Cryptocurrency derivatives trading has become a fundamental part of the financial markets, offering traders the opportunity to speculate on price movements, hedge their risks, and maximize their profit potential. Bybit, one of the most prominent crypto exchanges, provides a range of derivative products tailored to different trading strategies.

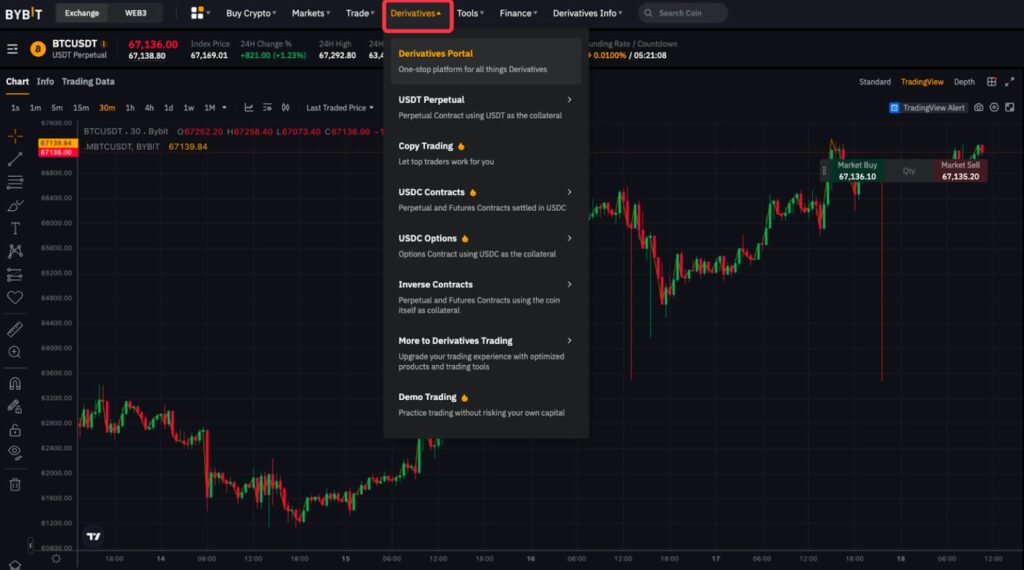

Understanding the types of Bybit derivatives trading is essential for both new and experienced traders who want to take full advantage of Bybit’s advanced trading tools. In this guide, we will explore the key types of derivatives on Bybit, including futures contracts, options trading, and perpetual swaps. Each of these instruments has unique characteristics that cater to various market conditions and trading preferences.

Futures Contracts on Bybit

Futures contracts are one of the most widely used types of derivatives on Bybit, allowing traders to buy or sell an asset at a predetermined price on a future date. These contracts enable speculation on price movements without requiring traders to own the underlying asset.

Understanding Futures Contracts

A futures contract is an agreement between two parties to exchange an asset at a set price at a future date. These contracts are commonly used in traditional finance and are now a significant part of the cryptocurrency market. There are two types of Bybit derivatives trading in the futures category:

Inverse Futures Contracts: These contracts are margined and settled in the base cryptocurrency (e.g., BTC/USD contracts settled in Bitcoin).

USDT-Margined Futures Contracts: These contracts are margined and settled in USDT, offering greater stability since profits and losses are calculated in a stablecoin.

Benefits of Futures Trading on Bybit

Trading futures on Bybit comes with several advantages:

- Leverage Trading: Traders can amplify their exposure by using leverage, increasing potential profits (and risks).

- Risk Hedging: Investors can hedge against price volatility by locking in future prices.

- Market Speculation: Traders can take both long and short positions to capitalize on price movements in either direction.

For instance, if a trader believes Ethereum’s price will rise from $3,000 to $3,500, they can go long on an ETH/USDT futures contract. If the price reaches their target, they can close the contract and realize a profit.

As one of the most commonly used types of derivatives on Bybit, futures trading attracts both short-term speculators and long-term investors looking to mitigate risk.

Options Trading on Bybit

Options trading is another important category among the types of derivatives on Bybit, offering traders the ability to buy or sell an asset at a predetermined price without the obligation to execute the trade.

How Options Trading Works

Options contracts come in two primary forms:

- Call Options: Gives the trader the right to buy an asset at a specific price before expiration. This is beneficial when expecting price increases.

- Put Options: Gives the trader the right to sell an asset at a specific price before expiration. This is useful when expecting price declines.

Unlike futures, options contracts provide more flexibility because traders are not obligated to execute the trade if the market moves unfavorably.

Advantages of Options Trading on Bybit

- Limited Risk Exposure: Unlike futures contracts, where losses can be substantial, options limit the trader’s maximum loss to the premium paid.

- Flexible Trading Strategies: Traders can use advanced strategies like spreads, straddles, and covered calls to optimize risk and reward.

- No Obligation to Execute: Traders have the option to let contracts expire if the trade does not go in their favor.

For example, if a trader expects Bitcoin’s price to surge from $40,000 to $45,000 within a month, they can purchase a call option with a strike price of $42,000. If Bitcoin surpasses this level, they can exercise the contract for a profit.

Among the types of derivatives on Bybit, options are particularly useful for traders who prefer defined risk management strategies while maintaining profit potential.

Perpetual Swaps on Bybit

Perpetual swaps are one of the most dynamic types of derivatives on Bybit, offering traders the ability to hold positions indefinitely without expiration dates.

What Are Perpetual Swaps?

Unlike traditional futures contracts, perpetual swaps do not have a settlement date. Instead, they use a funding mechanism that keeps their prices aligned with the underlying spot market. Bybit’s perpetual swaps allow traders to go long or short on various cryptocurrencies without worrying about contract expiry.

Why Trade Perpetual Swaps on Bybit?

- No Expiry Date: Traders can hold positions for as long as they want.

- Leverage Options: Bybit allows leverage trading on perpetual swaps, increasing potential returns.

- Efficient Price Tracking: The funding rate system ensures that the contract price remains close to the actual market price.

For instance, if a trader believes Bitcoin’s price will continue rising, they can open a long position in a BTC/USDT perpetual swap and hold it indefinitely as long as the uptrend continues.

Perpetual swaps are one of the most frequently used types of derivatives on Bybit, especially among professional traders who engage in high-frequency and leveraged trading.

Why Traders Choose Bybit for Derivatives Trading

Bybit has established itself as one of the leading platforms for cryptocurrency derivatives trading, attracting millions of traders worldwide. Its success can be attributed to a combination of advanced trading features, deep liquidity, robust security, and user-friendly interfaces. Whether you’re an experienced professional or a beginner exploring derivatives for the first time, Bybit offers a well-optimized environment tailored to various trading styles.

Ultra-Fast Matching Engine for Seamless Execution

One of the biggest advantages of trading derivatives on Bybit is its ultra-fast matching engine, which ensures smooth execution with minimal slippage. The system is capable of handling 100,000 transactions per second (TPS), making it one of the fastest trading platforms in the crypto industry.

Why does this matter? Speed is critical in derivatives trading, especially for high-frequency traders and scalpers who rely on quick order executions to capitalize on small price movements. Slow execution or slippage can significantly impact profitability, but Bybit’s cutting-edge technology minimizes such risks.

For example, if a trader places an order to buy BTC/USDT perpetual swaps at $45,000 and the market is volatile, a slow platform might execute the trade at a slightly higher price, reducing the trader’s profit margin. Bybit’s matching engine ensures that trades are executed instantly at the desired price, reducing unnecessary losses.

High Liquidity for Large-Scale Trading

Liquidity is a crucial factor when choosing a derivatives trading platform, and Bybit excels in this area. With its deep liquidity pool, traders can execute large orders without significant price fluctuations.

- Minimal Slippage: Even for large orders, price impact is minimal due to deep order books.

- Reliable Market Depth: Ensures that traders can enter and exit positions at their desired price points.

For institutional investors and high-net-worth traders who deal with substantial order sizes, Bybit’s high liquidity ensures that they can execute their strategies efficiently without major price disruptions.

Flexible Leverage Options for Maximized Returns

Bybit allows traders to use leverage, increasing their potential returns on various types of derivatives on Bybit. Depending on the product, traders can access leverage up to 100x on certain contracts, making it a popular choice for margin traders.

How leverage works:

A trader with $1,000 capital can control a $100,000 position using 100x leverage. If the market moves in their favor, their profits are multiplied.

However, leverage also increases risk, which is why risk management tools like stop-loss orders are essential.

Bybit’s isolated and cross-margin options allow traders to manage their risk more effectively, ensuring that they have the flexibility to choose their preferred trading style.

24/7 Customer Support and Multilingual Community

The crypto market operates 24/7, and Bybit ensures that its support system does too. Unlike many exchanges that have slow or automated customer service, Bybit provides real-time customer support through multiple channels, including:

- Live Chat (available 24/7)

- Email Support

- Community Forums and Telegram Groups

- Bybit caters to a global audience by offering multilingual support, including languages such as English, Chinese, Spanish, Russian, and more. This makes it easier for non-English speakers to access assistance and engage with the types of derivatives on Bybit more effectively.

For example, if a trader from Japan faces an issue with a futures contract, they can quickly connect with a Japanese-speaking support representative, ensuring clear communication and swift problem resolution.

Conclusion

Understanding the types of derivatives on Bybit is essential for any trader looking to navigate the complex world of cryptocurrency trading. Bybit offers a robust selection of derivative instruments, including futures contracts, options trading, and perpetual swaps, each designed to suit different trading strategies.

As cryptocurrency trading continues to grow, Bybit remains at the forefront of innovation, ensuring its platform remains the go-to destination for derivatives traders worldwide. Understanding and utilizing the types of derivatives on Bybit effectively can significantly improve trading performance and long-term success.