Futures trading is an exciting way to profit from market movements and manage risks, offering traders the opportunity to speculate on the future prices of assets. Whether you’re new to trading or an experienced investor, developing a solid strategy is crucial for success. In this comprehensive guide, we’ll dive into key aspects like fundamental and technical analysis, building an effective portfolio, and using advanced strategies. With the help of technology and by avoiding common mistakes, you’ll be better equipped to navigate the futures market on platforms like Binance Futures.

Fundamental Analysis in Futures Trading

Economic Indicators and Their Impact

In futures trading, economic indicators such as inflation rates, GDP growth, and employment data have a profound influence on market prices. These indicators help traders predict the future direction of asset prices. For example, if inflation is rising, traders might expect central banks to raise interest rates, which could negatively impact riskier assets like cryptocurrencies. Staying updated on these key economic signals is essential for making informed decisions when trading futures on platforms like Binance.

Supply and Demand Dynamics

The core principle of supply and demand plays a critical role in determining futures prices. When demand for an asset outstrips its supply, prices are likely to rise, and vice versa. In futures markets, understanding the balance between supply and demand helps traders anticipate price movements. For instance, a decrease in the supply of Bitcoin due to halving events could lead to higher prices, offering profitable opportunities for futures traders on Binance.

Geopolitical Factors Affecting Futures

Geopolitical events, such as trade tensions, sanctions, or political instability, can create volatility in the futures market. These factors can influence commodity prices, currencies, and even cryptocurrencies. For example, regulatory changes in major economies regarding crypto trading can affect futures prices significantly. Futures traders must keep an eye on global developments and adapt their strategies accordingly, as geopolitical shifts can lead to sudden market movements.

Technical Analysis in Futures Trading

Chart Patterns and Trends

In futures trading, recognizing chart patterns is essential for predicting price movements and making informed trading decisions. Patterns like head and shoulders, double tops/bottoms, and ascending/descending triangles can indicate whether a market is likely to continue its current trend or reverse. By studying these patterns, futures traders on platforms like Binance can time their entries and exits more effectively. Identifying these trends early can provide a significant advantage in volatile markets, allowing traders to capitalize on emerging opportunities.

Key Technical Indicators

Technical indicators play a crucial role in helping traders analyze market trends and make data-driven decisions. Some popular indicators include the Relative Strength Index (RSI), which measures the speed and change of price movements to determine if an asset is overbought or oversold, and Moving Averages (MA), which smooth out price data to help identify the direction of a trend. On Binance, these tools are integrated into the trading platform, making it easy for beginners to apply them and gain deeper insights into the market’s momentum.

Volume Analysis

Volume analysis is another critical component of technical analysis. It refers to the number of assets traded within a specific time period and helps confirm the strength of a price movement. For example, a price increase accompanied by high trading volume suggests a strong upward trend, whereas a price rise on low volume might indicate weakness. Understanding volume dynamics can help futures traders avoid false signals and identify genuine market trends. Platforms like Binance provide real-time volume data, enabling traders to make more informed decisions.

Developing a Futures Trading Strategy

Identifying Market Conditions

Before diving into futures trading on Binance, it’s essential to assess the current market conditions. Are we in a bull market, where prices are generally rising, or a bear market, where they’re falling? Identifying whether the market is trending, ranging, or experiencing high volatility helps traders choose the most appropriate strategies. For example, in a trending market, traders might opt for momentum strategies, while in a range-bound market, they may focus on buying low and selling high within the range.

Setting Goals and Risk Tolerance

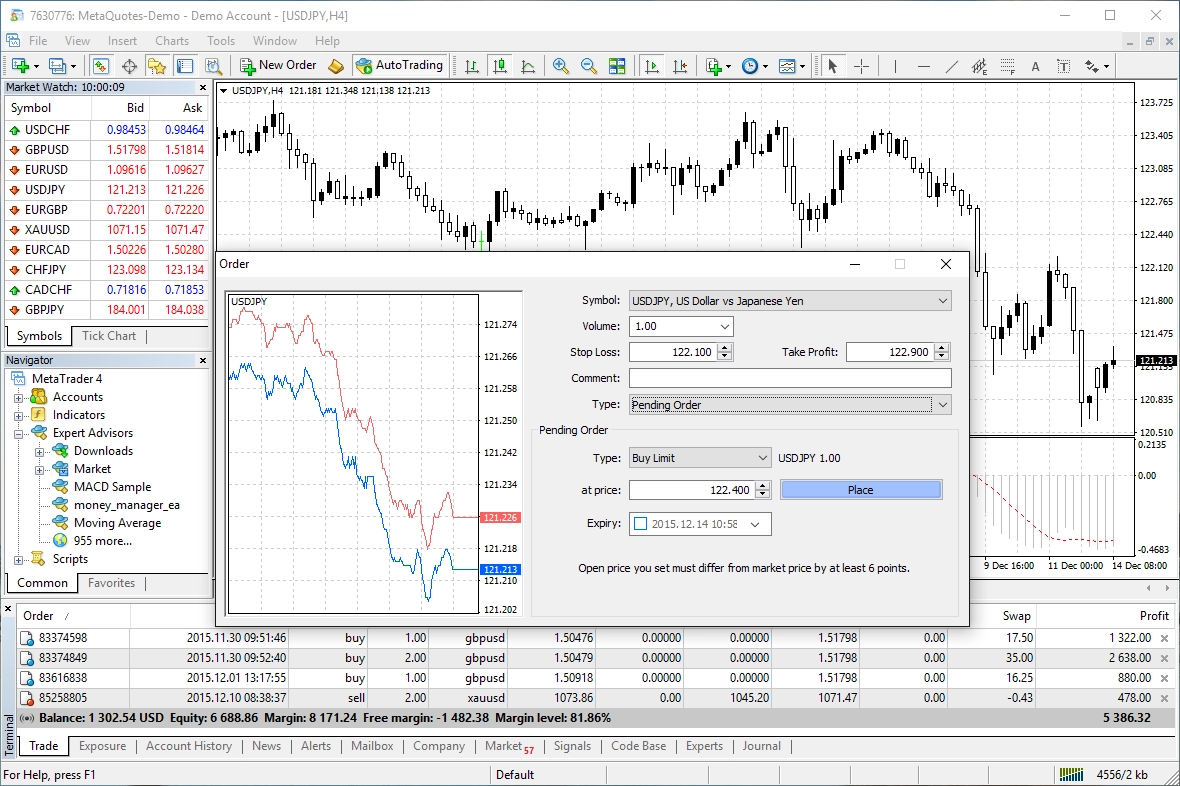

Every futures trader should have clear goals and an understanding of their risk tolerance before placing trades. Are you aiming for short-term gains or long-term wealth building? Futures trading can be highly profitable, but it also comes with significant risk, especially when using leverage. On Binance, you can control your exposure to risk by setting stop-loss and take-profit levels. Defining your financial goals and knowing how much risk you’re willing to take ensures you trade with a clear plan and avoid emotional decisions.

Time Frame for Trading

The time frame you choose for trading can greatly affect your strategy and the tools you use. For example, day traders focus on shorter time frames, like 15-minute or 1-hour charts, aiming to capitalize on small price movements throughout the day. Swing traders, on the other hand, look at longer time frames, such as daily or weekly charts, to profit from larger price swings over several days or weeks. On Binance Futures, you can easily switch between time frames, allowing you to tailor your strategy to your preferred trading style. Understanding which time frame suits your goals is crucial for developing a successful trading plan.

Advanced Futures Trading Strategies

Hedging Techniques

In futures trading, one of the most popular advanced strategies is hedging, which is used to minimize potential losses by offsetting your risk in other investments. For example, if you’re holding Bitcoin and fear a price drop, you can open a short position in Bitcoin futures on Binance to protect your holdings. This way, even if Bitcoin’s price decreases, the profit from your short futures trade can offset the loss in your spot position. Hedging is an effective tool for managing volatility and protecting your portfolio from unexpected market shifts.

Spread Trading Strategies

Spread trading involves buying and selling two related futures contracts to profit from the price difference between them. On Binance Futures, traders can execute strategies like calendar spreads, where they buy a futures contract expiring in one month and sell another expiring in a different month. The goal is to profit from the narrowing or widening of the price spread between the two contracts. Spread trading reduces directional risk and can be a more conservative approach compared to outright positions, as traders are focused on the relative performance of assets rather than the market’s overall movement.

Speculative Strategy

A speculative strategy in futures trading involves taking positions based solely on market predictions. Traders who use this strategy aim to capitalize on market movements without necessarily holding the underlying asset. Speculative traders often employ high leverage to maximize potential profits, although this comes with greater risk. For example, if you expect the price of Ethereum to rise, you could take a long futures position on Binance. While speculative trading can lead to significant profits, it’s also riskier, making it more suited for experienced traders who are comfortable with market volatility and understand the potential for both large gains and losses.

Utilizing Technology in Futures Trading

Trading Platforms and Software

For beginners in futures trading, having access to a reliable trading platform is key to success. Platforms like Binance Futures offer robust trading software equipped with real-time price charts, order management tools, and advanced technical analysis features. Binance’s user-friendly interface allows you to execute trades quickly and manage your positions with ease, whether you’re a day trader or a long-term investor. The availability of mobile apps also ensures that you can monitor the markets and trade from anywhere, providing flexibility and convenience.

Trading Platforms and Software

Algorithmic trading is a powerful tool that allows traders to automate their strategies using pre-set rules based on technical indicators, market conditions, or price movements. On Binance Futures, traders can deploy trading bots that execute trades 24/7, removing the need for constant monitoring. This type of trading is ideal for those looking to take advantage of market opportunities even when they’re not actively watching the charts. By setting clear parameters, traders can minimize emotional decisions and improve the consistency of their strategies.

Analyzing Data with AI and Machine Learning

The rise of AI and machine learning is transforming the way traders analyze market data. By leveraging these technologies, traders can process vast amounts of historical and real-time data to identify patterns, predict market trends, and optimize their trading strategies. On platforms like Binance, AI-powered tools can help improve decision-making by providing deeper insights into price movements and market behavior. For beginners, this technology can simplify the learning curve, allowing them to make more informed trading decisions based on data-driven analysis.

Building a Futures Trading Portfolio

Asset Allocation Strategies

In futures trading, having a well-diversified portfolio is crucial for managing risk. Asset allocation strategies involve spreading your investments across different types of assets, such as cryptocurrencies, commodities, and indices, to balance risk and potential returns. On platforms like Binance, you can easily diversify your portfolio by trading futures contracts for a variety of cryptocurrencies like Bitcoin, Ethereum, and others. This approach helps protect your investments from market volatility, as not all assets move in the same direction at the same time.

Rebalancing Your Portfolio

As market conditions change, the value of assets in your portfolio will fluctuate, which can throw your desired allocation out of balance. Rebalancing is the process of adjusting your positions to bring your portfolio back to its target allocation. For instance, if one asset becomes over-weighted after a price surge, you might sell some of that position and redistribute the profits to under-performing assets. On Binance Futures, regular rebalancing ensures that you maintain a well-diversified portfolio that aligns with your risk tolerance and investment goals.

Performance Evaluation

To grow as a trader, it’s essential to regularly evaluate your portfolio’s performance. Performance evaluation involves reviewing your trading history, identifying which strategies worked, and understanding where improvements can be made. Binance offers tools that help you track your trades, analyze profits and losses, and calculate metrics like return on investment (ROI). By consistently assessing your performance, you can refine your trading strategies, eliminate mistakes, and make more informed decisions that will lead to long-term success in futures trading.

Common Mistakes in Futures Trading

Overleveraging

One of the most common mistakes new traders make in futures trading is overleveraging. Leverage allows you to control a larger position with a smaller amount of capital, but while it can amplify profits, it can also magnify losses. On Binance Futures, beginners are often tempted to use high leverage to increase their potential gains, but this can lead to liquidation if the market moves against them. It’s important to use leverage responsibly and start with lower levels to minimize risk until you gain more experience.

Ignoring Market Research

Ignoring market research is another pitfall for many futures traders. Successful futures trading requires a solid understanding of market trends, economic indicators, and the assets you’re trading. Relying solely on intuition or rumors can lead to poorly timed trades. To make informed decisions, beginners should utilize the tools available on Binance, such as real-time price charts, technical analysis, and market news, to conduct proper research and develop a data-driven trading strategy.

Failing to Adapt to Market Changes

Markets are constantly evolving, and failing to adapt can lead to significant losses in futures trading. Traders who stick to the same strategy regardless of changing market conditions often find themselves on the wrong side of the trade. For example, a strategy that works well in a trending market may not be suitable in a range-bound market. On Binance Futures, it’s important to stay flexible and continuously adjust your approach based on current market conditions. Being adaptable can help you stay profitable even in volatile markets.

Conclusion

Navigating the world of futures trading requires a well-rounded strategy that incorporates both fundamental and technical analysis, a clear understanding of market conditions, and a flexible approach to risk management. Whether you’re using hedging techniques or advanced tools like algorithmic trading, it’s important to continually learn, adapt, and refine your strategy. Platforms like Binance provide the resources and technology needed to succeed in futures trading, but avoiding common mistakes—such as overleveraging and ignoring market research—is key to long-term success. With the right strategy and mindset, you can confidently build a successful futures trading portfolio.