Contents

ToggleUnderstanding Key Cryptocurrency Terms

To successfully navigate the world of digital assets, it’s essential to grasp fundamental cryptocurrency terms. These terms will help you make informed trading decisions, manage your investments, and understand the technical aspects of blockchain technology. Below are 20 essential cryptocurrency terms every trader and investor should know, along with examples to illustrate their use.

Blockchain

A blockchain is a decentralized, digital ledger that records transactions across multiple computers. It ensures transparency, security, and immutability of data.

Example: Bitcoin transactions are stored on a public blockchain, allowing anyone to verify transfers without relying on a central authority.

Cryptocurrency

A cryptocurrency is a digital asset designed for secure financial transactions. It operates on blockchain technology and uses cryptographic methods to control creation and verify transactions.

Example: Bitcoin (BTC) and Ethereum (ETH) are two well-known cryptocurrencies used for trading, investing, and payments.

Altcoin

An altcoin refers to any cryptocurrency other than Bitcoin. Some altcoins offer additional features like smart contracts, faster transactions, or unique governance models.

Example: Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA) are examples of popular altcoins.

Ethereum (ETH)

Ethereum is a blockchain platform that enables smart contracts and decentralized applications (dApps). Its cryptocurrency, ETH, is used to pay for transaction fees and computational services.

Example: Many NFTs and DeFi projects are built on the Ethereum blockchain, using ETH to pay for gas fees.

Smart Contract

A smart contract is a self-executing contract with the terms of the agreement directly written into code. These contracts run on blockchain networks without the need for intermediaries.

Example: A smart contract on Ethereum can automatically release payment to a seller once a buyer confirms delivery of goods.

Bitcoin (BTC)

Bitcoin is the first and most widely recognized cryptocurrency. Created by Satoshi Nakamoto in 2009, it is often referred to as “digital gold” due to its store-of-value properties.

Example: Many investors hold Bitcoin as a hedge against inflation, similar to how people invest in gold.

Decentralized Finance (DeFi)

DeFi refers to financial services that operate on blockchain networks, eliminating the need for traditional banks. These services include lending, borrowing, and yield farming.

Example: Platforms like Aave and Uniswap allow users to earn interest on crypto holdings without involving a bank.

NFT (Non-Fungible Token)

An NFT is a unique digital asset that represents ownership of digital or physical items like art, music, or collectibles. Unlike cryptocurrencies, NFTs are not interchangeable.

Example: The digital artwork “Everydays: The First 5000 Days” by Beeple was sold as an NFT for $69 million.

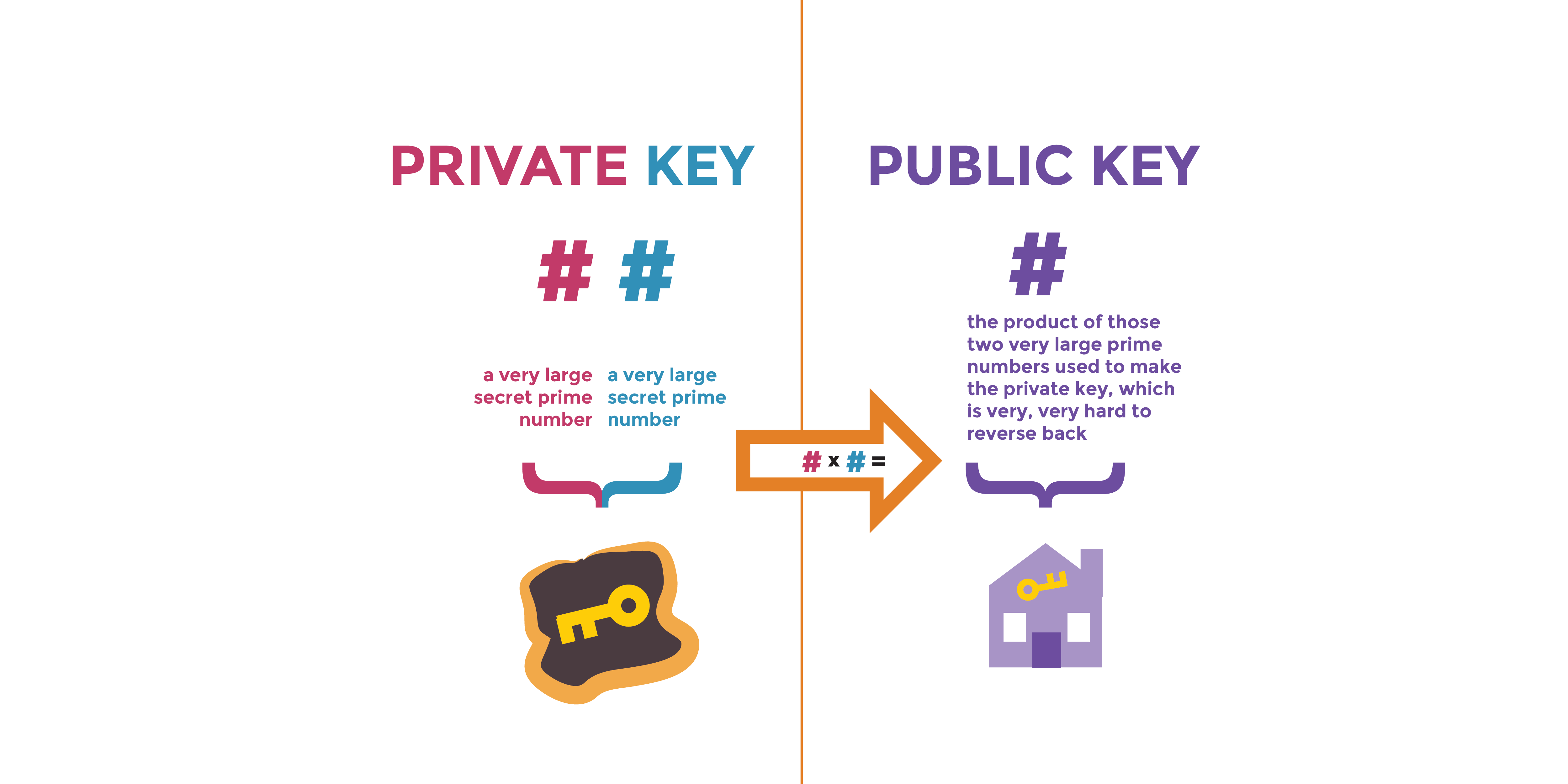

Private Key & Public Key

A private key is a secret code that grants access to cryptocurrency funds, while a public key is a wallet address used to receive funds.

Example: When sending Bitcoin, the sender uses the recipient’s public key. The recipient must use their private key to access the funds.

Wallet

A crypto wallet is a digital tool for storing and managing cryptocurrencies. Wallets can be hot (online) or cold (offline).

Example: MetaMask is a popular hot wallet, while Ledger Nano X is a secure cold wallet for storing Bitcoin.

Exchange

A cryptocurrency exchange is a platform where users can buy, sell, and trade digital assets. Exchanges can be centralized (CEX) or decentralized (DEX).

Example: Binance and Coinbase are centralized exchanges, while Uniswap is a decentralized exchange.

Market Order vs. Limit Order

A market order executes immediately at the current price, while a limit order is placed at a specific price and executes only if the market reaches that level.

Example: If Bitcoin is trading at $40,000 and you place a market order, it will be executed at the current price. If you place a limit order at $38,000, the trade will only execute if Bitcoin drops to that price.

Liquidity

Liquidity refers to how easily an asset can be bought or sold without significantly impacting its price.

Example: Bitcoin has high liquidity because it is widely traded, whereas smaller altcoins may have lower liquidity and higher price volatility.

Slippage

Slippage occurs when the final executed price of a trade differs from the expected price due to market fluctuations.

Example: If you place a large buy order for an altcoin with low liquidity, you might end up paying a higher price than expected.

Staking

Staking involves locking up cryptocurrency in a network to support operations like transaction validation in exchange for rewards.

Example: Users who stake Ethereum in Ethereum 2.0 earn rewards for helping to secure the network.

Mining

Mining is the process of validating transactions and securing a blockchain network by solving complex mathematical problems.

Example: Bitcoin miners use powerful computers to solve equations and receive BTC as a reward.

Hash Rate

The hash rate is a measure of computational power used in cryptocurrency mining. A higher hash rate means a more secure network.

Example: Bitcoin’s hash rate surged in 2024 as more miners joined the network, improving security and stability.

Gas Fees

Gas fees are transaction fees paid to process operations on blockchain networks like Ethereum.

Example: During times of high network congestion, gas fees on Ethereum can skyrocket, making transactions more expensive.

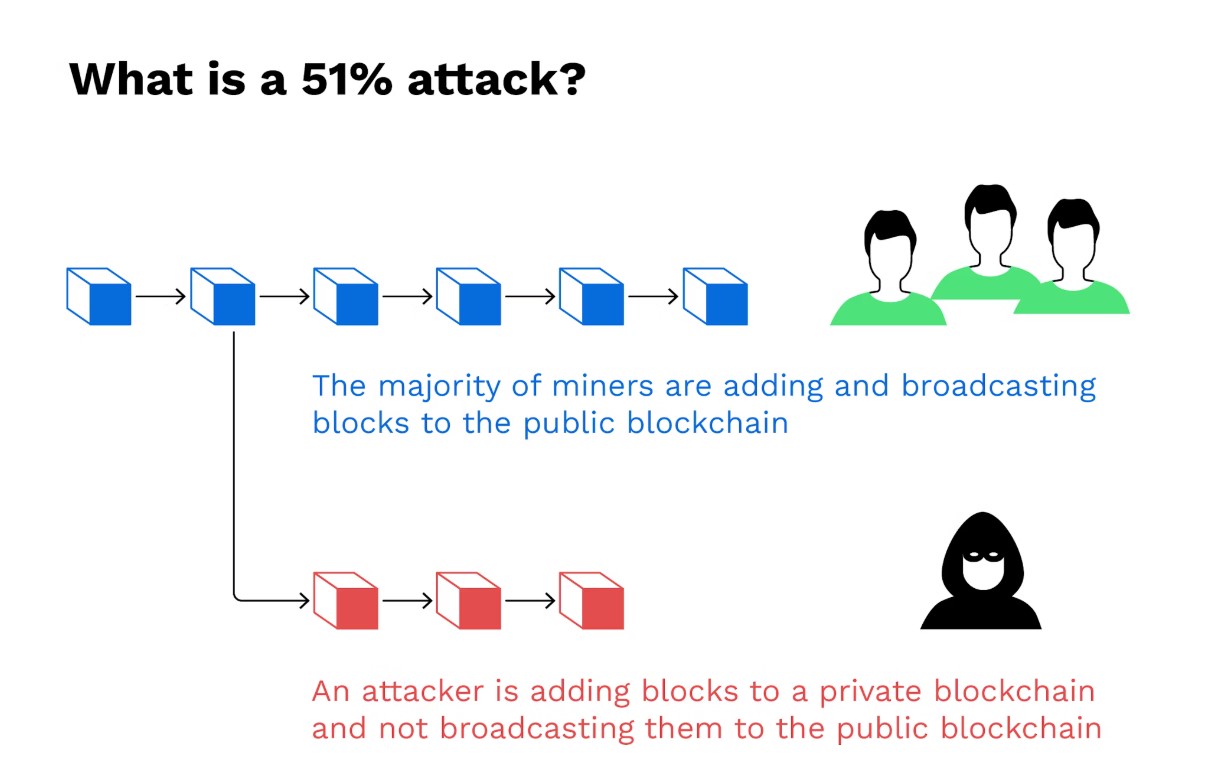

51% Attack

A 51% attack occurs when a single entity gains control of more than 50% of a blockchain’s mining power, allowing them to manipulate transactions.

Example: Smaller blockchains with low security are more vulnerable to 51% attacks, where attackers could double-spend coins.

HODL (Hold On for Dear Life)

HODL is a term used in the crypto community to encourage long-term investment despite market volatility.

Example: Many Bitcoin investors HODLed through market crashes in 2018 and 2022, only to see BTC prices surge in later years.

How Cryptocurrency Terms Impact Your Trading Strategy

Understanding cryptocurrency terms isn’t just about improving your crypto vocabulary—it plays a crucial role in developing a successful trading strategy. Here’s why:

- Choosing the Right Trading Method: Knowing the difference between a market order and a limit order ensures you execute trades at the most favorable prices.

- Managing Fees Efficiently: Awareness of gas fees, trading fees, and staking rewards helps optimize your profits by minimizing unnecessary costs.

- Avoiding Costly Mistakes: Understanding blockchain security, private keys, and 51% attacks can protect your assets from fraud or hacking attempts.

- Maximizing Investment Potential: Terms like DeFi, staking, and liquidity pools introduce opportunities for passive income and yield farming.

By mastering these cryptocurrency terms, you’ll be better equipped to analyze market trends, engage in effective trading, and make well-informed investment decisions.

Getting Started with CoinUp!

For traders seeking a secure, efficient, and user-friendly cryptocurrency exchange, CoinUp is an excellent choice. Whether you’re a beginner making your first trade or an experienced investor looking for advanced contract trading options, CoinUp provides the tools and resources to help you succeed.

Understanding essential cryptocurrency terms is crucial for maximizing your trading efficiency on CoinUp. By familiarizing yourself with key concepts such as liquidity, staking, and gas fees, you can make more informed investment choices. Start your crypto journey today with CoinUp, and take advantage of a platform designed for both beginners and seasoned traders alike.