In this article, we’ll dive deep into the world of Gemini Digital Asset Custody, exploring how it works, its standout features, and why it’s a top choice for both individual investors and institutions. We’ll also touch on related offerings like Nifty Gateway on Gemini and the broader scope of Crypto Custody Services on Gemini, providing a comprehensive look at how Gemini is shaping the future of digital asset storage. Whether you’re a seasoned trader or a newcomer to the crypto space, understanding these services can help you make informed decisions about protecting your investments.

The Growing Need for Secure Crypto Custody

Before delving into Gemini’s custody solutions, it’s worth understanding why secure storage is a cornerstone of cryptocurrency ownership. Unlike traditional assets held in banks or brokerage accounts, cryptocurrencies exist on decentralized blockchains, accessible only through private keys. If these keys are lost, stolen, or compromised, your funds can vanish irretrievably. High-profile hacks, such as the 2014 Mt. Gox incident, where over 850,000 BTC were stolen, underscore the vulnerabilities of keeping digital assets on exchanges or personal wallets without adequate protection.

For individual investors, the risks include phishing attacks, malware, and hardware wallet failures. For institutions like hedge funds, family offices, or corporations, the stakes are even higher, as they manage large volumes of crypto assets that require compliance with regulatory standards and protection against sophisticated cyberattacks. This is where professional custody services step in, offering a secure bridge between the decentralized nature of crypto and the safety demands of modern finance.

Gemini, founded in 2014 by Cameron and Tyler Winklevoss, recognized this need early on. With a mission to build trust in the crypto ecosystem, the exchange has positioned itself as a leader in security and compliance, making Gemini Digital Asset Custody a natural extension of its commitment to safeguarding user assets.

What Is Gemini Digital Asset Custody?

Gemini Digital Asset Custody is a specialized service designed to store and protect digital assets for both individual and institutional clients. Launched as part of Gemini’s broader suite of offerings, this custody solution leverages the exchange’s expertise in security and its adherence to strict regulatory frameworks. Unlike simply holding funds on the Gemini exchange for trading purposes, the custody service is a standalone product focused solely on long-term storage and asset protection.

At its core, Gemini Digital Asset Custody provides a cold storage solution, meaning the majority of assets are kept offline in air-gapped systems—devices physically isolated from the internet—to minimize the risk of hacking. This approach contrasts with hot wallets, which are connected online and more vulnerable to attacks. By combining cold storage with advanced encryption and multi-signature authentication, Gemini ensures that your assets remain secure even in the face of evolving threats.

The service caters to a wide range of clients, from individual investors looking to safely store their Bitcoin holdings to institutional players managing millions—or even billions—in digital assets. Gemini’s custody solution is also fully insured, offering an additional layer of reassurance that sets it apart from many competitors.

Key Features of Gemini Digital Asset Custody

What makes Gemini Digital Asset Custody stand out in a crowded market? Let’s break down its key features:

- Institutional-Grade Cold Storage: Gemini employs a sophisticated cold storage system that keeps the vast majority of assets offline. Private keys are stored in hardware security modules (HSMs), which are tamper-resistant devices designed to protect sensitive data. These HSMs are housed in secure, geographically distributed facilities, ensuring redundancy and resilience against physical or digital threats.

- Multi-Signature Security: Accessing funds in Gemini’s custody requires multiple signatures from authorized parties, a process known as multi-signature (multi-sig) authentication. This eliminates single points of failure, as no single individual or device can initiate a withdrawal, significantly reducing the risk of unauthorized access.

- Regulatory Compliance: Operating out of New York, Gemini is regulated by the New York State Department of Financial Services (NYSDFS), one of the strictest financial regulators in the U.S. The custody service complies with rigorous standards, including anti-money laundering (AML) and know-your-customer (KYC) requirements, making it a trusted option for institutions navigating complex legal landscapes.

- Insurance Coverage: Gemini Digital Asset Custody offers insurance for assets held in its cold storage system, protecting against theft or loss due to hacks, employee misconduct, or other unforeseen events. While the exact coverage limits depend on the client’s holdings, this insurance provides peace of mind—a feature not universally offered by all custody providers.

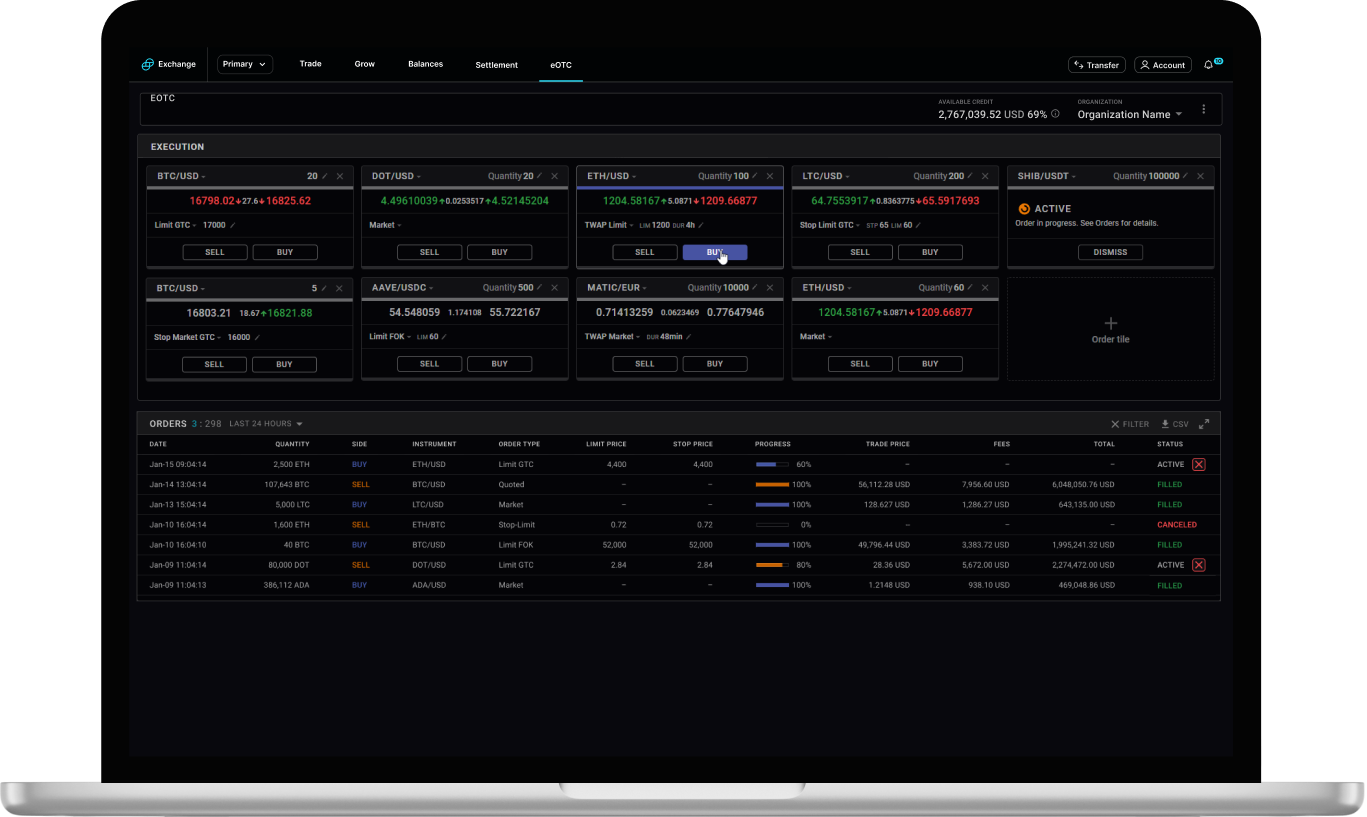

- Seamless Integration: For institutional clients, Gemini provides API access, allowing seamless integration with trading platforms or portfolio management systems. This ensures that assets can be securely stored while remaining accessible for strategic moves in the market.

- Support for a Wide Range of Assets: Beyond Bitcoin and Ethereum, Gemini’s custody service supports over 200 cryptocurrencies, including popular altcoins and stablecoins. This broad compatibility makes it a versatile option for diversified portfolios.

These features collectively position Gemini Digital Asset Custody as a premium solution, balancing security, accessibility, and compliance in a way that appeals to a diverse clientele.

Crypto Custody Services on Gemini: Beyond Basic Storage

While Gemini Digital Asset Custody is the flagship offering, the exchange’s broader suite of Crypto Custody Services on Gemini extends its capabilities to meet specialized needs. These services are tailored to institutional investors, such as hedge funds, asset managers, and corporations, who require more than just secure storage.

One notable aspect is Gemini’s sub-custody model, which allows institutions to manage client assets under their own branding while leveraging Gemini’s infrastructure. This is particularly valuable for financial advisors or firms that want to offer crypto custody without building their own systems from scratch. The service includes real-time reporting, audit trails, and customizable access controls, ensuring transparency and accountability.

Additionally, Gemini’s custody services integrate with its trading platform, enabling clients to move assets between custody and trading accounts efficiently. This flexibility is a boon for active traders who need to balance long-term storage with short-term market opportunities.

For institutions entering the crypto space, these custody services provide a turnkey solution that aligns with fiduciary responsibilities. By outsourcing storage to a regulated, insured provider like Gemini, firms can focus on their core business—whether that’s managing investments or advising clients—without worrying about the technical complexities of securing digital assets.

Nifty Gateway on Gemini: A Gateway to NFT Storage

Gemini’s custody offerings aren’t limited to traditional cryptocurrencies. Through its acquisition of Nifty Gateway in 2019, Gemini has expanded into the world of non-fungible tokens (NFTs), a booming sector of the digital asset market. Nifty Gateway on Gemini is a platform that allows users to buy, sell, and trade NFTs—unique digital collectibles ranging from art and music to virtual real estate.

What sets Nifty Gateway apart is its integration with Gemini’s custody infrastructure. When you purchase an NFT on Nifty Gateway, it’s stored securely in your Gemini account, benefiting from the same cold storage and multi-sig protections as other digital assets. This seamless connection ensures that your NFT collection is as safe as your Bitcoin or Ethereum holdings.

For collectors and creators, Nifty Gateway on Gemini offers a user-friendly interface and access to exclusive drops from top artists and brands. The platform also supports fiat payments via credit cards, lowering the barrier to entry for those new to NFTs. By tying NFT storage to its custody services, Gemini positions itself as a one-stop shop for all types of digital assets, from cryptocurrencies to tokenized art.

Why Choose Gemini for Digital Asset Storage?

With so many custody providers available, what makes Gemini a compelling choice? Several factors set it apart:

- Proven Track Record: Since its founding in 2014, Gemini has maintained a clean record with no major security breaches, a testament to its focus on safety. This stability is rare in an industry plagued by hacks and scandals.

- Regulatory Leadership: Gemini’s compliance with NYSDFS regulations and its proactive approach to licensing make it a trusted partner for institutions and individuals alike.

- Insurance Advantage: The inclusion of insurance coverage for custodial assets provides an extra layer of protection that many competitors lack.

- User-Centric Design: Whether you’re using Gemini Digital Asset Custody, exploring Crypto Custody Services on Gemini, or trading NFTs via Nifty Gateway, the platform prioritizes ease of use without compromising on security.

For institutional clients, Gemini’s custody solutions align with the growing trend of corporate adoption of cryptocurrency. Companies like Tesla and MicroStrategy, which hold significant Bitcoin reserves, highlight the need for reliable storage options. Gemini’s infrastructure is well-suited to meet these demands, offering scalability and peace of mind.

Comparing Gemini to Other Custody Providers

To fully appreciate Gemini’s offerings, it’s worth comparing it to other notable custody providers like Coinbase Custody, BitGo, and Anchorage Digital. While all four emphasize security, each has distinct strengths:

- Coinbase Custody: Backed by the popular Coinbase exchange, this service offers robust cold storage and insurance but is often seen as more trading-focused than Gemini’s standalone custody approach.

- BitGo: A pioneer in multi-sig wallets, BitGo provides flexible custody options and supports a wide range of assets. However, it lacks the same level of regulatory oversight as Gemini.

- Anchorage Digital: Targeting institutions, Anchorage offers a unique “active custody” model with on-chain governance features, but its higher fees may deter smaller clients.

Gemini strikes a balance between security, compliance, and affordability, making it a versatile choice for a broad audience. Its integration of NFT storage via Nifty Gateway also gives it an edge in the evolving digital asset landscape.

How to Get Started with Gemini Digital Asset Custody

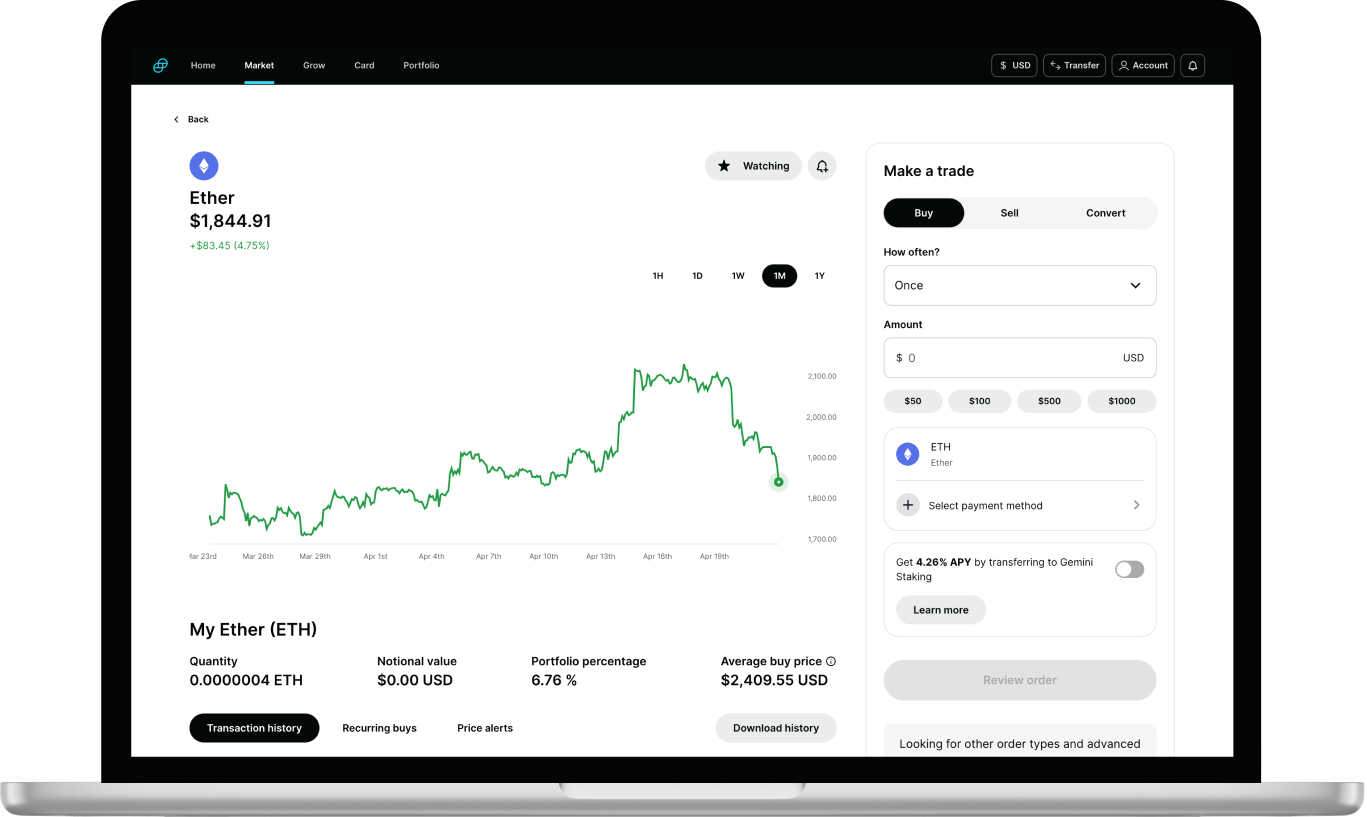

Ready to secure your crypto with Gemini? The process is straightforward:

- Create a Gemini Account: Sign up on the Gemini website and complete the necessary KYC verification.

- Deposit Assets: Transfer your cryptocurrencies to your Gemini wallet from an external wallet or exchange.

- Enable Custody: Contact Gemini’s support team or, for institutions, reach out to the sales team to activate custody services tailored to your needs.

- Manage Your Holdings: Use Gemini’s dashboard or API to monitor and manage your assets securely.

For NFT enthusiasts, simply log into Nifty Gateway with your Gemini credentials to start exploring and storing digital collectibles.

The Future of Digital Asset Custody

As the cryptocurrency market matures, the demand for secure custody solutions will only grow. Gemini is well-positioned to lead this charge, with ongoing innovations like enhanced NFT support and potential expansions into decentralized finance (DeFi) custody. The rise of central bank digital currencies (CBDCs) and tokenized securities could further elevate the role of trusted custodians like Gemini in bridging traditional and digital finance.

For now, Gemini Digital Asset Custody remains a gold standard, offering a blend of security, compliance, and versatility that’s hard to match. Whether you’re safeguarding a small Bitcoin stash or managing a multi-million-dollar portfolio, Gemini provides the tools to protect your digital wealth.

Take Control of Your Crypto Security Today

The world of cryptocurrency is full of opportunities, but it’s also rife with risks. Don’t leave your assets vulnerable to theft or loss—choose a custody solution that prioritizes safety and trust. Gemini Digital Asset Custody, with its cold storage, multi-sig security, and insurance coverage, offers a reliable way to protect your investments, while Nifty Gateway on Gemini and Crypto Custody Services on Gemini expand your options for managing diverse digital assets.

Ready to explore more about Gemini and other top crypto exchanges? Visit https://cryptoexlist.com/ for in-depth reviews, comparisons, and expert insights to guide your crypto journey. Secure your future in digital assets—start today!