Unlike traditional financial markets, the cryptocurrency market operates 24/7 and is highly volatile. Price swings of 10%–30% within hours are not uncommon, making CoinUp Risk Management a fundamental part of successful trading. Without a structured approach to CoinUp Risk Management, traders can quickly lose their capital. Implementing effective CoinUp Risk Management strategies helps mitigate losses and maximize long-term profitability in such an unpredictable environment.

Cryptocurrency trading presents immense profit opportunities, but it also carries significant risks. Market volatility, leverage mismanagement, and emotional decision-making can lead to substantial financial losses if traders do not employ effective risk management strategies. Understanding and implementing CoinUp Risk Management techniques can help traders navigate the complexities of the crypto market while protecting their capital and maximizing their potential gains.

In this guide, we will explore the best practices for CoinUp risk management, including leverage control, stop-loss and take-profit orders, portfolio diversification, and emotional discipline.

The Importance of Risk Management in Crypto Trading

- Protects Capital: Prevents significant losses that could wipe out an account.

- Minimizes Emotional Trading: Reduces impulsive decisions driven by fear or greed.

- Improves Consistency: Helps traders stay disciplined and stick to a predefined strategy.

- Maximizes Profit Potential: Enables traders to hold winning positions longer and cut losses early.

To trade successfully on CoinUp, you need to understand the essential risk management techniques that will safeguard your investments.

Leverage Control – Managing Margin Trading Risks

How Leverage Works on CoinUp

CoinUp offers leverage for contract trading, enabling traders to control larger positions with a smaller initial investment. However, high leverage magnifies price fluctuations, making positions more vulnerable to market swings.

Example of Leverage Trading:

- With 10x leverage, a $1,000 investment allows a trader to control a $10,000 position.

- A 5% increase in price results in a $500 profit (rather than $50 with no leverage).

- A 5% decrease in price results in a $500 loss, cutting the account balance by half.

Best Practices for Managing Leverage on CoinUp

- Use Low Leverage: Keeping leverage between 3x–5x reduces exposure to liquidation.

- Always Set Stop-Loss Orders: Avoid unexpected losses by defining exit points in advance.

- Monitor Market Conditions: Avoid high leverage during volatile periods.

- Never Risk More Than You Can Afford to Lose: Only trade with money you are prepared to lose.

Proper leverage management ensures traders can maximize their profits without exposing themselves to unnecessary risk.

Stop-Loss and Take-Profit Orders – Essential Risk Control Tools

Stop-loss and take-profit orders are critical for CoinUp Risk Management. These tools help traders automate their exits and avoid making emotionally driven decisions.

Stop-Loss Orders – Limiting Downside Risk

A stop-loss order automatically sells an asset when it reaches a certain price, preventing further losses.

Example:

- You buy Bitcoin at $50,000 and set a stop-loss at $48,000.

- If BTC falls to $48,000, the system automatically sells your position, limiting losses to $2,000 per BTC.

Take-Profit Orders – Locking in Gains

A take-profit order ensures your trade closes at a predefined price, securing profits before the market reverses.

Example:

- You buy Ethereum at $3,000 and set a take-profit order at $3,500.

- If ETH reaches $3,500, the system sells your ETH automatically, locking in a $500 profit per ETH.

Why Use Stop-Loss and Take-Profit Orders?

- Avoid Emotional Trading: Traders often hesitate to sell at a loss or hold onto winning trades for too long.

- Protect Against Market Fluctuations: Unexpected price movements can be mitigated.

- Automate Risk Control: Orders execute even if you are not actively monitoring the market.

By incorporating these orders into your trading strategy, you can protect your capital and ensure you exit trades at the right time.

Portfolio Diversification – Reducing Market Volatility Risks

How to Diversify Your Crypto Portfolio on CoinUp

- Allocate Funds Across Different Assets: Invest in large-cap cryptocurrencies (Bitcoin, Ethereum) for stability and smaller altcoins for potential growth.

- Use Stablecoins for Risk Management: Holding USDT, USDC, or BUSD can help preserve capital during bear markets.

- Consider Yield Farming or Staking: Earn a passive income while maintaining exposure to the crypto market.

Example of a Diversified Portfolio:

- 50% in BTC & ETH (Large-cap, stable assets)

- 30% in Altcoins (Higher growth potential)

- 20% in Stablecoins (Low-risk, liquid assets)

Diversification ensures that traders are not overly exposed to the price movements of a single asset, reducing overall risk.

Avoiding Emotional Trading – Controlling Fear and Greed

Many traders lose money not because of poor strategies but because of emotional decision-making. Fear and greed often lead to impulsive trading behaviors that can be disastrous.

Common Emotional Trading Mistakes

- Panic Selling: Selling assets at a loss due to fear during a market downturn.

- FOMO (Fear of Missing Out): Buying at high prices due to hype, only to see prices drop.

- Overtrading: Entering too many trades without a solid plan.

How to Stay Emotionally Disciplined

- Follow a Predefined Strategy: Have clear entry and exit rules.

- Use Stop-Loss and Take-Profit Orders: Automate trade management to remove emotions.

- Take Breaks During Market Volatility: Avoid trading when feeling anxious or impulsive.

By developing emotional discipline, traders can make rational decisions and avoid unnecessary losses.

Risk vs. Reward – Finding the Right Balance

Every trade carries a certain level of risk and potential reward. Understanding how to balance these two factors is essential for effective CoinUp Risk Management. A trader who consistently takes unfavorable trades—where the potential loss outweighs the potential gain—will struggle to stay profitable in the long run.

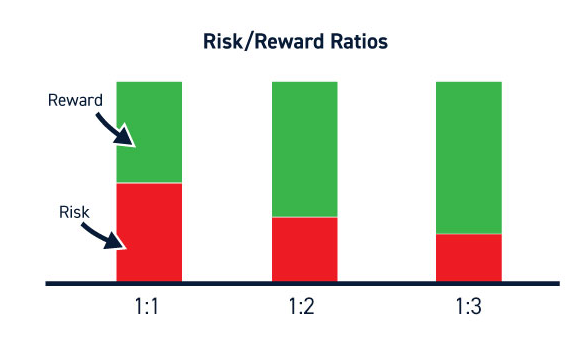

A well-defined risk-to-reward ratio (RRR) helps traders assess whether a trade is worth taking. This ratio represents the amount of profit a trader expects to earn relative to the amount they are risking. By maintaining a favorable RRR, traders can ensure that even if they lose some trades, their overall strategy remains profitable over time.

How to Calculate the Risk-to-Reward Ratio

To determine whether a trade is worth entering, traders must evaluate their entry price, stop-loss level, and take-profit target. The formula for calculating the risk-to-reward ratio is:

RRR = Potential Profit/Potential Loss

Example of a Risk-to-Reward Calculation

Let’s say a trader is analyzing a Bitcoin (BTC) trade:

- Entry Price: $50,000

- Stop-Loss Price: $48,000 ($2,000 loss per BTC if the trade goes wrong)

- Take-Profit Price: $54,000 ($4,000 profit per BTC if the trade succeeds)

RRR = $4,000/$2,000 = 2:1

This means that for every $1 at risk, the trader expects to earn $2 in profit.

Why the Risk-to-Reward Ratio Matters

- A low risk-to-reward ratio (e.g., 1:1 or lower) means that potential losses could outweigh or equal potential profits.

- A high risk-to-reward ratio (e.g., 3:1 or higher) indicates a strong trade setup where the potential reward is significantly greater than the risk.

Best Practices for Managing Risk-to-Reward Ratio

To effectively manage risk and maximize profits, traders should follow these best practices:

Always Aim for a Minimum 2:1 Risk-to-Reward Ratio

A 2:1 ratio ensures that even if a trader wins only 50% of their trades, they will still be profitable.

Example: If a trader places 10 trades, each risking $100 with a 2:1 RRR, they would need only 4 successful trades to break even and 5 to make a profit.

Avoid Low-Reward, High-Risk Trades

Some trades may seem attractive due to strong price movements, but if the risk is too high compared to the reward, they are not worth taking.

Bad Example:

- A trader enters Ethereum (ETH) at $3,000, sets a stop-loss at $2,900 (-$100 risk), but only sets a take-profit at $3,050 (+$50 reward).

- The RRR is 0.5:1, meaning the potential loss is double the potential gain.

- If the trader loses just a few of these trades, their account will decline quickly.

Adjust Stop-Loss and Take-Profit Levels Based on Market Conditions

Crypto markets are highly volatile, and fixed stop-loss/take-profit levels may not always work in changing conditions.

- During volatile markets, traders may need to widen stop-loss levels slightly to avoid being stopped out by short-term fluctuations.

- During stable markets, tighter stop-loss levels can help preserve capital while still achieving a strong risk-to-reward setup.

Consider Win Rate and Risk Management Together

A good risk-to-reward ratio should align with a trader’s win rate. If a trader has a high win rate (above 60%), they might be able to take some lower RRR trades (e.g., 1.5:1). However, if a trader has a lower win rate (below 50%), they must maintain a higher RRR (at least 2:1 or 3:1) to remain profitable.

Balancing Risk and Reward for Long-Term Success

The key to long-term profitability is not winning every trade but winning the right trades. Traders who consistently apply a strong risk-to-reward strategy will naturally build a more sustainable and profitable trading approach.

By integrating a solid RRR approach into CoinUp Risk Management, traders can make well-informed decisions, reduce emotional trading, and ultimately improve their overall performance in the cryptocurrency market.

Mastering CoinUp Risk Management for Long-Term Success

Mastering CoinUp Risk Management is the key to protecting your capital and maximizing profits in cryptocurrency trading. Whether you are a beginner or an advanced trader, applying the right risk management techniques ensures that you can trade confidently without exposing yourself to unnecessary financial losses.

Key Takeaways:

- Use stop-loss and take-profit orders to automate risk control.

- Manage leverage effectively to avoid liquidation.

- Diversify your crypto portfolio to reduce market volatility risks

- Stay emotionally disciplined and avoid impulsive trading decisions.

By implementing these proven risk management strategies, you can enhance your trading experience on CoinUp and build a sustainable crypto investment portfolio. Ready to trade securely? Sign up on CoinUp today and take control of your financial future!