For cryptocurrency traders seeking advanced tools to execute sophisticated strategies, the Gemini ActiveTrader platform offers a powerful solution. As part of Gemini, a regulated exchange founded by Cameron and Tyler Winklevoss in 2014, ActiveTrader provides a professional-grade interface designed for precision trading. This comprehensive Gemini ActiveTrader guide, exceeding 2500 words, will walk you through the process of Gemini ActiveTrader setup, explain how to use its features effectively, and detail Gemini ActiveTrader trading fees to help you optimize your trading experience. Whether you’re a seasoned trader or looking to elevate your skills, this guide will empower you to master Gemini ActiveTrader and maximize your crypto trading potential.

Why Choose Gemini ActiveTrader?

Gemini ActiveTrader is an advanced trading platform tailored for users who demand more control and insight than the standard Gemini interface provides. As a New York Trust Company regulated by the New York State Department of Financial Services (NYDFS), Gemini ensures a secure and compliant environment, and ActiveTrader builds on this foundation with sophisticated tools. Unlike the basic platform, which suits beginners with its simplicity, ActiveTrader caters to experienced traders with real-time market data, customizable charts, and a variety of order types.

The platform supports trading pairs like BTC/USD, ETH/GUSD, and more, integrating seamlessly with your Gemini wallet. This Gemini ActiveTrader guide will cover the setup process for Gemini ActiveTrader setup, how to navigate its features, and the impact of Gemini ActiveTrader trading fees on your profitability. By mastering these elements, you can execute trades with precision and efficiency, making ActiveTrader a valuable tool in your trading arsenal.

Gemini ActiveTrader Setup: Getting Started

To begin using Gemini ActiveTrader, you need an existing Gemini account and a funded wallet. Here’s a detailed step-by-step guide for Gemini ActiveTrader setup.

Step 1: Verify Your Gemini Account

Before you can use Gemini ActiveTrader, ensure your Gemini account is fully set up:

- Visit gemini.com and click “Sign Up” if you’re new, or log in if you already have an account.

- Provide your full name, email, and a strong password (minimum 12 characters with letters, numbers, and symbols).

- Verify your email via the link sent by Gemini.

- Complete KYC verification by uploading a government-issued ID (e.g., passport) and a selfie or proof of address. This process may take a few minutes to a few hours.

Step 2: Fund Your Gemini Wallet

ActiveTrader requires a funded wallet to execute trades. Deposit funds via:

- Cryptocurrency: Transfer BTC, ETH, or GUSD from an external wallet using the deposit address provided in the “Deposit” section. Account for network fees (e.g., Ethereum gas fees).

- Fiat: Add USD via ACH (free, 1-3 days), wire ($20-$35 fee), or credit/debit card (3.49% fee).

- Buy Crypto: Purchase assets directly on Gemini to credit your wallet.

Step 3: Access Gemini ActiveTrader

- Log In: Sign into your Gemini account.

- Navigate to ActiveTrader: From the dashboard, go to the “Trade” tab and select “ActiveTrader” from the interface options.

- Enable Access: If it’s your first time, you may need to confirm your intent to use ActiveTrader, which is available to all verified users without additional fees for access.

Step 4: Customize Your Setup

- Chart Preferences: Adjust timeframes, indicators (e.g., RSI, MACD), and chart types (candlestick, line) under the charting tools.

- Order Preferences: Set default order types (e.g., limit, stop-limit) and display settings for the order book.

- Alerts: Configure price alerts to stay informed of market movements.

Tips for Gemini ActiveTrader Setup

- Enable two-factor authentication (2FA) with an authenticator app or security key to secure your account.

- Start with a small balance to test ActiveTrader features.

- Familiarize yourself with the layout using the demo mode (if available) to optimize your Gemini ActiveTrader setup.

With your setup complete, you’re ready to explore how to use Gemini ActiveTrader for trading.

How to Use Gemini ActiveTrader: A Detailed Walkthrough

Gemini ActiveTrader offers advanced tools to execute complex trading strategies. This section provides a step-by-step Gemini ActiveTrader guide on how to use its features effectively.

Navigating the Interface

- Market Data: The left panel displays the order book, showing buy and sell orders in real-time.

- Charting Tools: The central area features customizable charts with technical indicators and drawing tools.

- Order Entry: The right panel allows you to input orders, view open positions, and monitor trade history.

Placing Orders

ActiveTrader supports multiple order types, enhancing your trading precision:

- Market Order: Execute instant trades at the current market price. Select your pair (e.g., BTC/USD), enter the amount, and click “Buy” or “Sell.”

- Limit Order: Set a specific price for execution. For example, place a limit buy order for 0.1 BTC at $30,000, which executes only if the price drops to or below that level.

- Immediate or Cancel (IOC) Order: Requires immediate execution or cancellation. Enter an IOC buy order for 0.5 ETH at $1,500; unfilled portions are canceled.

- Fill or Kill (FOK) Order: Demands full execution or cancellation. Place a FOK buy order for 1 BTC at $29,000; if not fully filled, it’s canceled.

- Maker-or-Cancel (MOC) Order: Ensures your order adds liquidity. Set an MOC buy order below market price to avoid taker fees.

- Stop-Limit Order: Combines a stop price (trigger) with a limit price (execution). Set a stop-limit sell for 1 BTC with a stop at $28,000 and limit at $27,500 to limit losses.

Monitoring and Managing Trades

- Real-Time Updates: Track order status, filled trades, and open positions in the trade history panel.

- Position Management: Adjust or close positions directly from the interface.

- Alerts: Set price or volume alerts to notify you of market changes.

Tips for Using Gemini ActiveTrader

- Use stop-limit orders to manage risk during volatile periods.

- Leverage real-time data to time your entries and exits.

- Practice with small trades to master how to use Gemini ActiveTrader.

Understanding Gemini ActiveTrader Trading Fees

Gemini ActiveTrader trading fees are a critical factor in your trading profitability. Unlike the standard platform’s flat 0.35% fee, ActiveTrader uses a maker-taker fee model based on your 30-day trading volume.

Fee Structure

- Maker Fee: 0.20% (for orders that add liquidity to the order book).

- Taker Fee: 0.40% (for orders that remove liquidity by matching existing orders).

- Volume Discounts: Fees decrease with higher trading volume. For example, at $1 million in 30-day volume, maker fees drop to 0.10% and taker fees to 0.30%.

Additional Costs

- Deposit Fees: Free for ACH and crypto; $20-$35 for wires.

- Withdrawal Fees: Free for ACH (up to 10/month); $20-$35 for wires; crypto incurs network fees (e.g., 0.002 BTC).

Strategies to Minimize Gemini ActiveTrader Trading Fees

- Prioritize maker orders (e.g., MOC) to benefit from lower fees.

- Increase your trading volume to qualify for tiered discounts.

- Avoid frequent small trades to reduce cumulative fee impact.

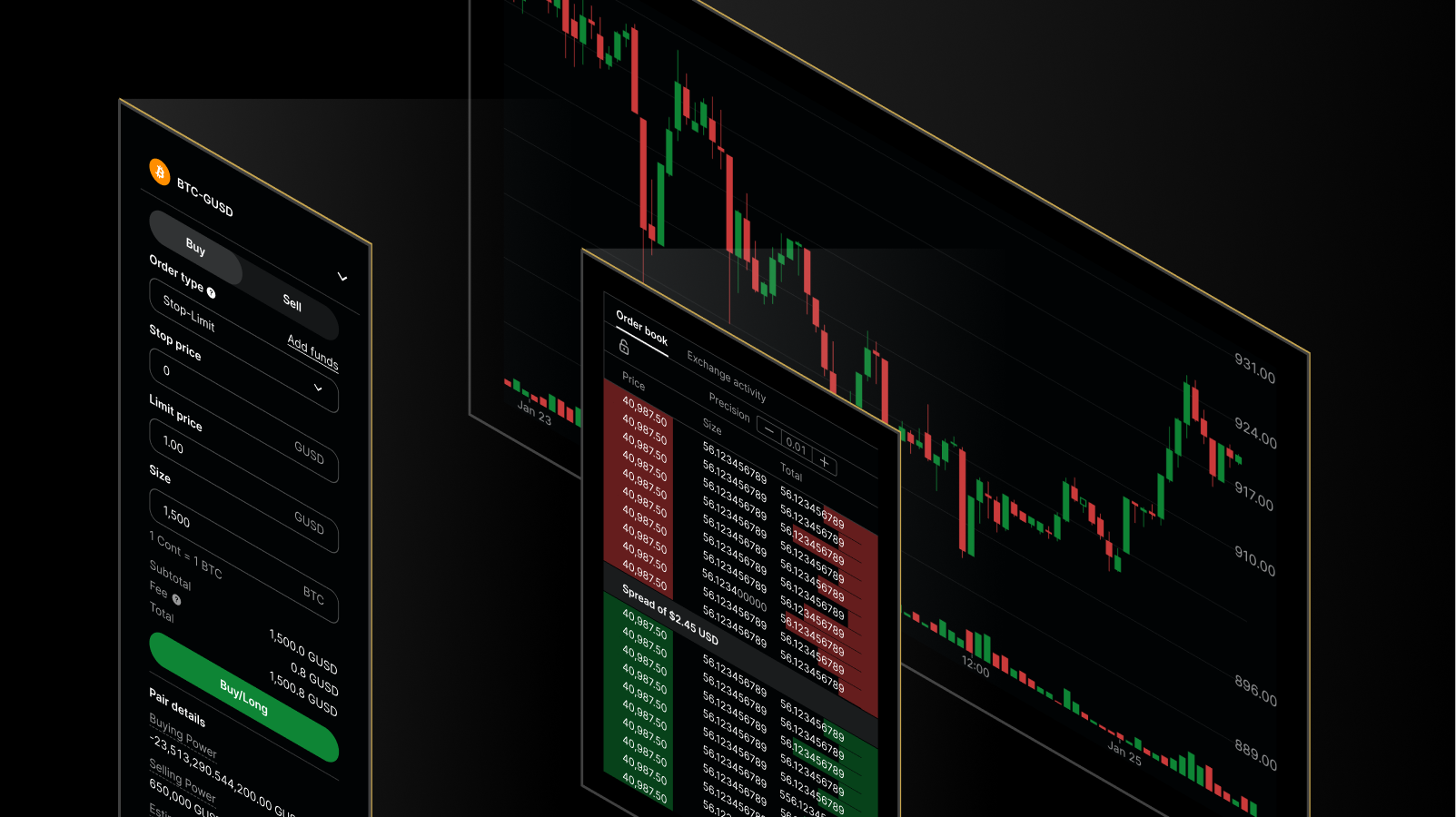

[Image Placeholder 1: “Gemini ActiveTrader Interface” – A screenshot of the ActiveTrader dashboard showing charts, order book, and order entry panel. Caption: “Master your trades with the Gemini ActiveTrader guide.”]

Advanced Trading Strategies with Gemini ActiveTrader

Elevate your trading with these strategies using the Gemini ActiveTrader guide:

1. Scalping with IOC and FOK Orders

Use IOC or FOK orders for short-term profits. Place an IOC buy order for ETH at $1,500, aiming to sell at $1,510 within minutes, leveraging ActiveTrader’s speed.

2. Risk Management with Stop-Limit Orders

Protect your portfolio by setting a stop-limit sell order. If you hold 1 BTC at $30,000, set a stop at $29,000 and a limit at $28,500 to cap losses.

3. Dollar-Cost Averaging (DCA)

Implement DCA with recurring limit orders. Schedule a weekly buy order for 0.05 BTC at $29,500 to average out price volatility.

4. Arbitrage Opportunities

Monitor price differences between Gemini and exchanges like Binance. Use limit orders to buy low on Gemini and sell high elsewhere, factoring in Gemini ActiveTrader trading fees.

5. Liquidity Provision

Place MOC orders to act as a maker, adding liquidity and reducing fees. Set a buy order slightly below market price to stay on the order book.

Comparing Gemini ActiveTrader with Other Platforms

How does Gemini ActiveTrader compare to advanced platforms on Binance, Coinbase Pro, and Kraken Pro, as reviewed in the document?

| Platform | Order Types | Trading Fees | Charting Tools | Security |

|---|---|---|---|---|

| Gemini ActiveTrader | Market, Limit, IOC, FOK, MOC, Stop-Limit | 0.20%-0.40% | Advanced | Cold storage, 2FA |

| Binance | Market, Limit, OCO, Stop | 0.10% | Extensive | Robust measures |

| Coinbase Pro | Market, Limit, Stop | 0.50% | Moderate | Insured wallets |

| Kraken Pro | Market, Limit, Stop-Loss | 0.16%-0.26% | Advanced | High security |

- Gemini vs. Binance: Binance offers lower fees and more order types (e.g., OCO), but Gemini’s regulatory compliance and detailed charting give it an edge.

- Gemini vs. Coinbase Pro: Coinbase Pro has higher fees and fewer order types, while Gemini ActiveTrader provides more flexibility.

- Gemini vs. Kraken Pro: Both offer advanced tools, but Gemini’s IOC, FOK, and MOC orders and lower fees for high volumes stand out.

Troubleshooting Common Issues with Gemini ActiveTrader

- Order Not Filling: Check liquidity in the order book; adjust limit prices or use market orders.

- High Fees: Review your 30-day volume to qualify for Gemini ActiveTrader trading fees discounts.

- Interface Lag: Ensure a stable internet connection; contact support if persistent.

- Access Denied: Verify your account status and KYC compliance.

Gemini’s 24/7 customer support via live chat and email can assist with unresolved issues.

Optimizing Your Gemini ActiveTrader Experience

- Automate Trades: Use the API to set automated strategies based on market conditions.

- Backtest Strategies: Leverage historical data in ActiveTrader to refine your approach.

- Stay Updated: Follow Gemini’s blog for new features or fee adjustments.

- Practice Risk Management: Set stop-limits and avoid over-leveraging to protect capital.

Conclusion

This Gemini ActiveTrader guide equips you with the knowledge to complete Gemini ActiveTrader setup, use its advanced features for precise trading, and manage Gemini ActiveTrader trading fees effectively. With its robust security, customizable tools, and competitive fee structure, ActiveTrader enhances your ability to navigate the crypto market confidently. Whether you’re scalping, hedging, or executing large orders, Gemini ActiveTrader is a powerful ally for traders of all levels.

Ready to elevate your trading with Gemini ActiveTrader? Sign up on Gemini and start exploring ActiveTrader today. For more guides, comparisons, and insights on crypto exchanges, visit Cryptoexlist. Begin mastering your trades now!