The cryptocurrency market offers immense opportunities for investors, but success often hinges on understanding the tools at your disposal. On Gemini, a leading crypto exchange founded by Cameron and Tyler Winklevoss in 2014, executing trades effectively requires a solid grasp of Gemini Trading Order types. Whether you’re a beginner or a seasoned trader, knowing how to use Gemini Trading Orders—such as Buy/Sell Orders on Gemini—can significantly enhance your trading strategy. Additionally, understanding Gemini Trading Fees ensures you maximize profits while minimizing costs. This in-depth guide, spanning over 2500 words, will walk you through the various Gemini Trading Order types, how to place Buy/Sell Orders on Gemini, and the associated Gemini Trading Fees, empowering you to trade smarter and more efficiently on Gemini’s secure, regulated platform.

Why Understanding Gemini Trading Orders Matters

Gemini is a New York Trust Company regulated by the New York State Department of Financial Services (NYDFS), known for its robust security measures and user-friendly interface. The platform supports a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Gemini’s stablecoin, GUSD, making it a popular choice for both novice and experienced traders. Gemini offers two trading interfaces: the standard platform for beginners and ActiveTrader for advanced users, each supporting a variety of Gemini Trading Orders.

Understanding Gemini Trading Order types is crucial because they determine how your trades are executed, impacting your entry and exit points in the volatile crypto market. Whether you’re placing Buy/Sell Orders on Gemini to capitalize on price movements or managing costs with Gemini Trading Fees in mind, the right order type can mean the difference between profit and loss. This guide will break down each Gemini Trading Order type, explain how to use them effectively, and provide strategies to optimize your trades while keeping Gemini Trading Fees in check.

Overview of Gemini Trading Order Types

Gemini offers a range of Gemini Trading Orders to suit different trading strategies, from simple market orders to more advanced options. Here’s a detailed look at the order types available on both the standard platform and ActiveTrader.

1. Market Order

A market order is the simplest Gemini Trading Order, designed for immediate execution at the current market price. When you place a market order as part of your Buy/Sell Orders on Gemini, you’re prioritizing speed over price control.

- How It Works: If you place a market buy order for 1 BTC, Gemini will execute the purchase at the best available price in the order book, filling your order instantly (or as quickly as possible).

- Best For: Traders who need to enter or exit a position quickly, especially during high volatility.

- Drawback: You have no control over the price, which can lead to slippage (the difference between the expected price and the actual execution price) in fast-moving markets.

2. Limit Order

A limit order allows you to set a specific price at which you want to buy or sell, offering more control than a market order.

- How It Works: For a limit buy order, you specify the maximum price you’re willing to pay (e.g., $30,000 for 1 BTC). The order only executes if the market price reaches or falls below your limit. For a limit sell order, you set the minimum price you’ll accept.

- Best For: Traders who want to control their entry or exit price and are willing to wait for the market to meet their conditions.

- Drawback: Your order may not fill if the market doesn’t reach your specified price.

3. Immediate or Cancel (IOC) Order

An IOC order is a type of limit order that must be executed immediately, or it’s canceled.

- How It Works: If you place an IOC buy order for 0.5 ETH at $1,500, Gemini will attempt to fill the order at that price or better. Any portion that can’t be filled immediately is canceled.

- Best For: Day traders who need quick execution but don’t want to leave an order open if it can’t be filled right away.

- Drawback: You may end up with a partially filled order or no execution at all if liquidity is low.

4. Fill or Kill (FOK) Order

A FOK order is similar to an IOC order but requires the entire order to be filled immediately, or it’s canceled entirely.

- How It Works: If you place a FOK buy order for 2 BTC at $29,000, Gemini must fill the entire 2 BTC at that price or better right away. If it can’t, the order is canceled.

- Best For: Traders who need to execute large orders without partial fills, ensuring they get the full amount at their desired price.

- Drawback: Less flexible than IOC, as it demands full execution or nothing.

5. Maker-or-Cancel (MOC) Order

A MOC order ensures your limit order adds liquidity to the order book (i.e., it’s a maker order) rather than taking liquidity (a taker order).

- How It Works: If your MOC buy order at $1,600 for ETH can’t be placed on the order book as a maker, it’s canceled.

- Best For: Traders looking to avoid taker fees, as maker orders typically have lower Gemini Trading Fees.

- Drawback: If the market moves too quickly, your order may not execute.

6. Stop-Limit Order (ActiveTrader Only)

A stop-limit order combines a stop order (trigger) with a limit order (execution price), offering protection against sudden price drops or spikes.

- How It Works: For a stop-limit sell order, you set a stop price (e.g., $28,000 for BTC) and a limit price (e.g., $27,500). If BTC’s price falls to $28,000, a limit sell order is placed at $27,500 or better.

- Best For: Risk management, such as protecting profits or limiting losses during volatile periods.

- Drawback: If the price gaps past your limit, the order may not fill.

[Image Placeholder 1: “Gemini Trading Order Types” – A visual chart displaying the different Gemini Trading Order types (Market, Limit, IOC, FOK, MOC, Stop-Limit) with brief descriptions. Caption: “Explore the variety of Gemini Trading Orders for smarter trades.”]

How to Place Buy/Sell Orders on Gemini

Now that you understand the types of Gemini Trading Orders, let’s walk through the process of placing Buy/Sell Orders on Gemini using both the standard platform and ActiveTrader.

Using the Standard Platform

The standard platform is ideal for beginners due to its simplicity.

- Log In: Access your Gemini account at gemini.com.

- Navigate to Trade: Go to the “Buy/Sell” tab on the dashboard.

- Select a Trading Pair: Choose a pair like BTC/USD or ETH/GUSD.

- Choose Order Type: Select Market or Limit from the dropdown.

- For a Market Order: Enter the amount (e.g., 0.1 BTC) and click “Buy” or “Sell.”

- For a Limit Order: Specify the price (e.g., $30,000) and amount, then click “Buy” or “Sell.”

- Review Fees: Gemini displays the estimated Gemini Trading Fees (e.g., 0.35% for standard trades) before confirmation.

- Confirm: Verify the details and submit your order. Market orders execute instantly, while limit orders wait for the market to reach your price.

Using ActiveTrader

ActiveTrader offers advanced tools and more Gemini Trading Order options.

- Switch to ActiveTrader: From the “Trade” tab, select “ActiveTrader.”

- Select a Pair: Choose BTC/USD, ETH/BTC, or another pair.

- Choose Order Type: Pick from Market, Limit, IOC, FOK, MOC, or Stop-Limit.

- For a Stop-Limit Order: Set the stop price (e.g., $28,000) and limit price (e.g., $27,500), then specify the amount.

- Review and Submit: ActiveTrader shows real-time order book data and fees. Confirm your order, and it will execute based on your conditions.

Tips for Placing Buy/Sell Orders on Gemini

- Start with small trades to familiarize yourself with the platform.

- Use limit orders to control costs, especially in volatile markets.

- Monitor the order book on ActiveTrader to gauge liquidity and avoid slippage.

Understanding Gemini Trading Fees

Gemini Trading Fees play a critical role in your profitability, so understanding how they work is essential when placing Gemini Trading Orders. Gemini uses a maker-taker fee model, with fees varying based on your 30-day trading volume and the interface you use.

Fee Structure on the Standard Platform

- Default Fee: 0.35% per trade (both buy and sell).

- Convenience Fee: An additional 0.5% on top of the market price for market orders, applied to cover price volatility.

- Example: If you buy $1,000 of BTC, you’ll pay $3.50 (0.35%) in trading fees plus a $5 convenience fee, totaling $8.50.

Fee Structure on ActiveTrader

ActiveTrader offers lower fees based on your 30-day trading volume:

- Maker Fee: 0.20% (adds liquidity to the order book).

- Taker Fee: 0.40% (removes liquidity by matching an existing order).

- Volume Discounts: Fees decrease as your trading volume increases. For example, at $1 million in 30-day volume, maker fees drop to 0.10% and taker fees to 0.30%.

Additional Fees

- Deposit Fees: Free for ACH and crypto deposits; $20-$35 for wire transfers.

- Withdrawal Fees: Free for ACH withdrawals (up to 10 per month); $20-$35 for wires; crypto withdrawals incur network fees (e.g., 0.002 BTC for Bitcoin).

Strategies to Minimize Gemini Trading Fees

- Use ActiveTrader to access the maker-taker model, prioritizing maker orders (e.g., MOC) for lower fees.

- Increase your trading volume over time to qualify for fee discounts.

- Avoid market orders on the standard platform to bypass the convenience fee, opting for limit orders instead.

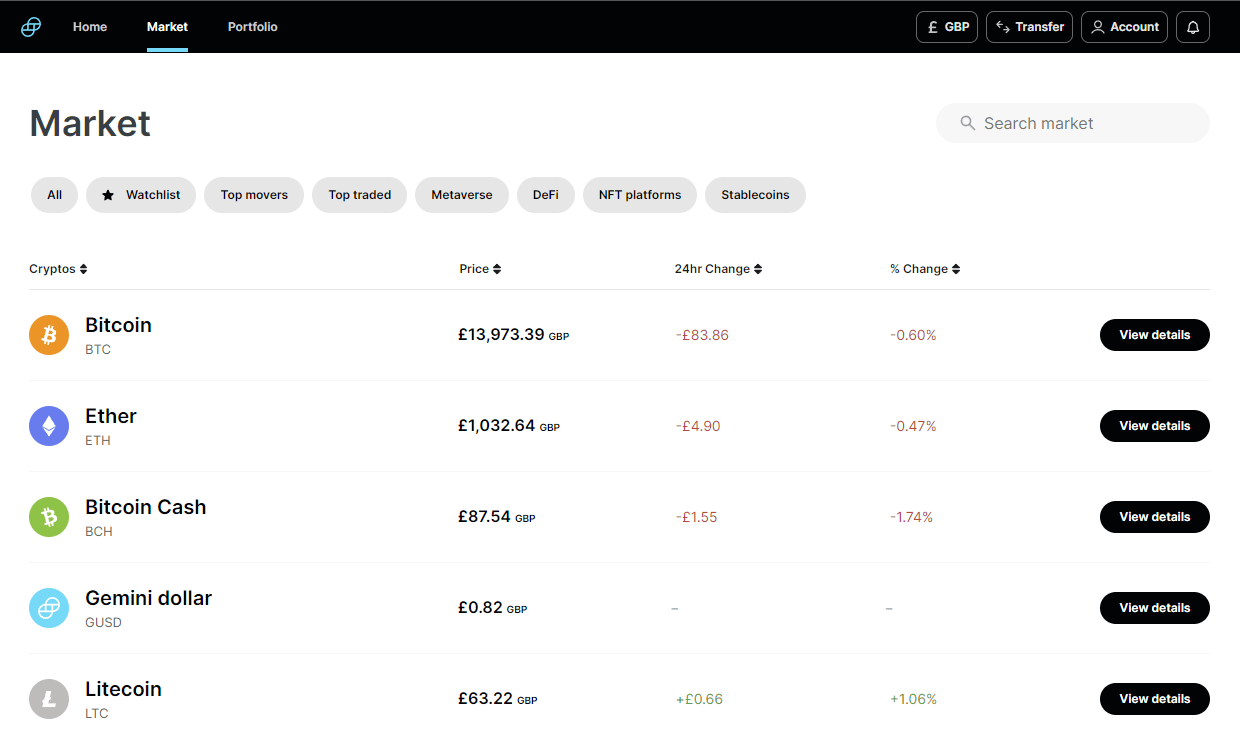

[Image Placeholder 2: “Gemini Trading Fees Breakdown” – A table comparing standard platform fees (0.35%) and ActiveTrader fees (maker: 0.20%, taker: 0.40%) with a graph showing fee tiers. Caption: “Understand Gemini Trading Fees to optimize your trades.”]

Advanced Strategies for Using Gemini Trading Orders

To elevate your trading game, leverage these strategies with Gemini Trading Orders:

1. Scalping with IOC and FOK Orders

Use IOC or FOK orders on ActiveTrader to scalp small profits during short-term price movements. For example, place an IOC buy order for ETH at $1,500, aiming to sell at $1,510 within minutes. These orders ensure quick execution without leaving unfilled orders on the book.

2. Risk Management with Stop-Limit Orders

Protect your portfolio by setting stop-limit orders. If you hold 1 BTC at $30,000, set a stop-limit sell order with a stop price of $29,000 and a limit price of $28,500 to limit losses if the price drops suddenly.

3. Dollar-Cost Averaging (DCA) with Limit Orders

Implement DCA by placing recurring limit buy orders. For instance, set a weekly limit buy order for 0.05 BTC at $29,500, buying consistently over time to average out price volatility.

4. Liquidity Provision with Maker Orders

Use MOC orders to act as a maker, adding liquidity and benefiting from lower Gemini Trading Fees. For example, place a MOC buy order for ETH slightly below the market price to ensure it sits on the order book.

5. Arbitrage Opportunities

Monitor price differences between Gemini and other exchanges like Binance. Use limit orders to buy low on Gemini and sell high elsewhere, accounting for Gemini Trading Fees and network fees.

Comparing Gemini Trading Orders with Other Exchanges

How do Gemini Trading Orders compare to those on Binance, Coinbase, and Kraken?

| Platform | Order Types | Trading Fees | Interface | Security |

|---|---|---|---|---|

| Gemini | Market, Limit, IOC, FOK, MOC, Stop-Limit | 0.20%-0.40% (ActiveTrader) | Standard & ActiveTrader | Cold storage, 2FA |

| Binance | Market, Limit, Stop-Limit, OCO | 0.10% (standard) | Advanced | Robust measures |

| Coinbase | Market, Limit, Stop | 0.50% (standard) | Simple | Insured wallets |

| Kraken | Market, Limit, Stop-Loss, Take-Profit | 0.16%-0.26% (standard) | Advanced | High security |

- Gemini vs. Binance: Binance offers more order types (e.g., OCO) and lower fees, but Gemini’s regulatory compliance and ActiveTrader interface appeal to cautious traders.

- Gemini vs. Coinbase: Coinbase has fewer order types and higher fees, while Gemini’s IOC, FOK, and MOC orders provide more flexibility.

- Gemini vs. Kraken: Kraken offers similar order types, but Gemini’s fee structure is more competitive for high-volume traders on ActiveTrader.

Common Mistakes to Avoid with Gemini Trading Orders

- Overusing Market Orders: Leads to slippage and higher fees; use limit orders for better control.

- Ignoring Fees: Failing to account for Gemini Trading Fees can erode profits, especially for frequent traders.

- Misplacing Stop-Limit Orders: Setting stop prices too close to the market price may trigger unwanted sales during minor fluctuations.

- Not Monitoring Liquidity: IOC and FOK orders may fail in low-liquidity markets; check the order book first.

Tips to Optimize Buy/Sell Orders on Gemini

- Start with ActiveTrader to access lower fees and advanced order types.

- Use stop-limit orders to protect against sudden price drops.

- Place maker orders (e.g., MOC) to reduce Gemini Trading Fees.

- Trade during high-liquidity periods (e.g., U.S. market hours) to minimize slippage.

- Monitor Gemini’s blog for updates on new order types or fee changes.

Conclusion

Mastering Gemini Trading Order types is the key to smarter, more profitable crypto trading. Whether you’re placing Buy/Sell Orders on Gemini with market, limit, IOC, FOK, MOC, or stop-limit orders, Gemini offers the tools to execute your strategy effectively. By understanding Gemini Trading Fees and leveraging ActiveTrader’s advanced features, you can minimize costs and maximize returns. Gemini’s secure, regulated platform ensures your trades are protected, making it an ideal choice for traders at all levels.

Ready to trade smarter? Sign up on Gemini, explore its Gemini Trading Orders, and start executing trades with confidence. For more guides and insights, visit http://cryptoexlist.com/. Begin mastering your trades on Gemini today!