Cryptocurrency derivatives trading has revolutionized the financial landscape, allowing traders to profit from price movements without directly owning digital assets. Bybit, one of the world’s leading cryptocurrency exchanges, provides a robust platform for trading derivatives, including futures contracts, perpetual swaps, and options.

To succeed in Bybit derivatives trading, traders must employ well-researched strategies that align with their risk tolerance and market outlook. In this article, we will explore three essential derivatives trading strategies on Bybit:

- Scalping Techniques – A short-term, high-frequency trading strategy designed to take advantage of minor price fluctuations.

- Swing Trading – A medium-term approach that focuses on capturing price swings over several days or weeks.

- Hedging Strategies – A defensive trading method used to mitigate risks and protect against adverse price movements.

Each strategy has its own benefits and challenges, and choosing the right one depends on your trading style and objectives. Let’s dive deeper into each approach to understand how traders can maximize their potential returns on Bybit.

Scalping Techniques

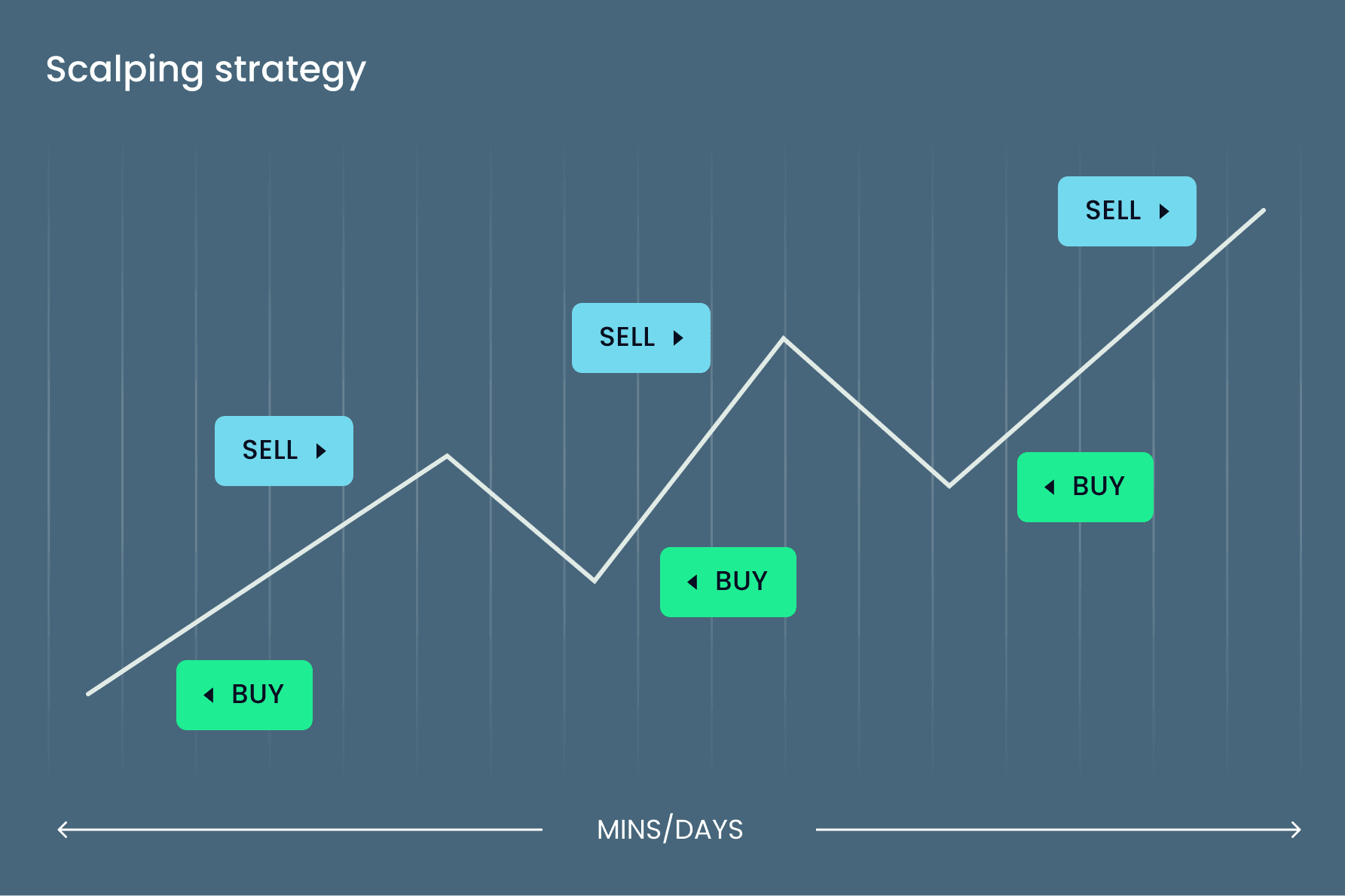

Scalping is one of the most popular strategies for traders looking to capitalize on small price fluctuations. This section explores how scalping works, the key techniques used by traders, and why Bybit’s advanced features make it an ideal platform for high-frequency trading.

What Is Scalping in Derivatives Trading?

Scalping in derivatives trading is a strategy focused on executing numerous trades within a short time frame, ranging from seconds to minutes, to profit from small price fluctuations. Instead of waiting for significant price movements, scalpers aim to accumulate a series of modest profits by capitalizing on small changes in asset prices. This approach demands a high level of speed and precision.

On platforms like Bybit, scalping proves to be particularly effective because of several features: ultra-fast order execution, deep liquidity, and advanced charting tools that enable traders to spot opportunities instantly. Scalpers rely heavily on these tools, along with technical indicators, to make quick decisions. Many traders also employ high-frequency trading bots to automate their strategies, as the process requires swift reaction times. The success of scalping relies on consistency and the ability to manage risks while making quick, well-timed trades.

Key Scalping Techniques on Bybit

Here are some key scalping techniques that traders can apply on the Bybit platform to maximize profits from small price movements within short time frames.

Order Book Scalping

By analyzing the order book, traders can identify potential price movements before they occur. Order book scalping involves spotting large buy or sell orders and placing trades in anticipation of price reactions.

For example, if a trader notices a significant buy order at $45,000 on the BTC/USDT perpetual contract, they may enter a long position, expecting the price to rise. Once the price reaches $45,100, they exit, securing a small profit.

Moving Average Scalping

Traders use short-term moving averages, such as the 5-period and 10-period EMAs, to identify price trends. A buy signal occurs when the shorter moving average crosses above the longer one, while a sell signal is triggered when the opposite happens.

For instance, if the 5-EMA crosses above the 10-EMA on Bybit’s ETH/USDT futures contract, a scalper may enter a long trade, aiming for a quick profit before exiting.

Bollinger Bands Scalping

Bollinger Bands help traders identify overbought and oversold conditions. The basic principle is:

- Price touching the lower band: A buying opportunity.

- Price touching the upper band: A potential selling opportunity.

On Bybit, a trader might buy BTC/USDT when the price dips to the lower band and sell when it reaches the middle or upper band, taking advantage of short-term price movements.

Swing Trading

Unlike scalping, which focuses on ultra-short-term price movements, swing trading is designed for traders looking to hold positions for several days or weeks. In this section, we will explore how swing traders on Bybit analyze market trends, set up trades, and manage risks.

What Is Swing Trading in Derivatives?

Swing trading in derivatives involves capturing price movements within a larger trend, typically over a few days or weeks. Traders using this strategy focus on identifying “swings” or shifts in market direction and entering positions to profit from those moves. Swing traders rely heavily on technical analysis, using indicators like moving averages, RSI, and support/resistance levels to determine the optimal entry and exit points.

Unlike scalping, which requires rapid trades, swing trading allows for more flexibility and less frequent transactions. Traders are looking for larger price movements, making it ideal for those who prefer to hold positions for a longer duration. Swing traders are often comfortable holding positions overnight or over several days to take advantage of trend developments.

This strategy works well in markets with clear, established trends, as it aims to capture price swings within those broader movements. Overall, swing trading requires patience and discipline, as traders must wait for the right setups and avoid being swayed by short-term fluctuations.

Key Swing Trading Strategies on Bybit

Trend Following Strategy

Swing traders often use moving averages or trendlines to determine the market direction. If BTC/USDT is in an uptrend, a trader may enter a long position on a pullback, riding the trend until it shows signs of reversal.

For example, if BTC is trading above its 50-day moving average, traders might buy on dips and hold the position until a trend reversal signal appears.

Support and Resistance Trading

This method involves buying at key support levels and selling at resistance levels. Traders analyze historical price data to determine where prices are likely to bounce or get rejected.

For instance, if ETH/USDT has consistently bounced off $3,500, a trader may enter a long trade near that level, setting a take-profit target at $3,800.

Fibonacci Retracement Strategy

Many swing traders use Fibonacci retracement levels to identify optimal entry and exit points. If a trader identifies a 61.8% retracement level on BTC/USDT, they might place a buy order there, anticipating a price reversal.

Hedging Strategies

Hedging is essential for traders who want to protect their portfolios from market downturns. This section will cover the different hedging techniques used on Bybit, allowing traders to safeguard their investments while still maintaining profit potential.

What Is Hedging in Derivatives Trading?

Hedging in derivatives trading is a risk management strategy used to protect investments from adverse market movements. It involves taking opposite positions in related assets, often through derivatives like futures, options, or swaps, to offset potential losses in the primary position. For example, if a trader holds a long position in an asset, they might open a short position in a related contract to reduce exposure to downward price movements.

This strategy is widely used by institutional investors, corporations, and experienced traders to mitigate risks, especially in volatile markets. Hedging can provide a safety net by ensuring that losses in one position are counterbalanced by gains in another, offering greater stability in uncertain market conditions. It allows traders to protect their portfolios without having to liquidate positions prematurely.

On platforms like Bybit, traders can hedge effectively using various derivative contracts, taking advantage of their flexibility and leverage. While hedging doesn’t eliminate risk, it can significantly reduce it, enabling traders to manage their exposure and maintain more predictable outcomes. It’s important to note, however, that hedging may limit potential profits as well, as the strategy is focused more on protection than speculation.

Key Hedging Strategies on Bybit

Here are some key hedging strategies that traders can implement on the Bybit platform to effectively manage risk and protect their positions in volatile market conditions.

Using Futures Contracts for Hedging

If a trader holds a large Bitcoin spot position, they can short BTC/USDT futures on Bybit to protect against potential price declines.

For example, if BTC is at $50,000, and the trader fears a correction, they can open a short futures position. If BTC drops to $45,000, their short trade profits, offset the losses in their spot holdings.

Options Trading for Risk Management

Options provide a flexible way to hedge against market uncertainty. A trader can use a put option to protect their portfolio from downside risk.

For instance, if an investor is bullish on ETH but worried about a price drop, they can buy a put option at $3,800, ensuring they can sell at that price even if ETH falls further.

Pair Trading Strategy

Pair trading involves going long on one asset while shorting another correlated asset. If BTC and ETH move together, a trader might long BTC and short ETH to hedge against market-wide movements.

Choosing the Right Derivatives Trading Strategy on Bybit

Bybit derivatives trading platform offers a variety of tools and instruments for traders, but success depends on choosing the right strategy based on market conditions and personal risk tolerance.

- Scalping is ideal for those who thrive in fast-paced environments and can handle quick decision-making.

- Swing trading suits traders who prefer analyzing market trends and holding positions for longer durations.

- Hedging is crucial for risk-averse traders who want to protect their portfolios from volatility.

By mastering these derivatives trading strategies on Bybit, traders can enhance profitability, reduce risks, and navigate the dynamic world of crypto derivatives with confidence.