Staking has become a popular way for crypto enthusiasts to earn passive income while supporting the blockchain networks they invest in. Binance Earn offers a variety of staking options that make it easy for both beginners and experienced users to grow their cryptocurrency holdings. In this guide, we’ll explore what staking is, how to staking on Binance, and share strategies to help you maximize your profits through staking.

Introduction to Staking

Staking has quickly become one of the most popular ways to earn passive income in the world of cryptocurrency, and Binance makes it easy for users to get started. Staking allows you to earn rewards by simply holding certain cryptocurrencies, making it an attractive option for both beginners and experienced crypto enthusiasts. For those new to the concept, Binance Earn provides a variety of staking options designed to suit different investment goals and risk levels. Let’s explore what staking is, its benefits, and how Binance makes staking accessible for everyone.

What is Staking?

Staking is the process of locking up your cryptocurrency in a blockchain network that operates on a Proof-of-Stake (PoS) consensus mechanism. By staking your assets, you help validate transactions and secure the network, and in return, you earn rewards in the form of additional cryptocurrency. Unlike mining, which requires expensive hardware and significant energy consumption, staking is much more energy-efficient and user-friendly. On Binance, you can participate in staking by simply holding your coins in your Binance account, with no need for complex technical setups. Staking is a great way to make your crypto work for you while contributing to the health and security of a blockchain network.

Benefits of Staking in Cryptocurrency

One of the key benefits of staking is that it allows you to earn passive income on your crypto holdings without actively trading them. As long as your assets are staked, you’ll earn rewards based on the amount of cryptocurrency you’ve locked up and the specific staking conditions. This makes staking an ideal strategy for long-term holders who want to generate returns without having to constantly monitor the market. Additionally, staking helps to support the network you’re invested in, making it a win-win situation for both the staker and the blockchain. On top of that, staking offers higher potential returns compared to traditional savings products, making it a popular choice for investors looking to maximize their earnings in the crypto space.

Overview of Binance Staking Options

Binance offers a wide range of staking options, making it easy for users to choose the best fit for their investment strategy. One of the key options is Locked Staking, where users can lock their assets for a fixed period—typically ranging from 30 to 90 days—in exchange for higher rewards. For those who prefer flexibility, it also offers DeFi Staking and Flexible Staking, which allow users to earn rewards without committing to a specific lock-up period. Binance supports a variety of staking coins, including popular assets like Ethereum (ETH), Cardano (ADA), and Binance Coin (BNB). Each option comes with different reward rates and terms, giving users the ability to customize their staking strategy to suit their risk tolerance and financial goals.

Understanding the Mechanics of Staking

Staking is a core feature of the cryptocurrency world that allows users to earn rewards by holding and supporting a blockchain network. It’s an excellent way for crypto holders to generate passive income while contributing to the network’s security and efficiency. For newbies exploring Binance Earn, understanding how staking works, the different types of staking models, and the role of validators can help you make informed decisions about which staking options best fit your investment goals.

How Staking Works

Staking works by locking up your cryptocurrency in a blockchain network that uses a Proof-of-Stake (PoS) consensus mechanism. When you stake your assets, you’re essentially helping to secure the network by validating transactions and creating new blocks. In return for your participation, you earn rewards in the form of additional cryptocurrency. The more assets you stake, the higher your chances of being selected to validate transactions and the greater your potential rewards. On Binance, the process is simplified: you just need to choose a staking product, select the cryptocurrency you want to stake, and Binance takes care of the rest, including distributing rewards on a regular basis.

Different Types of Staking Models

There are different staking models available depending on the blockchain network and the staking product offered. The most common type is Locked Staking, where users commit their assets for a fixed period in exchange for higher returns. The longer you lock your assets, the higher your rewards, but the trade-off is that your funds are inaccessible during the staking period. Binance also offers Flexible Staking, which allows users to withdraw their assets at any time, but with slightly lower rewards. Additionally, DeFi Staking provides a way to participate in decentralized finance (DeFi) protocols, where users can stake their assets in liquidity pools for higher, albeit riskier, returns. Understanding these staking models helps users choose the one that best fits their risk appetite and investment strategy.

The Role of Validators in Staking

In the staking process, validators play a crucial role in maintaining the security and integrity of the blockchain network. Validators are responsible for verifying transactions, creating new blocks, and ensuring that the network operates smoothly. When you stake your cryptocurrency, it is often delegated to a validator, who performs these tasks on your behalf. In return, the validator earns a portion of the rewards and distributes them to stakers based on the amount they’ve contributed. Validators are critical to the staking ecosystem, and choosing a reliable one can impact the performance of your staking rewards. On Binance, users don’t need to manually select validators, as the platform automatically connects them with trusted validators, making the staking process easy and secure.

Choosing the Right Assets to Stake

Staking on Binance can be a great way to earn passive income on your cryptocurrency holdings, but selecting the right assets to stake is key to maximizing your returns. With Binance Earn, you have access to a variety of staking options, each offering different rewards and lock-up terms. For beginners looking to get started with staking, understanding the factors to consider when selecting cryptocurrencies, knowing which assets perform well on Binance, and analyzing historical performance can help you make informed decisions and optimize your staking strategy.

Factors to Consider When Selecting Cryptocurrencies

When choosing which cryptocurrencies to stake, there are several important factors to keep in mind. First, consider the staking rewards offered for each asset. Different cryptocurrencies have varying reward rates, often influenced by the supply and demand for staking within the network. It’s also important to assess the lock-up period associated with staking. While some assets offer flexible terms that allow you to withdraw at any time, others may require you to lock your funds for a set duration. You should also take into account the risk profile of the cryptocurrency. More volatile assets may offer higher rewards but carry greater price fluctuations, whereas stablecoins provide more stability but typically offer lower returns. Additionally, look into the liquidity of the asset—staking illiquid tokens could make it harder to exit a position if needed.

Top Cryptocurrencies for Staking on Binance

Binance supports a wide range of cryptocurrencies for staking, providing plenty of options for users to choose from. Some of the most popular assets for staking include Binance Coin (BNB), the native token of the Binance platform, which offers competitive rewards and flexibility. Ethereum 2.0 (ETH) is also a top choice, especially with the network’s transition to Proof-of-Stake, making it one of the largest staking networks by volume. Other assets like Cardano (ADA) and Polkadot (DOT) are popular among users due to their strong staking rewards and active development communities. Stablecoins such as Tether (USDT) are also available for staking, though they typically offer lower returns compared to more volatile assets. Depending on your investment goals, selecting a mix of stablecoins and more volatile cryptocurrencies could balance out your risk and reward potential.

Analyzing Historical Performance

To make an informed decision about which assets to stake, it’s essential to analyze the historical performance of the cryptocurrencies you’re considering. Look at the long-term price trends of the asset and assess its stability over time. Has the cryptocurrency shown consistent growth, or has it experienced significant volatility? Evaluating its market cap, community support, and development progress can also provide insight into the asset’s future potential. Additionally, consider the staking rewards history—has the asset offered reliable and steady rewards, or do the returns fluctuate widely? Binance provides detailed information on each asset’s staking terms and rewards, helping you analyze past performance to better forecast potential returns.

How to Start Staking on Binance

Staking is one of the easiest and most rewarding ways to earn passive income in the cryptocurrency world, and Binance Earn makes the entire process simple for beginners. Whether you’re looking to stake popular cryptocurrencies like Ethereum or Binance Coin or are curious about staking newer assets, Binance offers an intuitive platform to get started. In this guide, we’ll walk you through how to navigate the Binance interface for staking, provide a step-by-step guide to staking your assets, and explain how staking rewards and returns work.

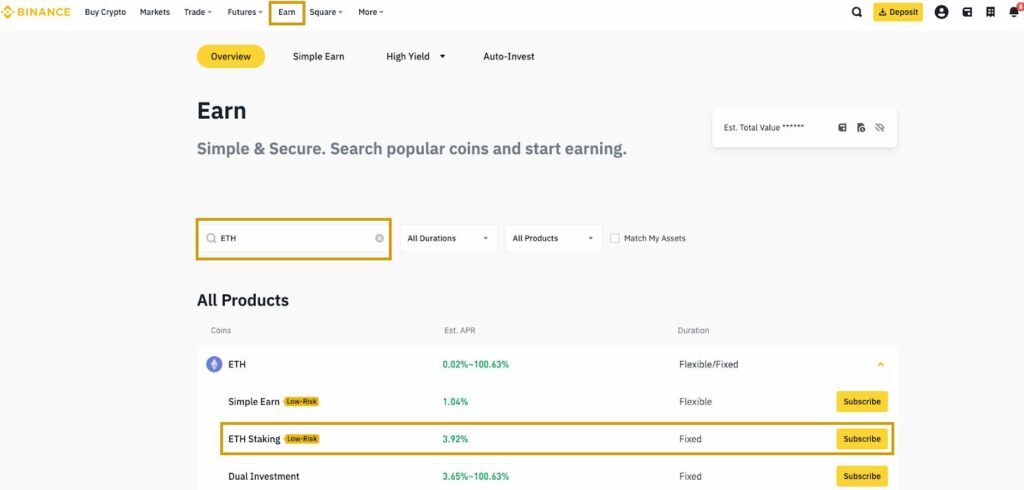

Navigating the Binance Interface for Staking

The first step to staking on Binance is getting familiar with the platform’s interface. Binance is known for its user-friendly design, and finding the staking section is straightforward. Once you log into your Binance account, navigate to the “Earn” tab on the top menu, and select “Staking” from the dropdown options. Here, you’ll see a list of available staking products, including both Locked Staking and DeFi Staking, with clear information on the staking rewards, lock-up periods, and supported cryptocurrencies. This dashboard makes it easy to browse the different options and select the right staking opportunity for your assets.

Step-by-Step Guide to Staking Your Assets

Staking on Binance is a simple process that can be completed in just a few clicks. Here’s a step-by-step guide to help you get started:

- Log in to Your Binance Account: If you don’t already have a Binance account, create one and complete any necessary identity verification steps.

- Go to the Staking Section: From the “Earn” tab, select “Staking” to view the available staking options.

- Choose Your Cryptocurrency: Browse the list of supported staking assets. You’ll see details on the staking rewards (Annual Percentage Yield – APY) and lock-up durations for each option.

- Select a Staking Product: Click on the staking product of your choice (e.g., Locked Staking or DeFi Staking). Review the staking terms, including the lock-up period and rewards, to make sure it aligns with your goals.

- Enter the Amount to Stake: Once you’ve chosen an asset, enter the amount you want to stake and click “Confirm.”

- Start Earning Rewards: After confirmation, your assets will be staked, and you’ll start earning rewards based on the APY of the staking product.

This simple process makes Binance staking accessible even for those new to cryptocurrency, allowing users to earn passive income without needing technical expertise.

Understanding Staking Rewards and Returns

One of the main attractions of staking is the opportunity to earn regular rewards. Staking rewards on Binance are distributed periodically, often daily or weekly, depending on the staking product and the cryptocurrency involved. The rewards are based on the Annual Percentage Yield (APY), which is displayed when you select your staking product. The APY can vary based on several factors, such as the cryptocurrency’s market demand, the duration of the staking period, and the total number of stakers in the network.

It’s important to note that while staking offers predictable returns, the value of the rewards can fluctuate based on the price of the staked asset. For example, if you’re staking Ethereum, your rewards will be paid in ETH, meaning your total earnings may be influenced by the market price of Ethereum during the staking period. Additionally, longer lock-up periods typically offer higher returns, but you won’t be able to access your assets until the period ends.

Maximizing Profits Through Staking Strategies

Staking on Binance can be an effective way to generate passive income from your crypto holdings, but to maximize your profits, it’s essential to implement the right staking strategies. Whether you’re new to Binance Earn or an experienced user looking to optimize returns, understanding key strategies such as asset diversification, balancing long-term and short-term staking, and reinvesting rewards can significantly boost your earnings. Here’s how to fine-tune your approach to staking on Binance to make the most of your cryptocurrency.

Diversification of Staked Assets

One of the most effective ways to maximize profits from staking is through asset diversification. Instead of staking a single cryptocurrency, you can spread your assets across multiple staking products to balance risk and increase potential returns. Binance supports a wide range of staking assets, including Ethereum (ETH), Binance Coin (BNB), Cardano (ADA), and stablecoins like Tether (USDT). Each cryptocurrency has its own reward rate and lock-up conditions, so by staking a variety of assets, you can take advantage of different APYs (Annual Percentage Yields) while minimizing the impact of any potential downturns in the market. Diversification not only helps protect your portfolio but also allows you to capture growth from various blockchain networks, creating a more stable and profitable staking experience.

Long-term vs. Short-term Staking

Another important consideration when staking on Binance is choosing between long-term and short-term staking strategies. Long-term staking often offers higher rewards, especially if you’re locking your assets in products like Locked Staking for several months. The longer the lock-up period, the higher the APY tends to be, which makes it a great option for those who don’t need immediate liquidity. However, short-term staking or Flexible Staking gives you the advantage of liquidity, allowing you to withdraw your funds at any time, although the APY might be lower. For users looking for a balanced approach, combining both long-term and short-term staking can help you optimize earnings while maintaining some flexibility. You can lock a portion of your assets for higher returns and keep the rest in flexible options for quick access to funds when needed.

Compounding Rewards: How to Reinstate Earnings

Compounding is a powerful strategy that can significantly enhance your staking profits over time. With Binance Earn, users can easily reinvest their staking rewards by adding them back into the staking pool. This compounding effect allows you to generate returns not only on your initial staked assets but also on the rewards you’ve earned, exponentially increasing your potential earnings. To apply this strategy, simply withdraw your earned rewards and restake them, or if the staking product supports it, let your rewards automatically compound. The longer you compound your rewards, the greater your profits will grow. For long-term investors, this is a highly effective strategy to build wealth in the crypto space without needing to trade or make constant adjustments.

Utilizing Binance Features for Enhanced Staking

Binance Earn offers a range of features designed to help users maximize their staking potential and earn passive income. Whether you’re new to cryptocurrency or an experienced investor, taking advantage of these features can significantly enhance your staking rewards. By understanding the pros and cons of Flexible vs. Locked Staking, participating in Binance Launchpad projects, and leveraging staking pools, you can tailor your approach to staking and make the most of your crypto assets.

Flexible vs. Locked Staking: Pros and Cons

One of the first decisions you’ll face when staking on Binance is choosing between Flexible Staking and Locked Staking. Both offer unique benefits, and the right choice depends on your financial goals and need for liquidity. Flexible Staking allows you to withdraw your staked assets at any time, providing the freedom to access your funds whenever necessary. This makes it ideal for users who want to maintain liquidity while still earning rewards. However, the downside is that Flexible Staking typically offers lower returns compared to Locked Staking.

Locked Staking, on the other hand, requires you to commit your assets for a fixed period, usually ranging from 30 to 90 days or more. In exchange for this commitment, Binance offers higher Annual Percentage Yields (APYs), making it a great option for users who are looking to maximize their returns. The trade-off is that you won’t be able to access your assets until the lock-up period ends. For investors with a long-term strategy, Locked Staking is an excellent way to earn higher rewards while still keeping your assets safe.

Participating in Binance Launchpad Projects

Another way to enhance your staking experience is by participating in Binance Launchpad projects. Binance Launchpad is a platform that allows users to invest in new, promising cryptocurrency projects before they are fully launched. By staking certain assets like BNB (Binance Coin), you can earn newly issued tokens from these projects, giving you early access to coins that may increase in value. This feature is particularly exciting for users who want to diversify their portfolio with new assets while earning additional rewards for staking. The risk is that not all projects will perform well in the long run, but Launchpad provides a unique opportunity to gain exposure to up-and-coming blockchain projects.

Leveraging Staking Pools for Greater Rewards

For users looking to maximize their staking potential, staking pools offer a powerful way to increase rewards. In staking pools, multiple users combine their crypto assets to increase their chances of being selected as validators in a Proof-of-Stake (PoS) blockchain. By pooling assets together, users can collectively earn greater rewards, even if they are staking smaller amounts individually. Binance simplifies this process by allowing users to easily join staking pools with supported cryptocurrencies, without needing to manually manage the technical aspects of staking. This makes it an excellent option for newcomers and small-scale investors who want to participate in staking with minimal effort but still enjoy higher returns.

Conclusion

Staking on Binance offers an excellent opportunity to generate passive income while participating in the growth of blockchain networks. Whether you’re new to cryptocurrency or a seasoned investor, understanding how staking works, choosing the right assets, and leveraging Binance’s unique features can significantly enhance your returns. From flexible staking options to advanced strategies like compounding rewards, Binance provides all the tools you need to succeed in the staking world. By applying the right techniques and making informed decisions, you can maximize your staking profits and make the most of your crypto investments.