When diving into the world of cryptocurrency, few platforms stand out like Kraken, a trusted name in digital asset trading. Whether you’re a newbie or a seasoned trader, understanding the terminology used on Kraken can make or break your experience. At CryptoExlist, we’re here to simplify the complex jargon of crypto trading, empowering you to navigate this bustling exchange with confidence. From “liquidity” to “margin trading,” this Kraken Cryptocurrency Terms guide unpacks essential terms to kickstart your journey on one of the most reputable crypto platforms out there.

What Makes Kraken a Go-To Crypto Exchange?

The cryptocurrency landscape is vast, but Kraken has carved out a stellar reputation since its launch in 2011. Known for its robust security, wide range of supported coins, and user-friendly interface, it’s a favorite among traders worldwide. However, to truly master this platform, you need to speak its language. Crypto terms can feel overwhelming at first—words like “order book,” “fiat,” and “staking” might sound foreign. Don’t worry; we’ve got you covered. This blog will break down the most critical terminology you’ll encounter on Kraken, ensuring you’re equipped to trade smarter. By understanding these concepts, you’ll unlock the full potential of this powerhouse exchange and elevate your crypto game.

Key Cryptocurrency Terms to Know on Kraken

To thrive on Kraken, you need a solid grasp of the foundational terms that define cryptocurrency trading. These aren’t just buzzwords—they’re the building blocks of every transaction you’ll make. Let’s dive into the essentials and see how they apply to your experience on this platform.

What Is a Blockchain and Why It Matters on Kraken?

At the heart of every cryptocurrency traded on Kraken lies the blockchain—a decentralized digital ledger that records all transactions. Think of it as an unchangeable history book for crypto. On Kraken, every deposit, withdrawal, or trade you make interacts with a blockchain, ensuring transparency and security. For example, when you buy Bitcoin, the transaction is verified by a network of computers and logged on the Bitcoin blockchain. Knowing this term helps you understand why Kraken emphasizes security and why withdrawals might take a few minutes to process.

Decoding Fiat and Crypto Pairs on Kraken

Next up is “fiat,” a term you’ll see often on Kraken. Fiat refers to government-issued currencies like USD, EUR, or GBP. On Kraken, you can trade fiat for cryptocurrencies or vice versa, such as swapping USD for Ethereum. Then there are “crypto pairs,” like BTC/ETH, where you trade one cryptocurrency for another. Understanding these pairs is crucial for spotting opportunities on Kraken’s market. For instance, if Bitcoin’s value spikes, you might trade ETH for BTC to capitalize on the trend. Mastering this lingo lets you navigate Kraken’s trading options with ease.

Liquidity: The Lifeblood of Kraken Trading

Liquidity is another key term you’ll encounter on Kraken. It measures how easily an asset can be bought or sold without affecting its price. High liquidity means tight spreads and fast trades—something Kraken prides itself on, especially for popular coins like Bitcoin and Ethereum. Low liquidity, on the other hand, can lead to price slippage, where your trade executes at a different price than expected. Knowing this helps you choose the best times to trade on Kraken and avoid costly surprises.

What Does Staking Mean on Kraken?

Staking is a buzzworthy feature on Kraken that lets you earn rewards by holding certain cryptocurrencies. Essentially, you lock up your coins to support a blockchain’s operations—like validating transactions—and get paid interest in return. On Kraken, coins like Polkadot (DOT) and Cardano (ADA) are stakeable, with clear guides on how to start. This term is vital because it offers a passive income stream, making Kraken more than just a trading platform—it’s a wealth-building tool too.

Advanced Trading Terms to Master on Kraken

Once you’ve mastered the basics, it’s time to take your skills to the next level with advanced trading terms that fully unlock Kraken’s powerful features. These key concepts are ideal for traders who want to sharpen their strategies, boost their decision-making, and increase their profits. Dive into this next layer of crypto vocabulary to enhance your trading game and stand out in the market. Let’s get started with these essential terms!

Order Book: Your Trading Blueprint on Kraken

The “order book” is a real-time list of buy and sell orders for a specific asset on Kraken. It shows the market’s depth—how much people are willing to buy or sell at different prices. For example, a thick order book for BTC/USD means high demand and liquidity, signaling a stable market. On Kraken, you can use this tool to gauge market sentiment and time your trades. It’s like a cheat sheet for predicting price movements, and understanding it gives you an edge over less-informed traders.

Margin Trading: Amplifying Gains (and Risks) on Kraken

Margin trading lets you borrow funds from Kraken to increase your buying power. Say you have $100 but borrow another $400 to buy $500 worth of Bitcoin. If Bitcoin rises 10%, you’ve made $50 instead of $10—a huge win. But beware: losses are magnified too. Kraken offers margin trading with clear terms, and knowing this concept helps you decide if it’s worth the risk. It’s a powerful tool for experienced traders, but it demands caution and strategy.

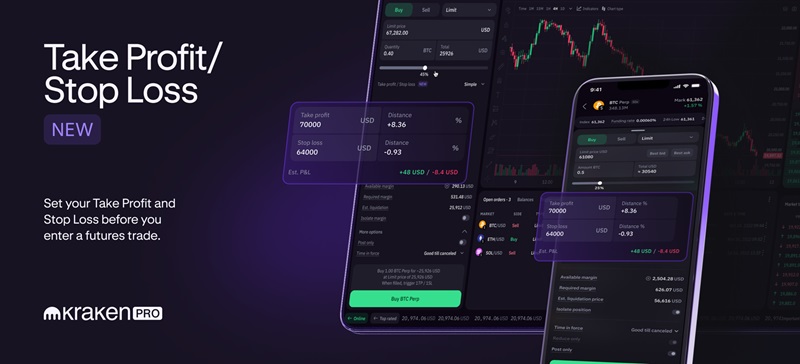

Stop-Loss and Take-Profit: Your Safety Nets on Kraken

These two terms are your best friends for managing risk on Kraken. A stop-loss order automatically sells your asset if its price drops to a set level, limiting your losses. Conversely, a take-profit order locks in gains by selling when the price hits your target. For instance, if you buy ETH at $2,000, you might set a stop-loss at $1,900 and a take-profit at $2,200. Kraken’s interface makes these easy to set up, giving you peace of mind while trading volatile markets.

Funding Rates: A Hidden Factor in Kraken Futures

If you dabble in Kraken’s futures trading, you’ll encounter “funding rates.” This is a periodic fee paid between traders to keep futures prices aligned with the spot market. A positive rate means long-position holders pay shorts, and vice versa. Understanding this term helps you calculate the true cost of holding a futures position on Kraken. It’s a small detail that can impact your bottom line, especially in long-term trades.

Why Understanding Kraken Cryptocurrency Terms Boosts Your Success

Knowledge is power, especially on a platform like Kraken. Each term you master—whether it’s “blockchain,” “staking,” or “margin trading”—brings you closer to trading like a pro. These aren’t just definitions; they’re tools to help you make informed decisions, minimize risks, and seize opportunities. Kraken offers a wealth of features, but without understanding its language, you’re navigating blind. This guide has laid out the essentials, from beginner basics to advanced strategies, so you can confidently explore everything the platform has to offer.

Tips for Learning Crypto Terms on Kraken

-

- Start small: Focus on one term at a time, like “fiat” or “liquidity,” and practice using it on Kraken.

-

- Use Kraken’s resources: The platform’s support pages explain many terms in detail.

-

- Join the community: CryptoExlist forums and Kraken’s social channels are goldmines for real-world insights.

-

- Simulate trades: Test your knowledge with Kraken’s demo mode before risking real money.

Conclusion: Take Control of Kraken with CryptoExlist

Mastering cryptocurrency terms isn’t just about sounding smart—it’s about taking control of your trading journey on Kraken. From grasping blockchain basics to leveraging advanced tools like margin trading and stop-loss orders, every piece of knowledge builds your confidence and skill. At CryptoExlist, we’re committed to helping you decode the crypto world, one term at a time. So, dive into Kraken, explore its features, and let these insights from CryptoExlist guide you to success in the ever-evolving universe of digital assets. Happy trading!