In the dynamic world of cryptocurrency, stability is a prized asset, and the Gemini Dollar (GUSD) stands out as a reliable stablecoin pegged 1:1 to the U.S. dollar. As a regulated digital currency issued by Gemini, a trusted cryptocurrency exchange founded by Cameron and Tyler Winklevoss in 2014, GUSD offers a secure way to hold and transact value without the volatility of assets like Bitcoin or Ethereum. Central to managing GUSD effectively is the Gemini Dollar wallet, a feature integrated into the Gemini platform that ensures safety, accessibility, and ease of use. This comprehensive guide, exceeding 2500 words, will explore the Gemini Dollar wallet in detail, covering its setup, benefits, security features, usage for trading and staking, and comparisons with other stablecoin wallets. Whether you’re a beginner or an experienced crypto user, this article will equip you with the knowledge to leverage the Gemini Dollar wallet confidently.

What Is the Gemini Dollar and Why Use It?

The Gemini Dollar (GUSD) is a stablecoin launched by Gemini in September 2018, designed to maintain a 1:1 peg with the U.S. dollar. Unlike volatile cryptocurrencies, GUSD’s value is backed by USD reserves held in bank accounts, ensuring stability for transactions, savings, and trading. Issued on the Ethereum blockchain as an ERC-20 token, GUSD combines the benefits of decentralization with the reliability of a regulated financial product.

Gemini’s commitment to transparency sets GUSD apart. The company provides monthly attestations from independent accounting firm BPM, confirming that every GUSD in circulation is backed by an equivalent amount of USD. This regulatory oversight, coupled with Gemini’s status as a New York Trust Company under the New York State Department of Financial Services (NYDFS), makes GUSD a trusted choice for users seeking stability in the crypto space.

The Gemini Dollar wallet is the key to managing your GUSD holdings. Integrated into the Gemini exchange, this wallet allows you to store, send, receive, and trade GUSD securely. Whether you’re using it for everyday transactions, earning interest through staking, or trading on Gemini’s platform, the Gemini Dollar wallet offers a seamless experience tailored to both novice and advanced users.

Setting Up Your Gemini Dollar Wallet

Getting started with the Gemini Dollar wallet is a straightforward process that begins with creating a Gemini account. Here’s a step-by-step guide to help you set up and fund your wallet.

Step 1: Sign Up for a Gemini Account

- Visit Gemini: Go to gemini.com and click “Sign Up” in the top right corner.

- Enter Details: Provide your full name, email address, and a strong password (minimum 12 characters, including letters, numbers, and symbols).

- Verify Email: Check your inbox for a verification link from Gemini and click it to activate your account.

- Complete KYC: Submit a government-issued ID (e.g., passport or driver’s license) and a selfie or proof of address. Verification typically takes a few minutes to a few hours.

Step 2: Access the Gemini Dollar Wallet

Once your account is verified, log in to Gemini. The Gemini Dollar wallet is automatically available as part of your account’s wallet section. Navigate to the “Assets” or “Wallet” tab to view your GUSD balance, which will initially be zero until you deposit funds.

Step 3: Fund Your Gemini Dollar Wallet

You can add GUSD to your wallet through deposits or purchases:

- Deposit GUSD: Transfer GUSD from an external ERC-20 compatible wallet (e.g., MetaMask) to your Gemini wallet address. Gemini provides a unique deposit address under the “Deposit” option—copy it carefully and initiate the transfer. Note that network fees (e.g., Ethereum gas fees) apply.

- Buy GUSD: Purchase GUSD directly on Gemini using USD via ACH transfer (free, 1-3 days), wire transfer ($20-$35 fee, same-day), or credit/debit card (3.49% fee, instant). Select GUSD from the buy/sell interface, enter the amount, and confirm the transaction.

Tips for a Smooth Setup

- Enable two-factor authentication (2FA) immediately using an authenticator app or security key to secure your Gemini Dollar wallet.

- Start with a small deposit (e.g., $50) to test the process.

- Double-check wallet addresses to avoid losing funds due to errors.

With your Gemini Dollar wallet funded, you’re ready to explore its features and benefits.

Benefits of the Gemini Dollar Wallet

The Gemini Dollar wallet offers several advantages that make it a preferred choice for managing stablecoins.

1. Unmatched Security

Gemini prioritizes security, storing the majority of user funds in offline, air-gapped cold storage. The Gemini Dollar wallet benefits from this infrastructure, reducing the risk of hacks. Additionally, mandatory 2FA and SOC 1 Type 2 and SOC 2 Type 2 certifications ensure your GUSD holdings are well-protected.

2. Regulatory Assurance

As a regulated entity, Gemini conducts monthly attestations with BPM to verify that every GUSD is backed by USD reserves. This transparency, combined with NYDFS oversight, provides confidence that your Gemini Dollar wallet holds a stable and trustworthy asset.

3. Seamless Integration with Gemini Services

The Gemini Dollar wallet is fully integrated with Gemini’s trading, staking, and NFT platforms. You can use GUSD for spot trading, as collateral in derivatives, or to participate in staking programs (if available), enhancing its utility within the ecosystem.

4. Fiat On/Off Ramps

Unlike many stablecoin wallets that require crypto-to-crypto transactions, the Gemini Dollar wallet supports direct USD deposits and withdrawals. This fiat accessibility makes it easy to convert GUSD to cash or vice versa, ideal for users new to crypto.

5. User-Friendly Interface

Gemini’s intuitive design extends to the Gemini Dollar wallet. The dashboard provides real-time balance updates, transaction history, and easy navigation for deposits, withdrawals, and trades, making it accessible for all users.

How to Use the Gemini Dollar Wallet for Trading

The Gemini Dollar wallet is a powerful tool for trading on Gemini’s platform. Here’s how to leverage it effectively.

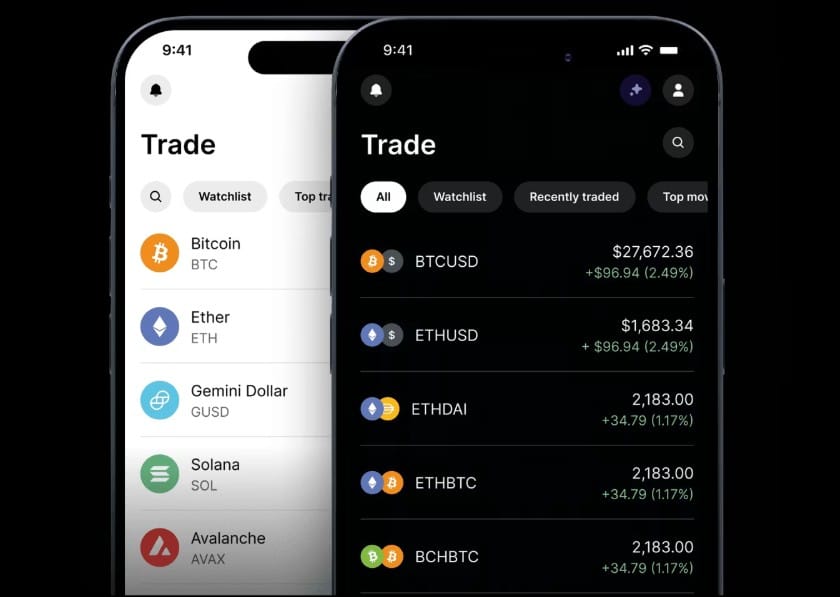

Spot Trading with GUSD

- Select a Pair: Navigate to the “Trade” tab and choose a trading pair involving GUSD (e.g., GUSD/BTC or GUSD/ETH).

- Place an Order: Use a market or limit order to buy or sell. For example, place a limit buy order for 0.1 BTC at $30,000 using GUSD.

- Confirm and Execute: Review the Gemini Trading Fees (0.35% on the standard platform, adjustable on ActiveTrader) and confirm the trade. Your GUSD balance adjusts accordingly.

Derivatives Trading with GUSD

Gemini’s derivatives platform (via the Gemini Foundation, non-U.S.) allows you to use GUSD for perpetual contracts.

- Access Derivatives: Switch to ActiveTrader and select a GUSD-based pair (e.g., BTC/GUSD).

- Set Leverage: Choose leverage up to 100x and place a buy or sell order.

- Monitor: GUSD’s stability hedges against crypto volatility, making it a reliable collateral option.

Tips for Trading with the Gemini Dollar Wallet

- Use limit orders to control costs and avoid slippage.

- Monitor GUSD’s peg stability via Gemini’s attestations to ensure it remains 1:1 with USD.

- Leverage ActiveTrader’s real-time data for precise entries and exits.

Staking and Earning with the Gemini Dollar Wallet

While GUSD itself isn’t directly stakeable, the Gemini Dollar wallet can hold proceeds from staking other assets or participate in future staking programs if Gemini expands its offerings.

- Indirect Benefits: Stake ETH or MATIC, and store your Gemini staking rewards in your Gemini Dollar wallet as GUSD for stability.

- Gemini Earn Legacy: Previously, Gemini Earn allowed lending GUSD for up to 7.4% APY, but it’s paused following the 2022 Genesis issues. Check for updates on Gemini’s blog.

How to Manage Staking Proceeds

- Convert Rewards: After staking ETH, sell your rewards for GUSD on the spot market.

- Store Securely: Keep GUSD in your Gemini Dollar wallet to avoid market volatility.

- Reinvest: Use GUSD to buy more staking assets, compounding your returns.

Withdrawing and Sending GUSD from Your Gemini Dollar Wallet

The Gemini Dollar wallet supports flexible withdrawal and transfer options.

Withdrawal Process

- Navigate to Withdraw: Go to the “Transfer Funds” or “Withdraw” section.

- Select GUSD: Choose GUSD and your method (e.g., ACH, wire, or crypto).

- Enter Details: For bank withdrawals, input your account details (minimum $10 for ACH, $500 for wires). For crypto, provide an ERC-20 address.

- Confirm: Verify with 2FA and submit. ACH takes 1-3 days (free up to 10/month), wires cost $20-$35, and crypto incurs network fees.

Sending GUSD

- Go to “Send” in the wallet section.

- Enter the recipient’s ERC-20 address and amount.

- Confirm with 2FA. Network fees apply (e.g., $5-$20 depending on Ethereum congestion).

Tips

- Use Gemini’s custody for large GUSD holdings to avoid external wallet risks.

- Withdraw during low-traffic periods to minimize gas fees.

Security Features of the Gemini Dollar Wallet

The Gemini Dollar wallet inherits Gemini’s robust security protocols:

- Cold Storage: Most funds are offline, reducing hack risks.

- 2FA: Mandatory for all actions, enhancing account security.

- Insurance: Gemini insures hot wallet funds against theft or loss.

- Encryption: Data is protected with strong encryption protocols.

Regularly back up your 2FA codes and monitor your wallet for unauthorized activity to maintain security.

Comparing the Gemini Dollar Wallet with Other Stablecoin Wallets

How does the Gemini Dollar wallet compare to alternatives like Tether (USDT) on Binance, USD Coin (USDC) on Coinbase, or Dai on MakerDAO?

| Wallet/Platform | Stability | Security | Fiat Support | Fees | Utility |

|---|---|---|---|---|---|

| Gemini Dollar Wallet | 1:1 USD peg, attested | Cold storage, 2FA | Yes (ACH, Wire) | 0.35% trading | Trading, staking |

| USDT (Binance) | 1:1 USD peg, less transparent | Moderate | No | 0.10% | Wide adoption |

| USDC (Coinbase) | 1:1 USD peg, attested | Insured wallets | Yes (Bank) | 0.50% | DeFi, trading |

| Dai (MakerDAO) | Algorithmic peg | Decentralized | No | Variable | DeFi focus |

- Gemini vs. USDT: USDT’s lack of regular attestations raises concerns, while Gemini’s transparency and fiat support give it an edge.

- Gemini vs. USDC: Both are attested, but Gemini’s lower trading fees and integrated wallet beat Coinbase’s higher costs.

- Gemini vs. Dai: Dai offers decentralization, but Gemini’s regulatory backing and fiat access make it more user-friendly.

Risks and Considerations

- Peg Stability: While rare, stablecoins can depeg. Gemini’s attestations mitigate this risk.

- Network Fees: Ethereum gas fees can be high for GUSD transactions; monitor congestion.

- Regulatory Changes: U.S. regulations could impact GUSD’s status or usage.

- Limited Staking: GUSD isn’t directly stakeable, reducing passive income options.

Mitigate risks by diversifying stablecoin holdings and staying informed via Gemini’s updates.

Advanced Tips for Using the Gemini Dollar Wallet

- Arbitrage: Exploit GUSD price differences between Gemini and other exchanges.

- Hedging: Use GUSD in derivatives to offset crypto volatility.

- Automation: Integrate with Gemini’s API for automated GUSD trading.

- Tax Planning: Track GUSD transactions for tax reporting, as stablecoin trades may be taxable.

Conclusion: Embrace the Gemini Dollar Wallet

The Gemini Dollar wallet offers a secure, regulated, and versatile way to manage GUSD, ideal for trading, staking, and withdrawals. With its fiat accessibility, robust security, and integration with Gemini’s ecosystem, it stands out among stablecoin wallets. While risks like network fees and regulatory changes exist, strategic use can maximize its benefits.

Ready to explore the Gemini Dollar wallet? Sign up on Gemini and start managing your GUSD today. For more insights and comparisons, visit Cryptoexlist. Take control of your stablecoin journey now!