Margin trading has become one of the most popular methods for traders looking to maximize their potential profits by using financial leverage. Unlike traditional trading, where you can only invest what you have, margin trading allows traders to borrow funds to increase their position size.

With the rapid growth of the cryptocurrency market, Bybit margin trading has emerged as a preferred choice for those who want to leverage their capital efficiently. Bybit provides a seamless trading experience with advanced features, making it accessible for both beginners and experienced traders.

In this comprehensive guide, we will explore everything you need to know about Bybit margin. Whether you’re new to margin trading or an experienced trader looking for a reliable platform, this guide will help you navigate Bybit margin trading in 2025.

What is Margin Trading? Introduction to Bybit Margin Trading

Margin trading is a powerful strategy that allows traders to borrow funds to increase their position size, enabling them to trade with greater capital than they actually own. This method is widely used in the cryptocurrency market to amplify potential profits, though it also comes with increased risks. Margin trading on Bybit takes this concept further by providing traders with a seamless and efficient platform to leverage their trades while offering advanced risk management tools.

Whether you’re an experienced trader looking to maximize your returns or a beginner exploring leveraged trading, understanding margin trading Bybit is crucial to making informed decisions in the volatile crypto market. Let’s dive deeper into how margin trading works and why Bybit is one of the top platforms for leveraged trading.

What is Margin Trading?

Before diving into Bybit margin trading, it’s important to understand the fundamentals of margin trading and how it differs from standard spot trading.

Definition and Basics of Margin Trading

Margin trading is a strategy that allows traders to borrow funds from an exchange to increase their position size beyond what they could afford with their own capital. This means traders can amplify their potential profits—or losses—by using leverage.

For example, if a trader has $1,000 and uses 10x leverage, they can trade with $10,000. If the market moves in their favor, their profits are multiplied. However, if the market moves against them, they can lose their entire collateral or face liquidation.

Key Features of Margin Trading

- Leverage: Traders can multiply their position size using borrowed funds (e.g., 10x, 50x, or even 100x leverage).

- Collateral: A trader must deposit an initial amount (margin) to secure the borrowed funds.

- Liquidation Risk: If the market moves against a leveraged trade and the trader doesn’t have enough margin to cover losses, the position may be liquidated.

- Long and Short Positions: Traders can profit from both rising (long) and falling (short) markets.

Now that you understand the basics, let’s explore how Bybit margin trading works and why it has become a preferred choice for many traders.

Introduction to Bybit Margin Trading

Bybit is one of the most popular cryptocurrency exchanges offering advanced margin trading features with a user-friendly interface and high liquidity.

What is Bybit Margin Trading?

Bybit margin trading allows traders to borrow funds from the exchange to increase their trade size. This enables higher potential returns, but also higher risks. Bybit provides a seamless trading experience with adjustable leverage options, risk management tools, and an intuitive interface for both beginners and professionals.

Types of Margin Trading on Bybit

Bybit offers three main types of margin trading:

- Cross Margin: In cross margin, all funds in the trader’s account act as collateral. This reduces the risk of immediate liquidation but puts the entire account balance at risk.

- Isolated Margin: In an isolated margin, only a specific amount of collateral is allocated to a trade. If a position is liquidated, only the isolated amount is lost, not the entire balance.

- Bybit Spot Margin: Bybit spot margin allows traders to borrow funds while still engaging in spot trading. This means traders can hold actual assets while using leverage. Now that we have a clear understanding of the Bybit margin, let’s discuss the step-by-step process of how it works.

How Bybit Margin Trading Works

To successfully trade with margin trading Bybit, traders must understand the mechanics behind it, including how leverage works, the role of collateral, trade execution, and risk management. Bybit provides a user-friendly and efficient margin trading platform, but using it effectively requires a solid understanding of the trading process. Below is a step-by-step breakdown of how Bybit margin trading works.

Step 1: Choosing Leverage

Leverage is one of the most important aspects of margin trading, as it determines how much a trader can amplify their position size using borrowed funds. Bybit offers flexible leverage ranging from 1x to 100x, depending on the asset and trading strategy.

Example of Using Leverage:

- Suppose a trader has $1,000 in their Bybit account.

- They choose to trade with 10x leverage, which means they can open a position worth $10,000 instead of just $1,000.

- If the price of Bitcoin increases by 5%, their position value rises to $10,500, giving them a $500 profit instead of just $50 without leverage.

- However, if Bitcoin’s price drops by 5%, they lose $500, a much larger loss than if they had traded without leverage.

Key Considerations:

- Higher leverage increases potential profits but also increases the risk of liquidation.

- Bybit allows traders to adjust their leverage based on their risk appetite.

- Lower leverage (e.g., 3x–5x) is generally safer for beginners, while higher leverage (50x–100x) is riskier and more suitable for experienced traders.

Step 2: Depositing Collateral

To open a margin trade on Bybit, traders must deposit collateral, which acts as security for the borrowed funds. The amount of collateral required depends on the chosen leverage and trade size.

Example of Collateral Deposit:

- A trader wants to go long on Bitcoin with a $2,000 position using 5x leverage.

- Since they are using 5x leverage, they need to deposit 1/5th of the trade size as collateral, which is $400.

- The remaining $1,600 is borrowed from Bybit.

Key Considerations:

- If the trade moves in the trader’s favor, they keep the profits and return the borrowed funds.

- If the trade goes against them, their position may face a margin call or liquidation if they don’t add more collateral.

Step 3: Placing a Margin Trade

Once the collateral is deposited, traders can open a long (buy) or short (sell) position based on market expectations.

- Long Position: A trader buys an asset, expecting its price to increase.

- Short Position: A trader sells an asset, expecting its price to decrease and plans to buy it back later at a lower price for profit.

Example of a Long and Short Trade:

- Long Trade: If Bitcoin is currently priced at $50,000, a trader uses 10x leverage and opens a $10,000 long position. If Bitcoin’s price rises to $52,000, the trader makes a $400 profit per 1% increase.

- Short Trade: If Bitcoin is priced at $50,000, a trader enters a $10,000 short position. If the price drops to $48,000, they buy back at a lower price and make a profit.

Key Considerations:

- Leverage amplifies both gains and losses, so proper risk management is essential.

- Bybit allows traders to adjust leverage and monitor real-time margin requirements to prevent liquidation.

Step 4: Managing Risk in Bybit Margin Trading

Risk management is one of the most critical aspects of Bybit margin trading, as improper strategies can lead to liquidation and substantial losses. Bybit offers multiple risk management tools to help traders minimize potential losses.

Essential Risk Management Tools on Bybit:

- Stop-Loss Orders – Traders can set stop-loss levels to automatically close a position if the price moves against them. Example: If a trader buys Bitcoin at $50,000 and sets a stop-loss at $48,500, the position will close automatically if Bitcoin’s price drops to this level, preventing further losses.

- Take-Profit Orders – This allows traders to lock in profits by closing a position at a predetermined price. Example: If a trader buys Bitcoin at $50,000 and sets a take-profit at $52,000, the system automatically closes the trade when the price reaches this level.

- Margin Call Alerts – Bybit notifies traders when their margin balance is running low, allowing them to add more collateral to avoid liquidation.

- Isolated vs. Cross Margin – Bybit offers two margin modes to manage risk: Isolated Margin – Limits losses to the specific trade’s margin amount. Cross Margin – Uses all available balances as collateral, reducing liquidation risk but increasing potential losses.

Key Considerations:

- Setting stop-loss and take-profit orders is crucial to protecting profits and minimizing losses.

- Avoid using excessive leverage, as it increases liquidation risk.

- Traders should monitor funding rates, as they impact costs when holding leveraged positions.

Step 5: Closing a Margin Trade

A trader can close a margin trade manually or use automated orders (such as take-profit or stop-loss orders).

Closing a Trade Manually:

- If a trader wants to exit a position, they can manually sell (long trade) or buy back (short trade).

- Profits or losses are settled based on the price difference.

Example of Closing a Trade:

- A trader buys Bitcoin at $50,000 using 10x leverage with a $10,000 position.

- Bitcoin’s price increases to $52,000, and they decide to close the trade.

- Profit = $2,000, minus any applicable Bybit margin fees.

Additional Costs and Fees in Bybit Margin Trading

Using Bybit margin trading comes with additional fees that traders must consider.

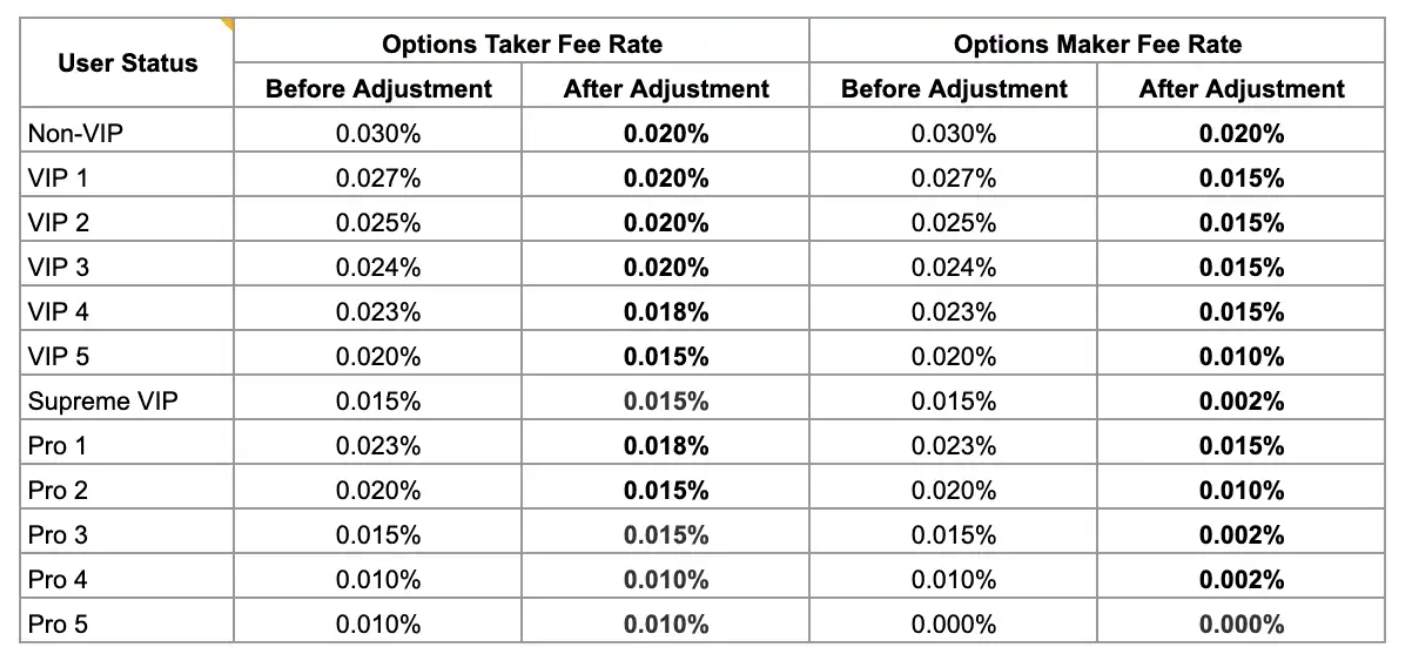

- Trading Fees: Maker Fee is 0.01%. Taker Fee is 0.06%

- Funding Rates: Applied every 8 hours for perpetual contracts. Fees depend on market conditions.

- Interest on Bybit Spot Margin: Traders borrowing funds through Bybit Spot Margin pay interest fees based on the borrowed amount.

- Liquidation Fees: If a position is liquidated, an additional fee is charged.

Key Considerations:

- Traders should always calculate the total Bybit margin fees before entering a leveraged trade.

- Holding leveraged positions for extended periods can increase costs due to funding rates.

Conclusion

Bybit margin trading offers traders a powerful way to amplify their potential profits through leverage, allowing them to maximize their capital efficiency while trading various cryptocurrency pairs. With flexible leverage options, advanced trading tools, and competitive Bybit margin fees, the platform has become a go-to choice for both novice and professional traders looking to enhance their market exposure. Additionally, Bybit spot margin trading provides an alternative way for traders to borrow funds while still engaging in spot trading, making it a versatile platform for diverse trading strategies.

As we move into 2025, Bybit continues to innovate, offering traders more ways to navigate the crypto market with ease and efficiency. Whether you’re just starting with margin trading Bybit or refining your strategy, staying informed and managing risks effectively is key to long-term success.