What Is MEXC Copy Trading and Why Should You Care?

Before jumping into the how-to, let’s break down the basics of MEXC copy trading and its appeal.

Understanding the Basics of MEXC Copy Trading

MEXC copy trading is an automated system that lets you replicate the trades of professional traders—called Lead Traders—on the MEXC platform. Imagine it as a shortcut: instead of analyzing markets yourself, you follow someone who’s already mastered the game. When the Lead Trader opens or closes a position, your account mirrors it in real time, adjusting for your chosen investment amount. Built into MEXC’s futures market, MEXC copy trading blends simplicity with the high-stakes potential of leveraged trading, making it a standout feature on this MEXC trading platform.

Why MEXC Copy Trading Stands Out

Why choose MEXC copy trading over doing it all manually? For starters, it saves time—hours spent on technical analysis become minutes of picking a trader to follow. It’s also beginner-friendly; you don’t need to understand candlesticks or RSI to start. Plus, MEXC offers low fees (0% maker, 0.01% taker on futures) and a robust pool of Lead Traders, ensuring you’re not stuck with amateurs. Whether you’re chasing profits or learning from the pros, MEXC copy trading bridges the gap between skill and opportunity.

How Does MEXC Copy Trading Work on the Platform?

Ready to see MEXC copy trading in action? Here’s how it operates on the MEXC trading platform.

The Mechanics Behind MEXC Copy Trading

On MEXC, copy trading happens within the futures section, where Lead Traders execute strategies using leverage up to 400x. As a follower, you link your account to theirs via the copy trading interface. When they trade—say, opening a long BTC/USDT position at 50x leverage—your account duplicates it instantly, scaled to your set budget. MEXC handles the technical syncing, ensuring near-identical entry and exit prices, though slight slippage can occur in volatile markets. You pay a profit share (up to 15%) to the Lead Trader if they win, incentivizing them to perform.

Roles in MEXC Copy Trading: Traders vs. Followers

There are two players here: Lead Traders and Followers. Lead Traders are the pros—vetted by MEXC for their track record—who trade and earn a cut of followers’ profits. Followers, like you, are the ones leveraging their expertise. You pick a trader, set your parameters (like investment amount or leverage), and let MEXC copy trading do the rest. It’s a win-win: traders gain extra income, and you ride their success.

How to Set Up MEXC Copy Trading Step-by-Step

Let’s get practical—here’s your guide to starting MEXC copy trading today.

Step 1: Create and Fund Your MEXC Account

First, you need an account on the MEXC trading platform:

- Visit mexc.com and click “Sign Up.”

- Register with your email or phone, set a password, and verify your details.

- Fund your account—go to “Wallets” > “Deposit,” choose a crypto (e.g., USDT), and transfer it from an external wallet. Alternatively, use P2P to buy USDT with fiat.

No KYC is required for basic trading (up to 10 BTC daily withdrawal), but completing it unlocks higher limits.

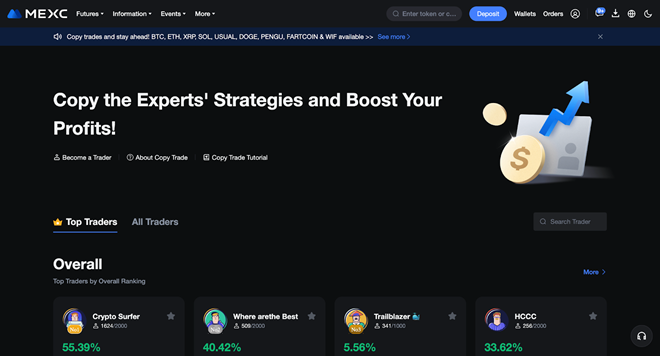

Step 2: Access the Copy Trading Feature

Once funded:

- Navigate to “Futures” on the top menu.

- Select “Copy Trade” from the dropdown.

- You’ll land on the copy trading dashboard, where you can see Lead Traders and their stats.

Step 3: Choose a Lead Trader to Follow

Picking the right trader is key to MEXC copy trading success:

- Browse the list—sort by ROI, win rate, or total followers.

- Check their profile: look at historical performance (7-day, 30-day, overall), drawdown (risk level), and trading style.

- Click “Follow” on your chosen trader. Each can have up to 1000 followers, so act fast for popular ones!

Step 4: Configure Your Copy Trading Settings

Customize your setup:

- Mode: Choose “Fixed Amount” (e.g., $50 per trade) or “Fixed Ratio” (a percentage of the trader’s margin).

- Leverage: Match the trader’s leverage or set your own (e.g., 20x for long positions).

- Slippage: Set a tolerance (e.g., 0.5%) to avoid big price gaps. Hit “Confirm,” and you’re live—your account now mirrors their trades.

What Are the Benefits of MEXC Copy Trading?

Why bother with MEXC copy trading? Let’s explore the perks.

Key Copy Trading Benefits for Beginners

Copy trading benefits on MEXC include:

- Time Efficiency: Skip the learning curve and let pros handle the heavy lifting.

- Access to Expertise: Tap into strategies from traders with proven results.

- Low Entry Barrier: Start with as little as 5 USDT per trade, making it budget-friendly.

- Learning Opportunity: Watch how experts trade and pick up tricks over time.

Profit Potential with Minimal Effort

With MEXC copy trading, you’re not just saving time—you’re potentially earning. A Lead Trader with a 70% win rate could turn your $100 into $150 in a week, minus their 15% cut. It’s passive income with the safety net of MEXC’s high liquidity and real-time execution.

What Risks Should You Watch Out For in MEXC Copy Trading?

No matter how appealing MEXC copy trading is, it’s not a flawless system, and understanding its risks is crucial to protecting your funds. While copying expert traders on MEXC can simplify your trading journey, there are pitfalls you need to manage carefully. By knowing what can go wrong and how to counter it, you’ll keep your MEXC copy trading experience on the right track.

Understanding the Downsides

Even when you follow traders on MEXC, MEXC risk is part of the game. One big downside is trader losses—if your Lead Trader makes a bad call, your account takes the hit too, since no strategy guarantees 100% success. Then there’s leverage risk; with options up to 400x, a small market dip can amplify into a devastating loss, potentially draining your wallet in minutes. Slippage is another hiccup—volatile markets can tweak your entry or exit prices slightly off the trader’s, especially during wild price swings, cutting into your returns.

How to Minimize Risks

You can stay safe with a few smart moves in MEXC copy trading. Start by picking traders with a solid history of consistent, long-term gains—avoid those riding short-term hot streaks that might fizzle out. Opt for lower leverage, like 5x or 10x, to keep your exposure manageable and give yourself breathing room against market drops. Finally, set a stop-loss in your copy trading settings to automatically cap losses if a trade goes south. These steps turn potential risks into manageable hurdles, letting you copy with confidence.

How to Choose the Best Lead Traders on MEXC?

Success in MEXC copy trading hinges on who you follow—here’s how to pick wisely.

Metrics to Evaluate Traders

When you follow traders on MEXC, check:

- ROI: High returns (e.g., 200% over 30 days) show profitability.

- Win Rate: Above 60% suggests reliability.

- Drawdown: Low max drawdown (under 20%) means less risk.

- Follower Count: More followers signal trust, but don’t chase hype alone.

Red Flags to Avoid

Steer clear of traders with:

- Erratic performance (big wins, bigger losses).

- High leverage with no stop-loss history.

- Short track records—stick to those with 90+ days of data.

How Does MEXC Copy Trading Compare to Manual Trading?

Still torn between copying and DIY? Let’s compare.

Copy Trading vs. Manual Trading on MEXC

- Effort: MEXC copy trading needs minutes to set up; manual trading demands hours of analysis.

- Skill: Copying requires none; manual needs market savvy.

- Control: Manual gives you full reins; copying delegates to traders.

- Profit Share: Copy trading takes up to 15% for the Lead Trader; manual keeps it all.

For busy beginners, MEXC copy trading wins on ease and speed.

Conclusion

MEXC copy trading transforms the crypto game for beginners and time-strapped traders alike. This guide has unpacked how to set it up on the MEXC trading platform, from funding your account to picking Lead Traders and managing risks. With copy trading benefits like time savings, expert access, and low entry costs, it’s no wonder MEXC’s feature is a hit among its 10 million users. Sure, there’s MEXC risk—trader losses or leverage pitfalls—but with smart choices (like following proven traders on MEXC) and cautious settings, you can tilt the odds in your favor. Ready to try it?