Launched with a vision to provide a seamless, secure, and efficient trading environment, CoinUp integrates advanced trading tools, competitive fees, and robust security measures, making it a strong contender in the digital asset trading space. As more traders seek platforms that balance ease of use with powerful trading functionalities, CoinUp has gained significant traction. This guide delves into the essential aspects of CoinUp trading orders, covering the different types of orders available, the process of executing buy/sell transactions, and the detailed breakdown of CoinUp trading fees.

Contents

ToggleCoinUp Trading Orders – The Core of Your Trading Strategy

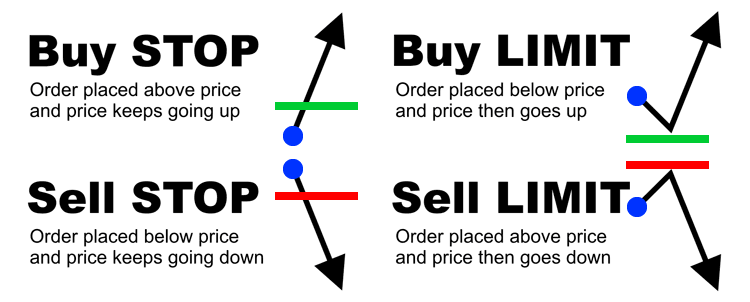

A CoinUp trading order is an instruction placed by a trader to buy or sell a cryptocurrency at a specific price or market condition. There are several types of trading orders available on CoinUp, each serving a unique purpose.

Types of Trading Orders on CoinUp

- Market Orders – Instantly buy or sell at the best available market price.

- Limit Orders – Set a specific price at which you want to buy or sell.

- Stop-Loss Orders – Automatically sell when the price reaches a predefined level.

- Take-Profit Orders – Lock in profits by selling when the price hits a target.

How to Place a CoinUp Trading Order

Placing a CoinUp trading order efficiently is crucial for executing successful trades. Understanding the different order types, how they function, and when to use them can help traders maximize profits and minimize risks. In this section, we will walk you through the step-by-step process of placing a CoinUp trading order, ensuring you can buy and sell cryptocurrencies seamlessly on the platform.

- Log in to Your CoinUp Account: Go to the trading section and select your desired trading pair (e.g., BTC/USDT).

- Choose Your Order Type: Select Market, Limit, Stop-Loss, or Take-Profit depending on your strategy.

- Enter Order Details: Specify the amount and price (if applicable), and confirm the order.

- Execute and Monitor: Your order will be placed, and you can track its status in the “Open Orders” section.

- Each CoinUp trading order type has its advantages, and choosing the right one depends on your market approach.

Buy/Sell Orders on CoinUp – How to Execute Trades Like a Pro

Mastering buy and sell orders on CoinUp is essential for executing trades efficiently and maximizing your profits. Whether you’re a beginner looking to make your first crypto purchase or an experienced trader aiming to optimize your strategy, understanding how to place and manage a CoinUp trading order is key. In this section, we’ll guide you through the process of executing buy and sell orders on CoinUp, helping you trade like a pro with confidence.

Understanding Buy and Sell Orders

Trading on CoinUp involves buying and selling cryptocurrencies using different types of orders. Here’s a closer look at how they work:

Buy Orders on CoinUp

- A buy order allows traders to purchase cryptocurrency at a specified price.

- If using a market buy order, the order is fulfilled immediately at the best available price.

- If using a limit buy order, the purchase will only be executed when the market price reaches the set level.

Sell Orders on CoinUp

- A sell order lets traders sell their crypto assets at a designated price.

- A market sell order executes instantly at the highest bid price.

- A limit sell order will only be triggered when the price reaches the desired selling level.

Step-by-Step Guide to Placing Buy/Sell Orders on CoinUp

Placing a CoinUp trading order correctly is crucial for ensuring smooth and successful transactions. Whether you’re buying or selling cryptocurrencies, understanding the step-by-step process will help you execute trades efficiently while minimizing risks. In this section, we’ll walk you through the exact steps to place buy and sell orders on CoinUp so you can trade with confidence and precision.

Go to the Trading Interface

Select the cryptocurrency pair you want to trade (e.g., ETH/USDT).

Choose Buy or Sell

- Click on “Buy” if you want to purchase.

- Click on “Sell” if you want to liquidate holdings.

Select the Order Type

- Choose between Market, Limit, or Stop orders.

Input Trade Details

- Enter the quantity of crypto to buy or sell.

- For limit orders, specify the price.

Confirm and Execute

Click on “Confirm Order” to place your trade.

By mastering buy/sell orders on CoinUp, traders can maximize profits and minimize risks.\

CoinUp Trading Fees – Understanding the Costs

One of the key factors in cryptocurrency trading is the fee structure. CoinUp offers competitive trading fees, but understanding them is crucial to optimizing your strategy and placing an efficient CoinUp trading order.

Breakdown of CoinUp Trading Fees

- Spot Trading Fees: CoinUp charges a 0.2% fee for both buying and selling cryptocurrencies in the spot market. This fee is applied based on your trading volume and impacts each CoinUp trading order executed in the spot market.

- Contract Trading Fees: If you trade contracts on CoinUp, the fees are structured differently. Makers, who add liquidity to the order book, are charged a lower fee of 0.02% per trade, while Takers, who remove liquidity, incur a higher fee of 0.06% per trade. Every CoinUp trading order placed in the contract market will be subject to these varying costs.

- Contract Interest Fees: If you hold leveraged contract positions on CoinUp, an interest fee is applied every 8 hours. This charge is standard across most crypto exchanges to account for the funding costs of leveraged trades and can impact the overall profitability of a CoinUp trading order that remains open for an extended period.

- Withdrawal Fees: The withdrawal fees on CoinUp are adjusted dynamically based on market conditions. These fees depend on factors such as blockchain congestion and the cryptocurrency being withdrawn. Users can check the exact withdrawal fee on the CoinUp withdrawal page before making a transaction to ensure they manage the costs of moving funds after completing a CoinUp trading order.

How Fees Impact Your CoinUp Trading Orders

- Spot Trading Fees are applied when executing buy/sell orders in the spot market. These costs can add up over time, especially for high-frequency traders.

- Contract Trading Fees vary based on whether you are a Maker (providing liquidity) or a Taker (removing liquidity), making it crucial to choose the right trading strategy when placing a CoinUp trading order.

- Interest Fees apply when holding leveraged contract positions, meaning traders must account for these costs if they plan to hold positions for extended periods.

- Withdrawal Fees fluctuate, so it is advisable to check the current rates before withdrawing funds to minimize unnecessary expenses.

Tips to Minimize CoinUp Trading Fees

- Use Limit Orders: Since taker fees are higher than maker fees, placing limit orders instead of market orders can reduce costs over time.

- Trade During Low-Fee Periods: Market conditions impact withdrawal fees, so planning withdrawals during lower-fee periods can help save costs.

- Increase Trading Volume: Some exchanges offer tiered fee discounts for high-volume traders, so maintaining a higher trading volume could result in lower overall fees.

Understanding CoinUp trading order fees allows traders to make cost-effective decisions when placing orders. By strategically managing fees, traders can maximize profits while keeping costs under control.

Final Thoughts

Mastering the CoinUp trading order system is essential for efficient crypto trading. Whether placing buy/sell orders on CoinUp or understanding CoinUp trading fees, having the right knowledge ensures a smoother experience.

CoinUp offers multiple trading order types, including Market, Limit, Stop-Loss, and Take-Profit orders, each serving different trading strategies. When executing buy/sell orders, traders can choose between Market orders for instant execution or Limit orders for setting a specific price. Additionally, understanding the CoinUp trading fees is crucial, as fees vary depending on the trade type. For contract trading, makers pay lower fees compared to takers, making it beneficial to choose the right trading approach.

By using this CoinUp trading order guide, you’ll be equipped with the knowledge needed to trade confidently in 2025. Whether you’re a beginner or an expert, optimizing your orders and fees will give you an edge in the crypto market.