Cryptocurrency futures trading has gained immense popularity, allowing traders to speculate on price movements without holding the actual assets. Bitget, one of the leading exchanges in this space, has positioned itself as a go-to platform for futures traders due to its user-friendly interface, competitive fees, and advanced trading tools.

Bitget Futures offers perpetual contracts, allowing traders to take long or short positions with leverage up to 125x. This means a trader with $100 can open a position worth $12,500, significantly amplifying potential profits (and risks). If you’re looking to master Bitget Futures, this guide will provide a detailed breakdown of fees, a futures calculator, and proven strategies to optimize your trading.

What is Bitget Futures?

Bitget Futures is a cryptocurrency derivatives trading platform that allows traders to speculate on the price movements of digital assets without owning them. Unlike spot trading, where traders buy and sell actual cryptocurrencies, futures trading involves contracts that represent the underlying asset. Traders can go long if they expect the price to rise or short if they anticipate a decline, allowing them to potentially profit from both bullish and bearish markets.

One of the key advantages of Futures Trading on Bitget is the availability of high leverage, with options up to 125x, enabling traders to maximize their potential returns. However, with high leverage comes significant risk, making it essential for traders to implement effective risk management strategies.

Bitget offers two primary types of futures contracts:

- USDT-Margined Futures: These contracts are settled in USDT, a stablecoin pegged to the U.S. dollar, providing stability in a volatile market.

- Coin-Margined Futures: These contracts are settled in cryptocurrencies such as BTC or ETH, making them a preferred choice for traders who want to accumulate digital assets while trading.

What Are Bitget Futures Fees?

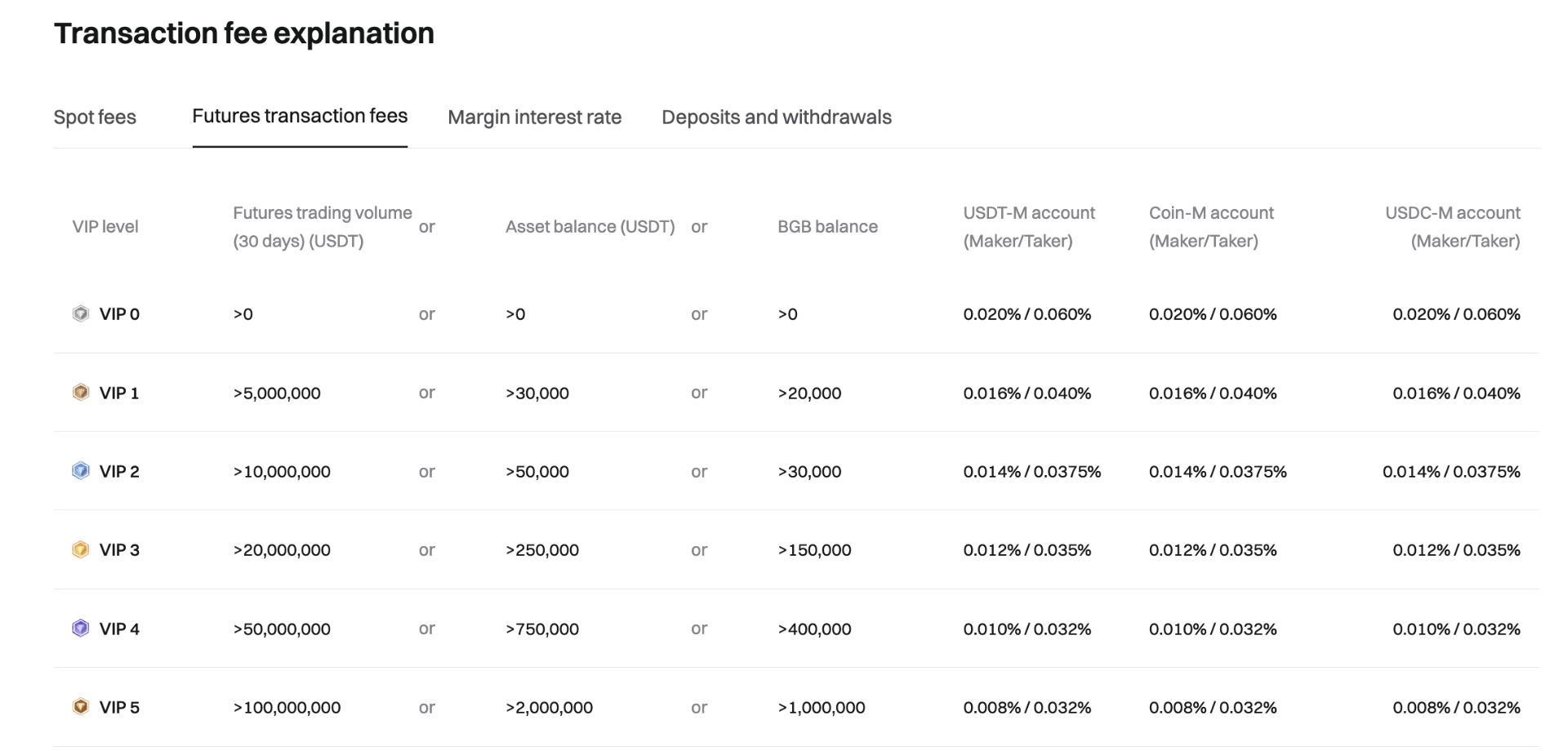

Bitget Futures operates on a maker-taker fee model, which means that the fees depend on whether a trader provides liquidity (maker) or removes liquidity (taker) from the market. As of 2025, the standard trading fees are:

- Maker fee: 0.02% per transaction.

- Taker fee: 0.06% per transaction.

- Traders can reduce these fees through several methods:

- VIP Levels: Bitget offers a tiered VIP program where higher trading volumes qualify users for lower fees.

- BGB Token Discounts: Holding and using Bitget’s native token (BGB) to pay for trading fees grants users discounts.

- Fee Promotions: Occasionally, Bitget runs promotional campaigns that temporarily lower trading fees for specific trading pairs.

Compared to competitors like Binance and Bybit, Bitget remains competitive in terms of trading fees, making it an attractive platform for both beginner and advanced futures traders.

How to Start Trading on Bitget Futures

Getting started with Bitget Futures can seem overwhelming at first, but with the right approach, you can navigate the platform efficiently. This section will walk you through the essential steps to open an account, fund your wallet, and place your first trade with confidence.

Creating a Bitget Account

To start trading on Bitget Futures, users must first create an account on the platform. Registration is simple, requiring only an email address or phone number. Unlike many other exchanges, Bitget does not mandate Know Your Customer (KYC) verification for basic accounts, allowing users to begin trading quickly.

Depositing Funds

Once registered, traders need to deposit funds into their Bitget accounts. This can be done using cryptocurrencies transferred from external wallets or by purchasing assets via fiat on-ramp services. It’s essential to ensure that sufficient funds are available to cover both margin requirements and potential trading fees.

Navigating the Bitget Futures Interface

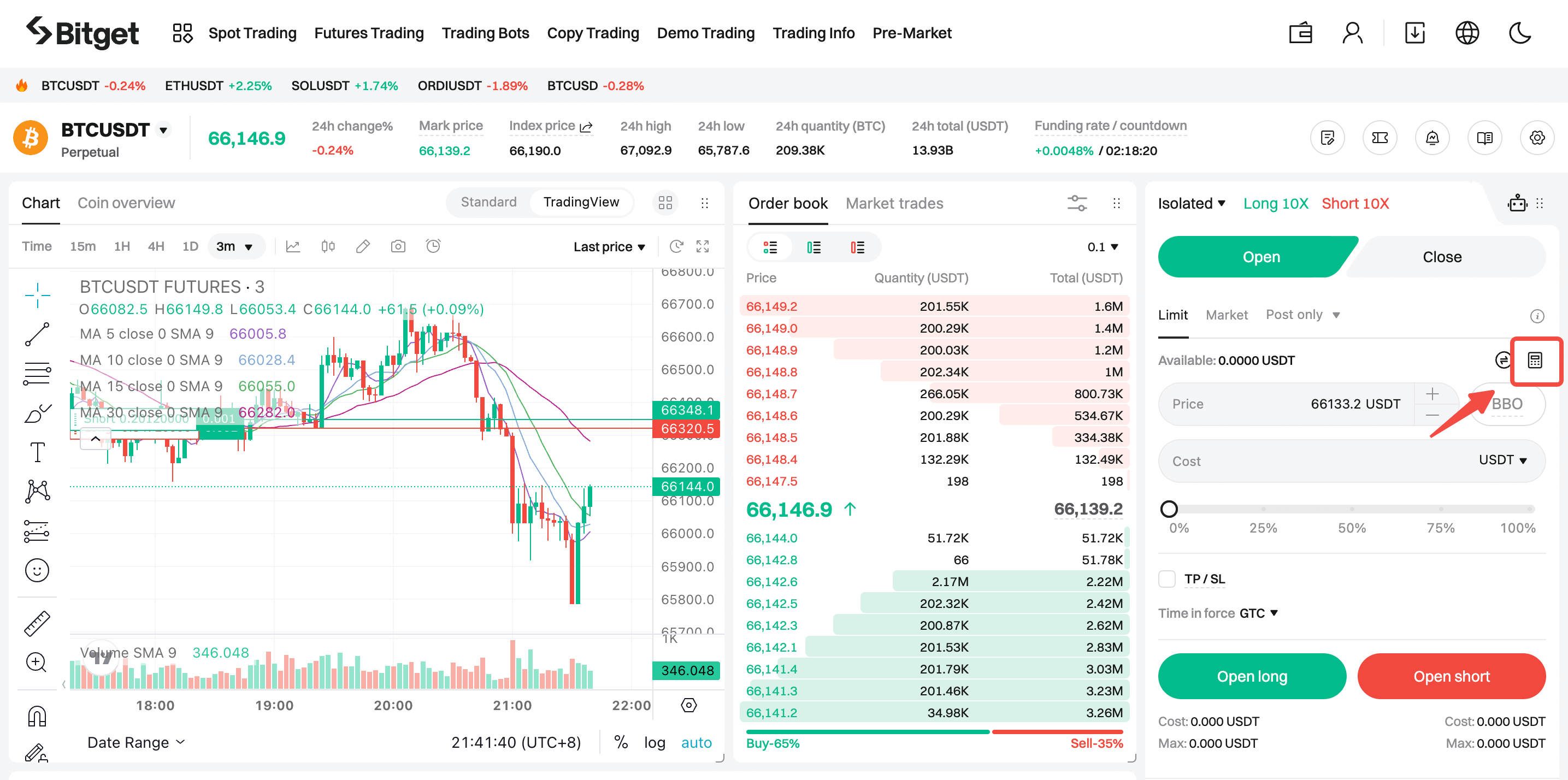

The Bitget Futures trading interface consists of several key components:

- Order Book: Displays real-time buy and sell orders.

- Charting Tools: Integrated TradingView charts allow traders to analyze price trends.

- Order Panel: Provides options to place market, limit, and stop orders.

- Position Management: Shows open positions, realized profits/losses, and liquidation prices.

Placing a Futures Trade

To place a futures trade, traders need to:

- Choose a trading pair (e.g., BTC/USDT or ETH/USDT).

- Select a margin mode: Cross margin (sharing margin across positions) or Isolated margin (specific to one position).

- Set the leverage level based on risk tolerance.

Choose an order type:

- Market Order: Executes immediately at the best available price.

- Limit Order: Executes only when the asset reaches a specified price.

- Stop Order: Triggers a buy or sell order when a certain price is reached.

- Click Confirm Order to execute the trade.

Bitget Futures Calculator: A Must-Have Tool

One of the essential tools for any Bitget Futures trader is the Bitget Futures Calculator, which helps users estimate potential profits, losses, and liquidation prices before entering a trade. This tool is particularly useful for:

- Calculating Margin Requirements: Ensuring that traders allocate the correct amount of capital.

- Estimating Potential Profits: Based on different price scenarios.

- Avoiding Liquidation: By understanding at what price a position may be liquidated.

Using the calculator effectively can significantly enhance a trader’s ability to manage risk and optimize their trading strategy.

Strategies to Maximize Success in Bitget Futures Trading

Maximizing success in Bitget Futures trading requires more than just market knowledge—it demands disciplined risk management, strategic planning, and continuous performance evaluation. By implementing key trading strategies, traders can optimize their profits while minimizing potential losses. The following approaches will help you build a sustainable and effective trading plan on Bitget Futures.

Start with a Small Capital Allocation

For beginners, the best approach to futures trading on Bitget is to start with a small initial investment. Allocating between $100 and $500 allows traders to familiarize themselves with the platform’s interface, order types, and market fluctuations without taking on excessive risk. A gradual increase in investment should be based on experience and confidence gained over time. Jumping in with a large amount of capital without proper risk management can lead to significant losses, especially given the volatile nature of futures markets.

Utilize Stop-Loss and Take-Profit Orders

Risk management is crucial in futures trading, and stop-loss and take-profit orders are essential tools for safeguarding capital. A stop-loss order automatically closes a trade when the price reaches a predetermined level, preventing further losses in case the market moves unfavorably. Similarly, take-profit orders secure gains by closing positions at a set profit target. For instance, if a trader enters a long position on Bitcoin at $45,000, they might set a stop-loss at $44,000 to limit losses and a take-profit at $47,000 to lock in profits. These measures ensure disciplined trading and prevent emotional decision-making.

Regularly Review Trading Performance

Successful futures traders consistently monitor and analyze their trading performance to refine their strategies. Conducting weekly or monthly performance reviews helps identify areas for improvement, such as adjusting entry and exit points, modifying risk levels, or recognizing common mistakes. Bitget provides analytical tools, including trade history and performance metrics, that help traders assess their past trades. Keeping a trading journal can also be beneficial, as it allows traders to document their decisions, strategies, and market conditions at the time of each trade.

Manage Leverage Responsibly

Bitget Futures offers leverage of up to 125x, but high leverage significantly increases the risk of liquidation. While leverage can amplify profits, it also magnifies losses, making responsible use of leverage crucial for long-term success. A more balanced approach is using moderate leverage, typically in the range of 5x to 10x. For example, with a 10x leverage on a $500 position, a trader controls $5,000 in capital, which increases both potential gains and risks. Using excessive leverage without proper risk controls can quickly deplete an account, especially during periods of high market volatility.

Diversify Across Multiple Positions

Diversification is a key strategy in futures trading that helps mitigate risk by spreading capital across different trading pairs. Instead of putting all funds into a single asset, traders should consider opening positions in multiple markets to reduce exposure to sudden price movements. For instance, instead of allocating the entire capital to Bitcoin futures, a trader might divide their investments across Ethereum, Solana, and XRP futures. This approach ensures that a loss in one position can be offset by gains in another, leading to a more balanced risk profile.

By applying these strategies—starting with small capital, using risk management tools, reviewing performance regularly, managing leverage responsibly, and diversifying positions—traders can improve their chances of long-term success in Bitget Futures trading while minimizing potential losses.

Comparing Bitget Futures with Other Platforms

When compared to Binance and Bybit, Bitget stands out for its user-friendly experience, high-leverage options, and competitive fee structure. Key differences include:

- Lower Entry Barriers: No mandatory KYC for basic trading.

- More Flexible Bitget Future Trading Fees: Discounts available through BGB tokens.

- Innovative Features: Tools like copy trading and the Bitget Futures Calculator enhance the trading experience.

Final Thoughts: Is Bitget Futures Worth It in 2025?

Bitget Futures is a powerful platform for both beginner and experienced traders, offering high leverage, low fees, and essential trading tools. Whether you’re looking to hedge, speculate, or actively trade crypto futures, Bitget provides a secure and efficient environment to execute strategies. However, futures trading carries inherent risks, so it’s crucial to approach it with a well-thought-out plan and proper risk management techniques.

With its competitive edge in fees, leverage, and trading tools, Bitget Futures is undoubtedly a top choice for crypto traders in 2025. By leveraging tools like the Bitget Futures Calculator and implementing smart trading strategies, traders can maximize their potential in the dynamic cryptocurrency market.