Are you ready to dive into the world of cryptocurrency trading? With Kraken Trading Order options, Kraken stands out as a top-tier exchange, offering a seamless experience for beginners and seasoned traders alike. At CryptoExlist, we’re here to break down everything you need to know about trading on this platform—from the variety of Kraken Trading Orders to Kraken Trading Fees and how to execute Buy/Sell Orders on Kraken. Let’s explore how Kraken empowers you to take control of your crypto journey!

What Makes Kraken a Go-To Crypto Exchange?

Kraken has earned its reputation as one of the most reliable and user-friendly cryptocurrency exchanges since its launch in 2011. Founded by Jesse Powell with a mission to accelerate crypto adoption, Kraken combines robust security, a wide range of supported assets, and advanced trading tools to cater to a global audience. Whether you’re a casual investor looking to dip your toes into Bitcoin or an experienced trader aiming to leverage complex strategies, Kraken’s trading platform offers something for everyone. At the heart of this ecosystem lies its powerful Kraken Trading Order system, which allows users to execute trades with precision and flexibility. Unlike many exchanges that overwhelm users with jargon, Kraken simplifies the process while still providing depth for those who crave it. From its intuitive interface to its real-time market data, Kraken ensures you’re equipped to make informed decisions. In this guide, we’ll unpack the types of Kraken Trading Orders, dive into Kraken Trading Fees, and walk you through placing Buy/Sell Orders on Kraken, so you can trade confidently.

Exploring the Types of Kraken Trading Orders

One of Kraken’s standout features is its diverse range of order types, designed to suit different trading styles and goals. Understanding these Kraken Trading Orders is key to mastering the platform and optimizing your trades. Whether you’re looking to buy at the best price or set specific conditions for your trades, Kraken has you covered with options that range from basic to advanced. Let’s break down the most popular order types you’ll encounter and how they can work for you.

Market Orders: Fast and Simple Execution

Market orders are the go-to choice for traders who prioritize speed over price control. When you place a market order on Kraken, your trade executes immediately at the best available price in the order book. This is perfect for volatile markets where prices shift rapidly, and you want to secure your position without delay. For example, if Bitcoin’s price is surging and you want in on the action, a market order ensures you don’t miss out. However, keep in mind that the final price might differ slightly from what you see due to market fluctuations—an important factor when calculating Kraken Trading Fees for these Buy/Sell Orders on Kraken.

Limit Orders: Precision and Control

If you’re a trader who likes to set your own terms, limit orders are your best friend. With a limit order, you specify the exact price at which you’re willing to buy or sell, and the trade only executes if the market hits that price or better. This gives you greater control over your entry and exit points, making it ideal for strategic trading. For instance, if you believe Ethereum will dip to $1,500 before climbing, you can set a limit buy order at that price and wait for the market to come to you. The trade-off? Your order might not fill if the price doesn’t reach your target, but it’s a small price to pay for precision in your Kraken Trading Order.

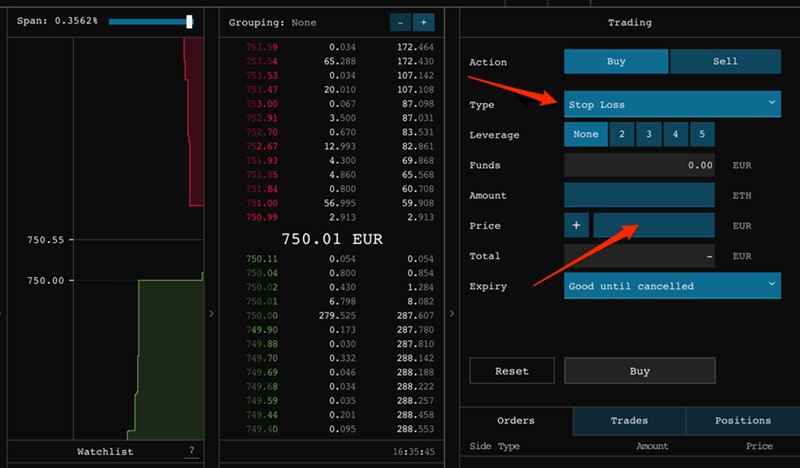

Stop-Loss and Take-Profit Orders: Managing Risk and Reward

For those looking to protect their investments or lock in profits, Kraken offers stop-loss and take-profit orders. A stop-loss order triggers a market sell order when the price drops to a level you’ve set, helping you minimize losses during a downturn. Conversely, a take-profit order lets you sell automatically when the price hits your target profit level. These Kraken Trading Orders are invaluable for managing risk, especially in the unpredictable crypto market. Imagine holding XRP and setting a stop-loss at $0.80 to limit downside risk while placing a take-profit at $1.20 to cash in on gains—this dual approach keeps your strategy balanced and hands-free.

Understanding Kraken Trading Fees

No discussion of trading is complete without addressing costs, and Kraken Trading Fees are a critical piece of the puzzle. Kraken operates on a maker-taker fee model, which rewards users for adding liquidity to the market while charging slightly more for taking it away. This structure is designed to be fair and scalable, with fees decreasing as your trading volume increases. Whether you’re placing Buy/Sell Orders on Kraken or exploring advanced Kraken Trading Orders, understanding these fees can help you maximize your returns.

Maker vs. Taker Fees: What’s the Difference?

When you place a limit order that doesn’t immediately fill—like one sitting in the order book awaiting a match—you’re a “maker” and pay lower fees, starting at 0.16% for low-volume traders and dropping to 0.00% for high rollers exceeding $10 million monthly. On the other hand, market orders or limit orders that fill instantly make you a “taker,” with fees ranging from 0.26% down to 0.10% based on volume. This incentivizes adding liquidity, so strategic use of Kraken Trading Order types can save you money over time. For example, opting for limit orders over market orders could lower your Kraken Trading Fees significantly if you trade frequently.

Additional Costs: Margin and Futures Trading

Beyond spot trading, Kraken offers margin and futures trading, each with its own fee structure. Margin trading incurs an opening fee (typically 0.01%-0.02%) and a rollover fee every four hours, while futures trading follows a similar maker-taker model but with different rates. These options amplify your trading power but come with added costs, so factor them into your Buy/Sell Orders on Kraken. Kraken’s transparency ensures you see all fees upfront, allowing you to plan your trades without surprises.

How to Place Buy/Sell Orders on Kraken

Ready to start trading? Placing Buy/Sell Orders on Kraken is straightforward, whether you’re using the standard interface or the advanced Kraken Pro platform. Here’s a step-by-step guide to get you going, ensuring you can navigate the process with ease and confidence.

Step 1: Setting Up Your Account and Funding

First, sign up for a Kraken account and complete the verification process—it’s quick and secures your access to all features. Once verified, deposit funds via bank transfer, crypto wallet, or card. Kraken supports over 200 cryptocurrencies, so you’ve got plenty of options. Head to the “Funding” tab, select your preferred method, and load your account. This sets the stage for your Kraken Trading Order.

Step 2: Placing Your Order

Navigate to the “Trade” tab and choose between the “Simple” or “Advanced” order forms. For a market order, select “Buy” or “Sell,” pick your asset (e.g., BTC/USD), enter the amount, and hit “Submit”—your trade executes instantly. For a limit order, specify your price, review the estimated Kraken Trading Fees, and confirm. Want a stop-loss? Switch to the “Advanced” tab, set your trigger price, and let Kraken handle the rest. With Buy/Sell Orders on Kraken, you’re in full control of your trading destiny.

Why Choose Kraken for Your Trading Needs?

Kraken isn’t just another exchange—it’s a platform built on trust, innovation, and user empowerment. Its variety of Kraken Trading Orders caters to all skill levels, while competitive Kraken Trading Fees reward active traders. The ability to seamlessly place Buy/Sell Orders on Kraken makes it accessible yet powerful, backed by top-notch security like 2FA and cold storage for 95% of funds. Whether you’re chasing quick profits or building a long-term portfolio, Kraken delivers the tools you need. At CryptoExlist, we believe Kraken’s blend of simplicity and sophistication makes it a standout choice for crypto enthusiasts—why not explore it for yourself today?