Automation is revolutionizing crypto trading, helping traders optimize their strategies and maximize efficiency. Bitfinex Automation provides powerful tools, including trading bots, alerts, and API integrations, enabling users to trade effectively with minimal manual intervention. Whether you’re a beginner or an advanced trader, understanding how to automate your trading on Bitfinex can significantly enhance your profitability.

This in-depth review explores the best Bitfinex Automation tools and how to set up trading bots, utilize alerts, and build automated crypto trading strategies tailored to market trends.

Contents

ToggleWhy Bitfinex Automation is Essential for Crypto Traders in 2025

The cryptocurrency market operates around the clock, creating both opportunities and challenges for traders. While the profit potential is high, the demands of monitoring price movements, executing timely trades, and managing risk manually can be overwhelming. This is where Bitfinex Automation becomes an indispensable tool for crypto traders in 2025.

With advanced automation features, Bitfinex allows traders to execute strategies seamlessly without constant manual oversight. By leveraging automated trading bots, alerts, and API integrations, traders can optimize performance, minimize emotional decision-making, and enhance efficiency. Below are the key reasons why Bitfinex Automation is essential for anyone looking to succeed in crypto trading:

Increased Trading Efficiency

Manual trading requires constant market monitoring, quick decision-making, and precise execution—tasks that can be slow and prone to errors when done by humans. Bitfinex Automation eliminates delays and inefficiencies by enabling trading bots to execute orders instantly based on predefined rules. These bots analyze market conditions, place orders, and manage positions faster than any human trader, ensuring that opportunities are not missed due to reaction times.

Elimination of Emotional Bias

One of the biggest pitfalls of manual trading is emotional decision-making. Fear and greed often lead traders to make irrational choices, such as panic selling during a market downturn or overleveraging in a bull run. Bitfinex Automation removes these psychological factors by executing trades strictly based on logic and preset algorithms. This disciplined approach improves consistency and helps traders stick to their strategies without emotional interference.

24/7 Trading Without Downtime

Unlike traditional stock markets, which operate within set hours, the crypto market never sleeps. This means that significant price movements can occur at any time—during the night, on weekends, or even during holidays. For manual traders, staying alert around the clock is not feasible. Bitfinex Automation ensures uninterrupted trading by allowing bots to operate continuously, capturing opportunities in real time and preventing missed trades due to inactivity.

Backtesting and Strategy Optimization

Successful trading requires a well-tested strategy, but experimenting with real funds can be risky. Bitfinex provides automation tools that allow traders to backtest their strategies using historical market data. This means traders can evaluate how a strategy would have performed under past market conditions before applying it in live trading. Backtesting helps refine automated strategies, identify weaknesses, and optimize performance without financial risk.

Advanced API and Trading Tools for Customization

Bitfinex is one of the most advanced cryptocurrency exchanges when it comes to automation tools. It offers robust API integrations, allowing traders to connect third-party trading bots or develop custom automated solutions tailored to their strategies. From grid trading bots to arbitrage strategies, Bitfinex Automation provides unparalleled flexibility, making it a top choice for serious traders.

How to Set Up Trading Bots on Bitfinex

Automating your crypto trading with Bitfinex can significantly enhance your trading efficiency and profitability. Setting up trading bots allows you to execute predefined strategies, manage risk, and capitalize on market movements—all without constant manual oversight. Below is a step-by-step guide to selecting and configuring the best trading bots for Bitfinex Automation in 2025.

Choosing the Right Bitfinex Trading Bot

Not all trading bots are created equal. Each bot comes with unique features tailored to different trading styles, from grid trading to high-frequency scalping. To ensure optimal performance, selecting the right bot is crucial. Here are some of the best third-party trading bots that integrate seamlessly with Bitfinex Automation:

3Commas – Smart Trading Bots for Advanced Strategies

3Commas is one of the most popular crypto trading bots, offering powerful automation tools such as:

- Smart Trade Terminal for advanced order execution.

- DCA (Dollar-Cost Averaging) Bots to minimize market risk.

- Trailing Stop & Take-Profit Features to maximize gains.

HaasOnline – High-Frequency and Algorithmic Trading

HaasOnline is best suited for experienced traders who need high-frequency trading automation. It provides:

- Scriptable trading bots for customized automation.

- Backtesting and historical market data analysis to optimize strategies.

- Advanced arbitrage tools to exploit price differences across exchanges.

Bitsgap – Grid & Arbitrage Bots for Market Neutral Strategies

Bitsgap is ideal for traders who focus on automated grid trading and arbitrage. It features:

- AI-driven trading bots for grid trading optimization.

- Cross-exchange arbitrage scanners to identify profitable spreads.

- Portfolio tracking tools for seamless fund management.

Before selecting a bot, consider your trading goals, risk tolerance, and preferred strategy. Some bots specialize in scalping, while others are better suited for long-term automated portfolio management.

Connecting Your Trading Bot to Bitfinex API

Once you’ve chosen the right trading bot, the next step is integrating it with Bitfinex Automation through the Bitfinex API. The API enables your bot to execute trades, manage positions, and access real-time market data. Here’s a step-by-step guide to connecting your bot:

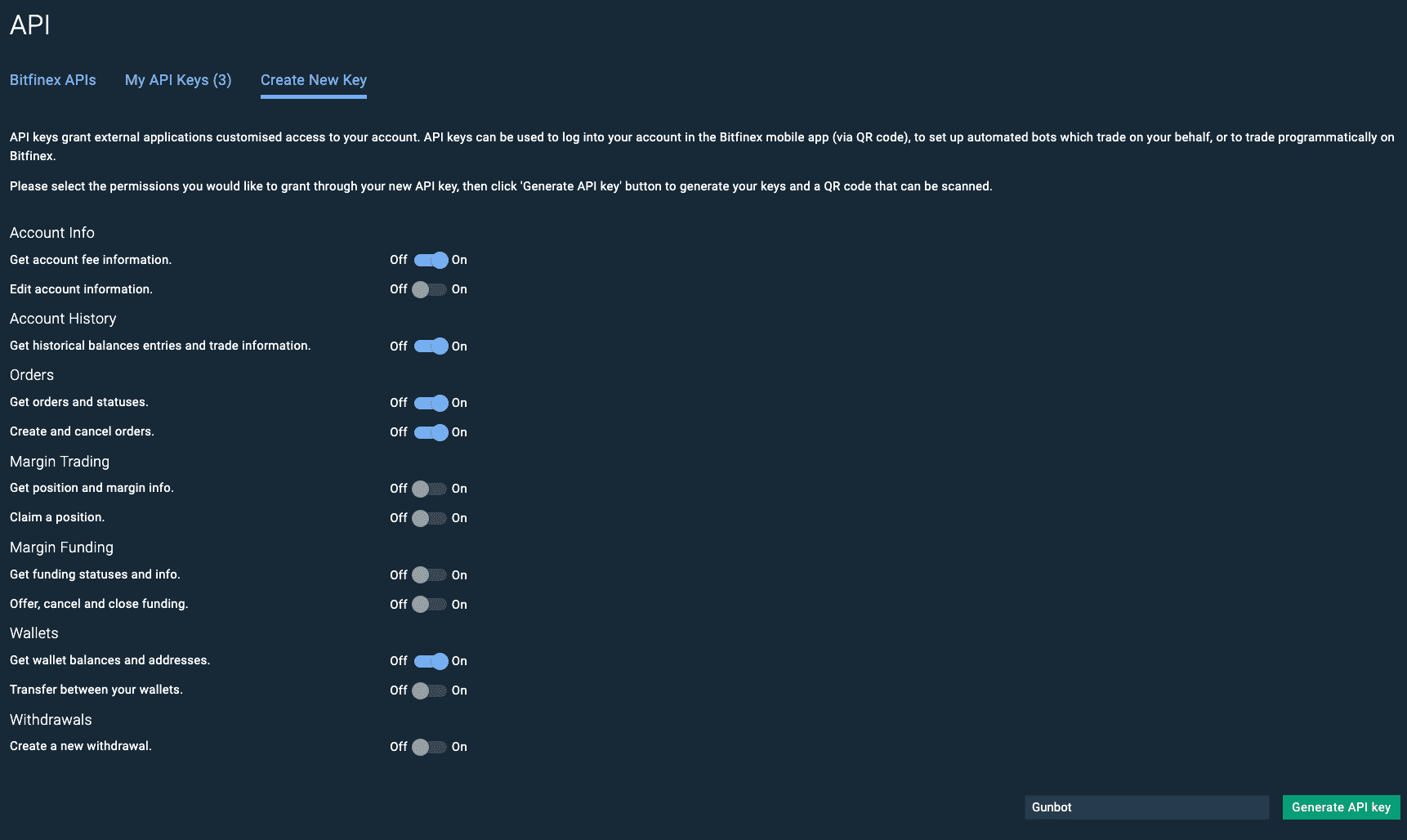

Create an API Key in Your Bitfinex Account

- Log in to your Bitfinex account.

- Navigate to API Management under the account settings.

- Click Create New Key and specify permissions based on your bot’s requirements.

Configure API Key Permissions

Depending on your trading bot’s functionality, set permissions for:

- Read-only access (for monitoring balances and market data).

- Trade execution (to place, modify, and cancel orders).

- Withdrawal permissions (not recommended for security reasons).

Once permissions are set, generate the API key and secret—store them securely, as they will not be displayed again.

Connect Your Trading Bot to Bitfinex API

- Open your chosen trading bot’s interface.

- Locate the API integration section.

- Enter your Bitfinex API key and secret key into the bot’s settings.

- Save and test the connection to ensure the integration is successful.

Set Trading Parameters for Automated Execution

Once the connection is established, configure the bot’s trading settings:

- Choose a trading pair (e.g., BTC/USDT, ETH/USD).

- Set risk management rules, such as stop-loss and take-profit levels.

- Define order types (market orders, limit orders, trailing stops).

- Activate additional features like DCA (Dollar-Cost Averaging) or grid trading.

By carefully setting up your Bitfinex Automation bot, you ensure the smooth execution of trades while managing risk effectively.

Optimizing Trading with Bitfinex Alerts

Bitfinex Alerts provide real-time notifications, helping traders make informed decisions without constantly monitoring charts. By leveraging customizable alerts, you can automate market tracking, improve reaction times, and execute trades more efficiently. Here’s how to optimize your trading strategy with Bitfinex Automation and alert systems.

What Are Bitfinex Alerts?

Bitfinex Alerts notify traders of price movements, market trends, and trade executions. This feature helps traders react swiftly to market changes and optimize their Bitfinex Automation strategy.

Setting Up Custom Alerts

To set up alerts:

- Log in to Bitfinex and navigate to the alerts section.

- Select the asset pairs you want to track.

- Define conditions like price thresholds or percentage changes.

- Choose notification methods (email, push notification, or SMS).

Using Bitfinex Alerts, traders can make informed decisions and automate responses for efficient crypto trading.

Building a Profitable Automated Crypto Trading Strategy

A successful automated crypto trading strategy requires more than just setting up a bot—it demands careful planning, risk management, and continuous optimization. With Bitfinex Automation, traders can leverage advanced tools to execute trades efficiently, minimize emotional decision-making, and maximize profitability. Let’s explore the key components of a profitable Bitfinex bot strategy.

Understanding Automated Crypto Trading

Automated crypto trading uses pre-programmed rules to execute trades. Bitfinex offers multiple automation options, including:

- Algorithmic Trading – Execute trades using AI and machine learning.

- Copy Trading – Mimic strategies from expert traders.

- Market-Making Bots – Provide liquidity and earn passive income.

Key Bitfinex Bot Strategies

Master these key Bitfinex bot strategies to maximize efficiency, minimize risk, and enhance your automated trading performance.

Trend-Following Strategies

- Bots detect market trends and execute trades accordingly.

- Example: Using moving averages to buy when prices are above the 50-day average.

Arbitrage Bots

- Profit from price differences across exchanges.

- Example: Buying BTC on Bitfinex and selling on another exchange for a higher price.

Grid Trading Bots

- Place buy/sell orders at predefined price levels.

- Works well in volatile markets.

Mean Reversion Bots

- Buy assets when prices dip below historical averages.

- Sell when prices rise above averages.

By implementing these Bitfinex Bot Strategies, traders can maximize profits while minimizing risks.

Monitoring and Adjusting Automated Strategies

Even though automation handles trading, regular monitoring ensures performance optimization. Review your bot’s performance weekly and adjust strategies as needed.

Conclusion

Absolutely! Bitfinex Automation streamlines crypto trading, enhances efficiency, and reduces emotional biases. By leveraging Bitfinex Alerts, trading bots, and robust automated crypto trading strategies, traders can optimize performance and stay ahead in the market. If you’re serious about crypto trading in 2025, integrating Bitfinex Automation is a game-changer. Ready to start? Explore Bitfinex’s automation tools and take your trading to the next level!