

One of the first and easiest steps to enhance your account security and risk management is enabling Two-Factor Authentication (2FA). Bybit offers 2FA options through both Google Authenticator and SMS. Enabling 2FA adds an extra layer of protection to your account, ensuring that even if a hacker obtains your password, they will still need access to your 2FA device to complete the login process.

For example, suppose a hacker somehow gains access to your password. Without the unique code generated by your 2FA app or SMS, they will not be able to log into your account. This makes it far harder for cybercriminals to compromise your account and steal your funds.

Monitor Your Account Regularly

Bybit offers its users access to an activity log that displays a history of all account activities, such as logins and withdrawals. Regularly checking your activity log for any unusual transactions or login attempts is a critical habit for all traders. If you notice suspicious behavior, like logins from unfamiliar IP addresses or unauthorized withdrawals, it is vital to take action immediately.

For example, if you receive an email from Bybit saying that someone has logged into your account from an unfamiliar device, it is crucial to change your password and disable 2FA to ensure that your account is not compromised further. Regularly reviewing your account activity helps you stay vigilant and catch potential security threats before they can cause damage.

Be Cautious of Phishing Scams

Phishing is one of the most common cyberattacks targeting cryptocurrency traders. Phishing attacks typically involve fraudulent emails or websites pretending to be Bybit (or another cryptocurrency exchange) in an attempt to trick you into revealing sensitive information like your account credentials or private keys. Attackers often send you links to fake Bybit websites that look almost identical to the real platform.

Always ensure that you are visiting the legitimate Bybit website (https://www.bybit.com). If you receive an unsolicited email, be cautious of clicking any links within the message. Instead, navigate directly to Bybit’s website by typing the URL into your browser. Verify the sender’s email address and never provide any personal information unless you are certain the communication is legitimate.

Keep Your Software and Devices Updated

Keeping your devices and software up to date is essential in protecting against security vulnerabilities. Hackers often exploit weaknesses in outdated software, so regularly updating your operating system, antivirus programs, and mobile apps is crucial. Ensure your computer and mobile devices are running the latest security patches to guard against malware, viruses, and other types of malicious software that could compromise your account.

For example, many modern smartphones and desktop computers release regular updates that include fixes for security loopholes. These updates help protect your devices from potential exploits, reducing the likelihood of a successful attack on your Bybit account.

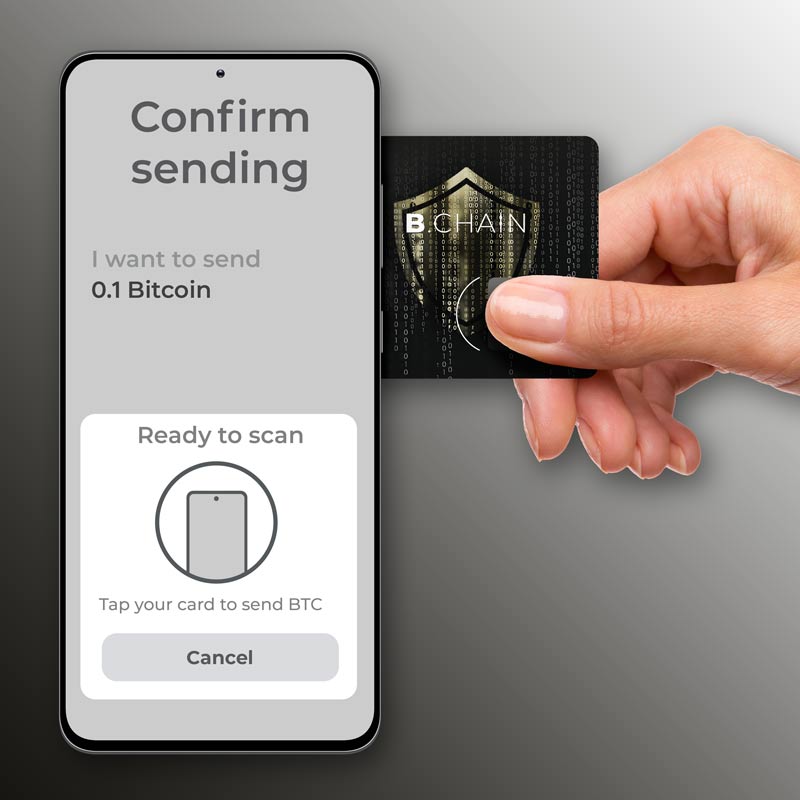

Use a Hardware Wallet for Storing Funds

While Bybit provides users with an internal wallet to store their assets, it is recommended to avoid leaving large sums of cryptocurrency on the exchange for extended periods. Exchange wallets are vulnerable to potential hacks or platform failures. To protect your assets in the long run, consider using a hardware wallet, such as Ledger or Trezor, which keeps your private keys offline.

When you transfer your funds to a hardware wallet, they are stored securely offline, far removed from the threat of online hackers. Hardware wallets are extremely safe and reduce your exposure to the risk of exchange breaches. For instance, if you plan to hold Bitcoin for a long time, transferring it to a hardware wallet will protect your assets from any platform vulnerabilities.

Understanding Market Risks

While securing your account is paramount, understanding the risks involved in cryptocurrency spot trading is equally important. The crypto market is notorious for its high volatility, making it possible for prices to swing rapidly and unpredictably. Spot trading, which involves buying and selling assets at current market prices, exposes traders to various market risks. To navigate these risks effectively,traders must implement robust risk management strategies.

Volatility Risk

Volatility is perhaps the most significant risk for traders in the cryptocurrency market. Cryptocurrencies like Bitcoin, Ethereum, and others can experience significant price fluctuations within a short period. While volatility presents an opportunity for substantial profits, it also exposes traders to the risk of unexpected losses. For example, you may purchase a cryptocurrency at $50,000, only to see its price fall to $45,000 within hours. Such swings can lead to rapid losses if not properly managed.

To mitigate volatility risk, traders need to employ risk management strategies, such as setting stop-loss orders (more on this later) and diversifying their portfolios to avoid over-exposure to any one asset. Traders should also consider the potential for high price swings when making entry and exit decisions and never over-leverage positions in highly volatile markets.

Liquidity Risk

Liquidity risk refers to the possibility of being unable to execute trades at the desired price due to insufficient market participants. In the case of a thinly traded cryptocurrency, you may struggle to sell at the price you want, which could result in executing the trade at a worse price. For instance, if you wish to sell a specific asset but no buyers are willing to purchase at your desired price, you may be forced to sell at a lower price to complete the transaction.

To avoid liquidity risk, focus on trading cryptocurrencies with high trading volumes and deep order books. These assets tend to have greater liquidity, meaning that buyers and sellers can transact without significantly impacting the market price. Bybit provides traders with access to a wide range of liquid assets that are suitable for spot trading.

Counterparty Risk

Counterparty risk refers to the possibility that the exchange itself could face issues such as a hack, insolvency, or regulatory actions that could affect your ability to withdraw funds. While Bybit has a reputation for being a secure and reliable exchange, it is important to recognize that, like any exchange, there is always the risk of counterparty failure.

To mitigate counterparty risk, traders should limit the amount of funds held on the exchange at any given time. It is always advisable to withdraw funds that you do not need for immediate trading to your secure wallet. This limits your exposure to platform risks, such as sudden withdrawal restrictions or unexpected security breaches.

Regulatory Risk

Regulatory uncertainty in the cryptocurrency market presents another significant risk for traders. Governments worldwide are still in the process of creating clear regulations for digital assets, and these regulations could change rapidly, impacting cryptocurrency exchanges and their users. Bybit is committed to complying with regulatory requirements in various jurisdictions, but traders must remain aware of any regulatory changes in their region that may affect their access to the platform or certain assets.

For example, a government might implement new tax regulations on cryptocurrency transactions or even ban certain types of cryptocurrency trading. Traders need to stay informed about the regulatory landscape in their region to avoid being caught off guard by sudden changes in the rules.

Setting Stop-Loss and Take-Profit Orders

Effective risk management in spot trading involves setting clear boundaries for potential losses and gains. Bybit offers various risk management tools, including stop-loss orders and take-profit orders, that can help traders minimize potential losses and lock in profits. These tools are essential for managing risk in an inherently volatile market.

Stop-Loss Orders

A stop-loss order is a tool that automatically triggers a sale when the price of an asset reaches a predetermined level. The purpose of a stop-loss order is to limit potential losses if the market moves against your position. For example, if you purchase Bitcoin at $50,000, you can set a stop-loss order at $47,500 to limit your losses to 5%. If the market price drops to $47,500, the stop-loss order will automatically execute and sell your position.

Stop-loss orders help traders avoid emotional decision-making during volatile market conditions, ensuring that you exit the market before losses escalate further. By setting a stop-loss order, you can define your maximum loss upfront and stick to your trading strategy.

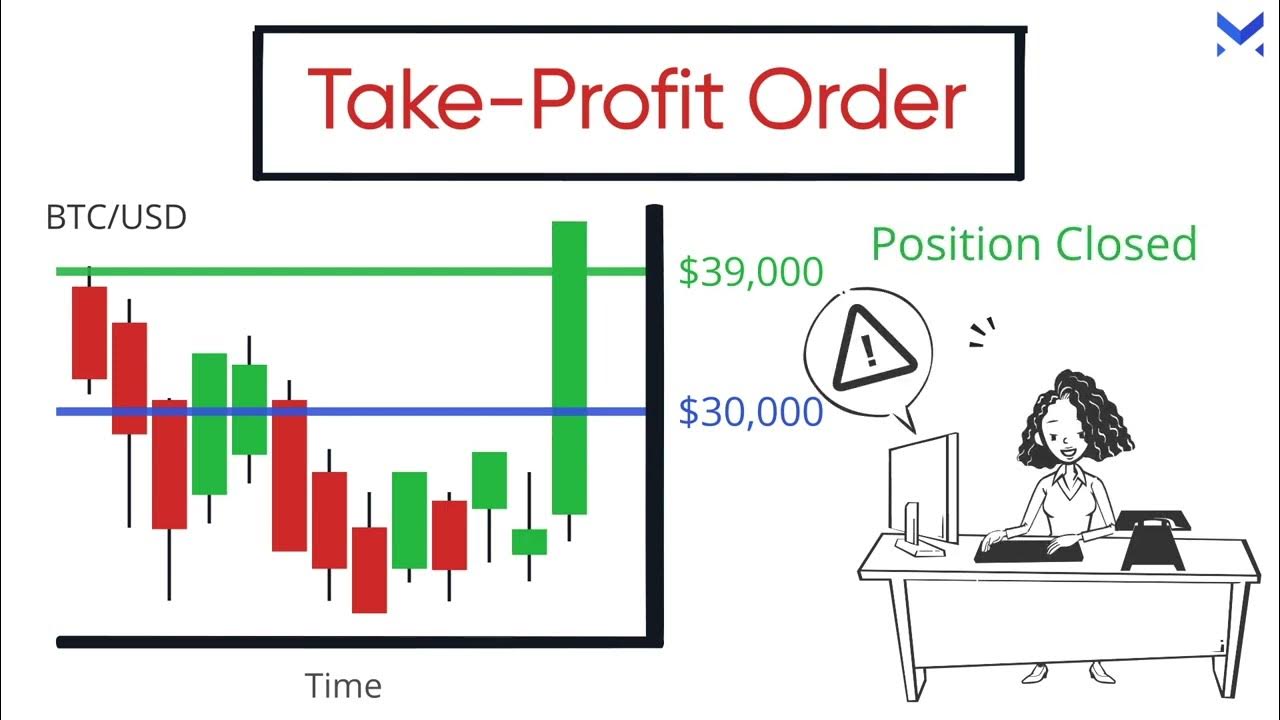

Take-Profit Orders

Take-profit orders are designed to automatically sell an asset once it reaches a specified price target, allowing traders to lock in profits. For example, if you purchase Bitcoin at $50,000 and wish to secure a 10% profit when the price hits $55,000, you can place a take-profit order at $55,000. Once the price reaches this level, your position will automatically be closed, ensuring you lock in your gains.

Take-profit orders remove the need for constant monitoring, allowing traders to set their targets and walk away from the screen. These orders are particularly useful when you are confident in your analysis but cannot dedicate hours to monitoring price movements.

Trailing Stop Orders

A trailing stop order allows traders to lock in profits as the market price moves in their favor. With a trailing stop, your stop-loss level is adjusted upward as the price increases, maintaining a specified distance between the stop price and the market price. For example, if you buy Bitcoin at $50,000 and set a trailing stop order with a 5% distance, the stop-loss order will initially be set at $47,500. If the price rises to $55,000, the stop-loss will automatically adjust to $52,250, thus locking in some of the profits as the market continues to move in your favor.

Trailing stop orders are useful in trending markets, as they allow traders to capture profits while still leaving room for further price growth.

Conclusion

Security and risk management are critical components of successful spot trading on Bybit. By understanding how to secure your account using 2FA, hardware wallets, and other measures, you can protect your funds from cyber threats. At the same time, understanding market risks such as volatility, liquidity, and counterparty risk will help you make more informed trading decisions.

Moreover, utilizing Bybit’s advanced risk management tools, such as stop-loss and take-profit orders, allows traders to manage their positions effectively and minimize losses. With the cryptocurrency market continuing to evolve in 2025, traders who implement these best practices and strategies will be well-equipped to navigate the challenges of spot trading.

Bybit provides a secure and reliable platform, but successful trading ultimately relies on the trader’s ability to manage both security and risk effectively. With the right tools, knowledge, and vigilance, you can achieve success in the rapidly changing world of cryptocurrency trading.