When you place a Bitfinex trading order, you are either buying or selling an asset. Let’s break down the mechanics of Bitfinex trading orders, including buy and sell orders on the platform:

As one of the most advanced cryptocurrency exchanges in the world, Bitfinex offers a wide range of trading order types to help traders execute their strategies effectively. Whether you’re a beginner looking to understand the basics of buy/sell orders or an experienced trader seeking advanced order execution options, Bitfinex provides the tools you need to navigate the crypto market efficiently.

In this comprehensive Bitfinex Trading Order guide, we’ll explore everything from basic market orders to more complex options like stop-limit, trailing stop, and post-only limit orders. Additionally, we’ll break down Bitfinex trading fees to help you understand the cost structure and optimize your trading performance in 2025.

About Bitfinex Trading Orders

A Bitfinex Trading Order is an instruction given by a trader to buy or sell a cryptocurrency asset at a specified price or under predefined conditions. These orders determine how a trade is executed, affecting factors like execution price, market impact, and overall trading costs.

Bitfinex offers various types of trading orders to cater to different trading styles, from short-term scalping to long-term investment strategies. Knowing when and how to use each order type can significantly improve your trading efficiency and risk management.

Buy/Sell Orders on Bitfinex: How Do They Work?

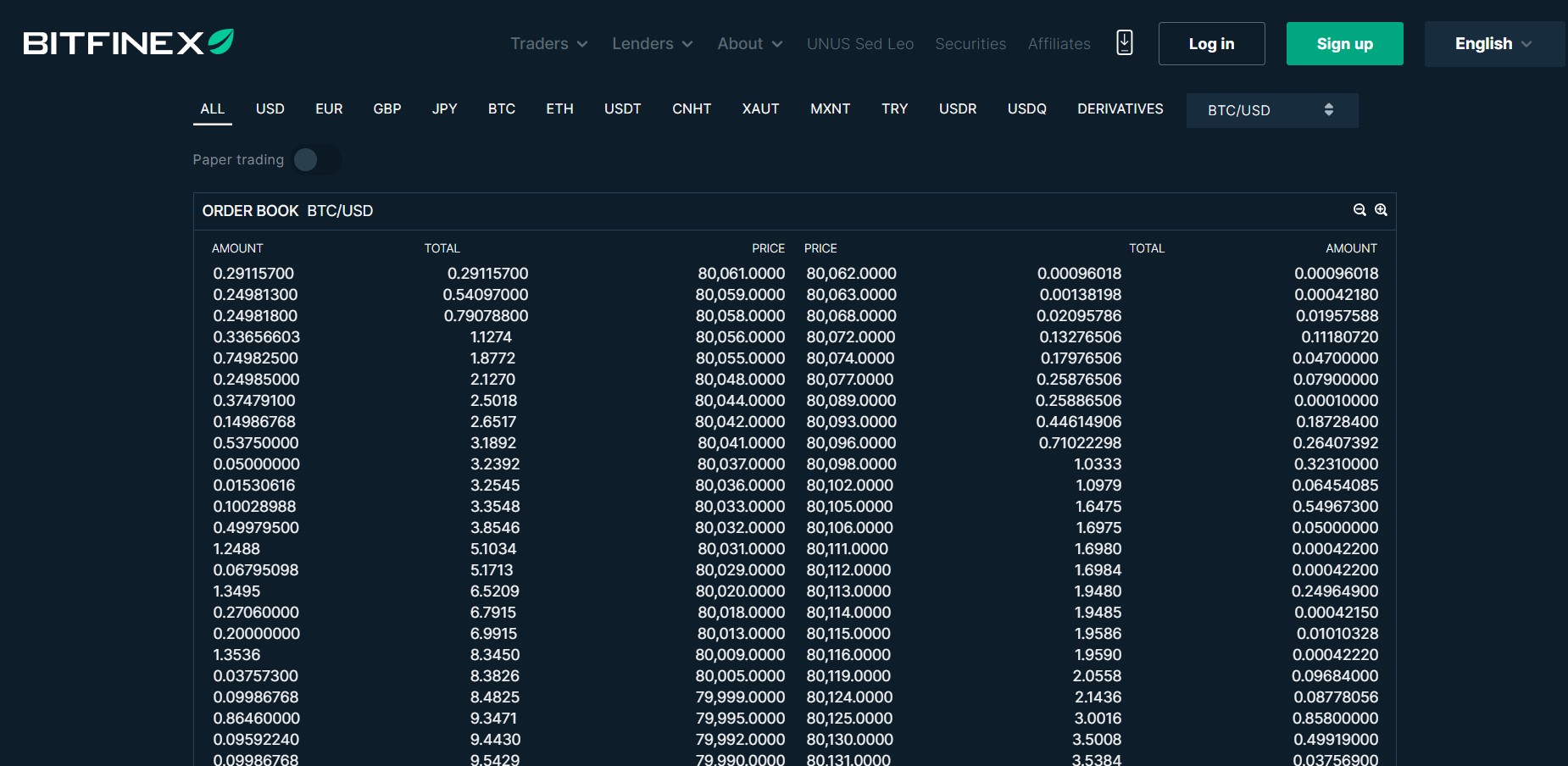

Market Orders

A market order is the simplest type of Bitfinex Trading Order, executing immediately at the best available market price.

- Market Buy Order: Purchases the asset at the lowest ask price currently available.

- Market Sell Order: Sells the asset at the highest bid price currently available.

Market orders prioritize speed over price control, making them useful for traders who need instant execution. However, they can lead to slippage, especially in low-liquidity markets.

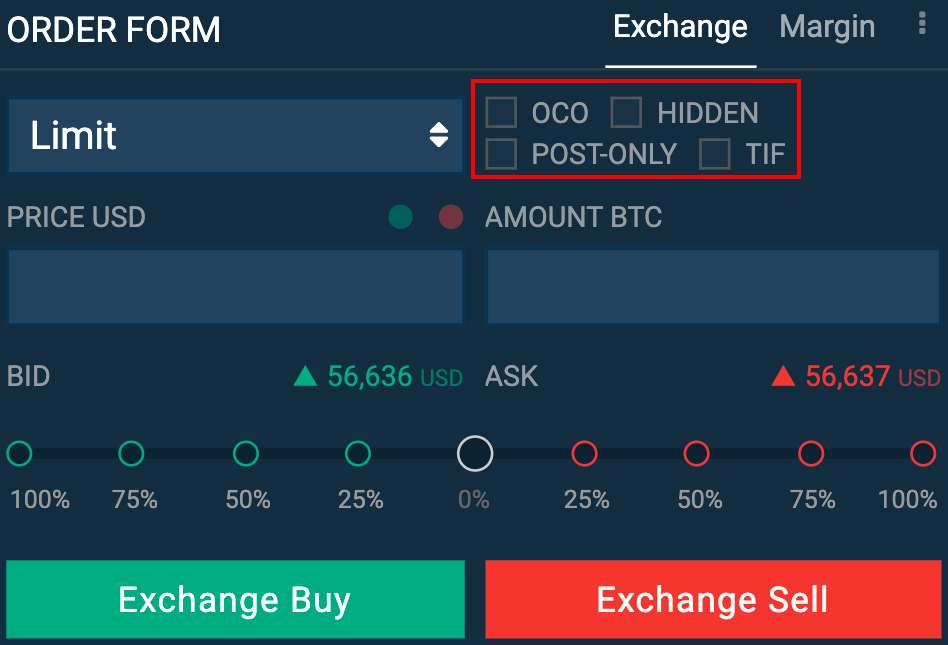

Limit Orders

A limit order allows traders to set a specific price at which they are willing to buy or sell.

- Limit Buy Order: Executes when the market price reaches or falls below the set price.

- Limit Sell Order: Executes when the market price reaches or exceeds the set price.

Limit orders give traders more control over their trades but may not be executed if the market does not reach the specified price.

Stop Orders (Stop-Loss & Stop-Buy)

A stop order is used to trigger a trade when the market reaches a certain price level.

- Stop-Loss Order: Triggers a market sell order when the price falls to a predefined level to limit losses.

- Stop-Buy Order: Triggers a market buy order when the price rises to a certain level, often used to enter positions on breakouts.

Stop orders are essential for managing risk and automating trade execution in volatile markets.

Stop-Limit Orders

A stop-limit order is a combination of a stop order and a limit order. It triggers a limit order once the stop price is reached.

For example, if you want to buy Bitcoin at $30,000 but not above $30,500, you could set a stop price of $30,000 and a limit price of $30,500. If the stop price is reached, a limit order will be placed at $30,500.

Trailing Stop Orders

A trailing stop order allows traders to set a stop order that moves with the market.

For example, if you set a trailing stop sell order with a $500 trailing distance and the price of Bitcoin rises from $30,000 to $31,000, the stop price will automatically adjust to $30,500. If the market price drops by $500, the order is triggered.

This type of Bitfinex Trading Order helps protect profits while allowing for potential upside movement.

Fill or Kill (FOK) Orders

A Fill or Kill (FOK) order is an order that must be executed immediately in full at a specified price, or it will be canceled entirely.

This type of order is used by traders who want to ensure that their entire position is filled at the specified price without partial execution.

Immediate or Cancel (IOC) Orders

An Immediate or Cancel (IOC) order executes all or part of the order immediately. Any unfilled portion is canceled.

Unlike FOK orders, IOC orders allow for partial fills. This is useful when liquidity is uncertain and traders want immediate execution for as much of their order as possible.

Scaled Orders

Bitfinex also provides a Scaled Order feature that allows traders to place multiple limit orders at different price levels automatically. This is beneficial for traders who want to distribute their orders across a price range to reduce the impact of large trades on the market.

Bitfinex Trading Fees: What You Need to Know

When trading on Bitfinex, understanding the platform’s fee structure is essential for optimizing costs and maximizing profitability. Every Bitfinex trading order incurs a fee, which varies depending on whether the trader is a maker or a taker. These fees directly impact your trading expenses, so knowing how they work can help you make smarter trading decisions.

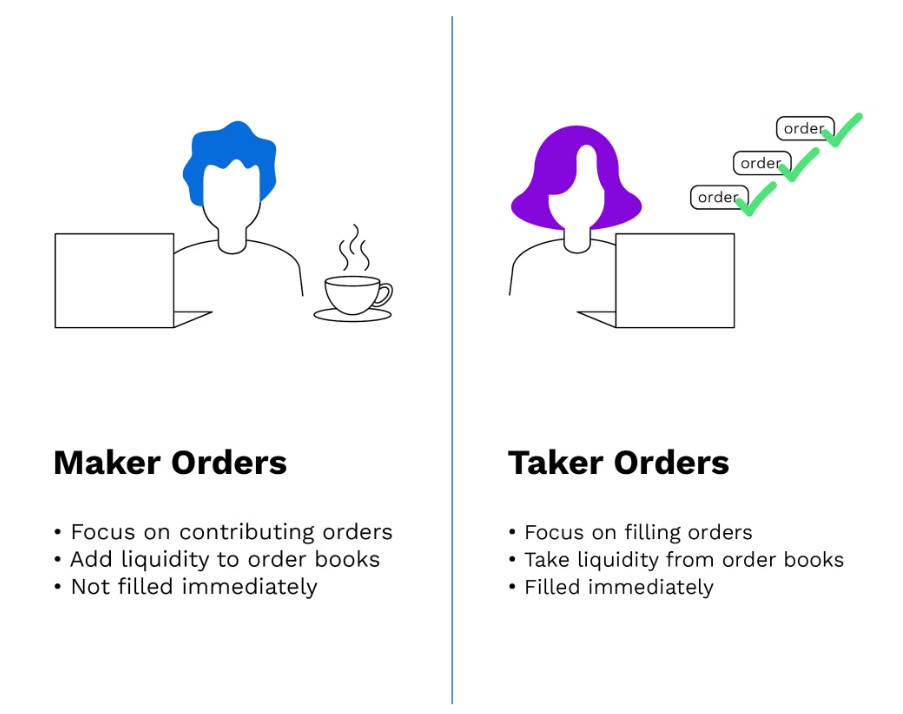

Maker vs. Taker Fees: How They Work

Bitfinex, like most cryptocurrency exchanges, operates on a maker-taker fee model.

- Maker Fees: These fees are charged when you add liquidity to the order book by placing a limit order that is not immediately matched with an existing order. Since these orders help maintain market liquidity, maker fees are lower than taker fees.

- Taker Fees: Charged when you remove liquidity from the order book by placing a market order (or a limit order that immediately matches with an existing order). Because takers execute trades instantly, they pay slightly higher fees.

This fee model incentivizes liquidity provision, rewarding traders who contribute to the depth of the order book.

Bitfinex Trading Fee Structure in 2025

Standard Trading Fees for Regular Users

- Maker Fee: 0.10% (applies to limit orders that do not execute immediately).

- Taker Fee: 0.20% (applies to market orders and immediately executed limit orders).

Fee Discounts for High-Volume Traders

Bitfinex offers fee reductions for traders with high monthly trading volumes. Below is an estimated breakdown of the Bitfinex trading fees based on 30-day trading activity:

- Trading Volume < $500,000 → Maker: 0.10% | Taker: 0.20%

- Trading Volume ≥ $1M → Maker: 0.08% | Taker: 0.18%

- Trading Volume ≥ $10M → Maker: 0.06% | Taker: 0.16%

- Trading Volume ≥ $50M → Maker: 0.04% | Taker: 0.14%

- Trading Volume ≥ $100M → Maker: 0.02% | Taker: 0.12%

- Trading Volume ≥ $500M → Maker: 0.00% | Taker: 0.10%

High-volume traders benefit from significantly reduced fees, making Bitfinex an attractive option for institutional and professional traders.

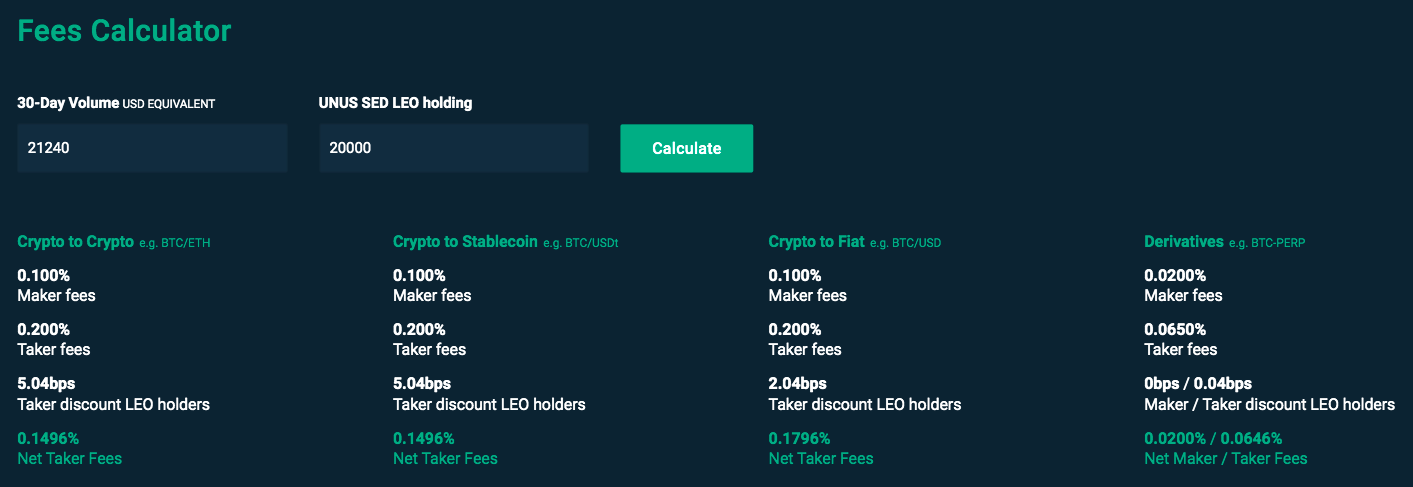

Additional Fee Reductions: LEO Token Discounts

Bitfinex offers an extra discount on trading fees for users who hold UNUS SED LEO (LEO) tokens, the exchange’s native utility token.

- Holding LEO tokens can reduce taker fees by up to 25%.

- Discounts are automatically applied based on the amount of LEO held in the user’s account.

If you frequently trade on Bitfinex, holding LEO tokens can help lower your Bitfinex trading fees significantly.

Margin Trading and Derivatives Fees

For margin trading and derivatives, Bitfinex trading fees are structured slightly differently:

-

Margin Trading Fees:

- Opening a position: Standard maker/taker fees apply.

- Funding cost: Traders who borrow funds for margin trading must pay interest to the lender (rates vary based on supply and demand).

-

Derivatives Trading Fees (Futures Contracts):

- Maker Fee: 0.02%

- Taker Fee: 0.065%

Derivatives traders also enjoy fee discounts based on volume and LEO token holdings.

Deposit & Withdrawal Fees

In addition to trading fees, Bitfinex charges deposit and withdrawal fees, which vary based on the method used.

Deposit Fees

- Crypto Deposits: Free for most cryptocurrencies.

- Fiat Deposits (Bank Wire): 0.1% of the deposit amount (minimum $60).

Withdrawal Fees (Cryptocurrency)

Bitfinex charges network-based withdrawal fees for crypto assets:

- Bitcoin (BTC): 0.0004 BTC per transaction.

- Ethereum (ETH): 0.0025 ETH per transaction.

- Tether (USDT) (ERC-20): 5 USDT.

- Tether (USDT) (TRC-20): 0 USDT (free).

To minimize withdrawal fees, users can opt for lower-cost blockchain networks like TRON (TRC-20) instead of Ethereum (ERC-20).

Withdrawal Fees (Fiat Currencies)

- Standard Bank Wire Withdrawal: 0.1% (minimum $60).

- Expedited Bank Wire Withdrawal: 1% (for faster processing).

Fiat withdrawal fees can be high, so many traders prefer using stablecoins (like USDT) to move funds between exchanges.

How to Reduce Bitfinex Trading Fees?

To optimize your trading costs, consider the following strategies:

- Increase Trading Volume → Trade higher amounts over 30 days to qualify for lower fee tiers.

- Use Limit Orders Instead of Market Orders → Avoid taker fees by placing limit orders that add liquidity to the order book.

- Hold LEO Tokens → Get additional trading fee discounts.

- Choose Low-Fee Withdrawal Methods → Use TRC-20 USDT instead of ERC-20 USDT to save on withdrawal fees.

- Use the Bitfinex Fee Calculator → Utilize the Bitfinex fee calculator to estimate trading costs in advance and plan your trades more efficiently.

By applying these strategies, traders can significantly reduce their Bitfinex trading fees and maximize their profits.

Conclusion

Trading on Bitfinex requires a solid understanding of different order types and fee structures. Whether you’re executing simple buy/sell trades or leveraging advanced order options like stop-limit and trailing stop, knowing when and how to use each Bitfinex Trading Order can significantly improve your profitability and risk management.

By mastering the platform’s order system and keeping an eye on Bitfinex trading orders and fees, traders can optimize their trading strategies and enhance their overall experience. If you’re looking for a powerful and flexible exchange for crypto trading in 2025, Bitfinex trading orders provide the versatility needed for both retail and institutional traders. Ready to start trading? Sign up on Bitfinex today and explore the full range of trading orders!