The cryptocurrency market is a whirlwind of volatility and opportunity, where anticipating price movements can mean the difference between profit and loss. For traders on the MEXC exchange, understanding the MEXC Price Trend is key to staying ahead. This blog dives into the art and science of predicting price trends on MEXC, exploring the tools, strategies, and factors that shape crypto prices.

What is MEXC Price Trend Analysis?

Price trend analysis is about forecasting where a cryptocurrency’s value is headed based on historical data, market dynamics, and external influences. On MEXC, the MEXC Price Trend reflects how assets—over 2,300 coins and 2,800+ trading pairs—move across spot and futures markets. It’s not just guesswork; it’s a blend of technical tools, fundamental insights, and sentiment tracking to spot patterns. For example, is Bitcoin (BTC) on MEXC gearing up for a bull run, or is an altcoin like MX token poised to dip? Predicting these shifts helps traders time their entries and exits with precision.

MEXC, launched in 2018, powers this process with a trading engine handling 1.4 million transactions per second and a global user base of 10 million. It’s real-time data and advanced charting make it a prime hub for decoding the MEXC Price Trend.

Why MEXC is Ideal for Price Trend Prediction

MEXC stands out as a powerhouse for traders chasing the MEXC Price Trend, thanks to its robust features and market depth. With zero spot trading fees and futures fees as low as 0.02% (maker) and 0.06% (taker), it’s cost-effective for testing predictions across short and long plays. The platform’s integration with TradingView charts offers pro-grade tools—think candlesticks, RSI, and MACD—to map trends in real time. Add in 200x leverage on futures, and you’ve got a playground to amplify your MEXC Price Trend calls, whether you’re betting on Solana’s next surge or Ethereum’s consolidation.

Beyond tools, MEXC’s sheer variety—spanning major coins to niche tokens—gives traders a broad canvas to spot trends. The MEXC Blog and Learn sections drop market updates and token insights, while staking and DeFi data hint at sentiment shifts. Operating in 170+ countries, MEXC mirrors global crypto pulses, making it a crystal ball for price trend hunters.

Factors Influencing MEXC Price Trends

Predicting the MEXC Price Trend means understanding what drives crypto prices on the platform. Here’s a breakdown of the forces at play:

- Market Sentiment: Hype on X or fear from a regulatory crackdown can swing prices fast—think BTC spiking after an ETF rumor.

- Trading Volume: High volume on MEXC, like $10M daily for AVAX, signals strong trends; low volume hints at stagnation.

- Tokenomics: MX’s buyback-and-burn cuts supply, nudging prices up, while unlimited coins risk dilution.

- Macro Events: Fed rate hikes or crypto bans ripple through MEXC’s markets, often tanking altcoins first.

- Tech Upgrades: A Solana network boost can juice its MEXC Price Trend, drawing in traders.

These factors don’t act alone—they collide, creating the waves you’ll ride or dodge on MEXC.

Tools for Analyzing MEXC Price Trends

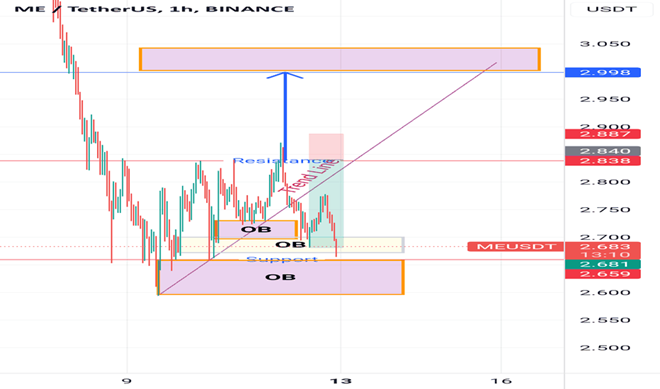

MEXC equips traders with a toolkit to decode the MEXC Price Trend. Here’s how its features break it down. Candlestick charts reveal price action—say, a bullish engulfing pattern on ETH/USDT hinting at a climb. Moving averages (MA5, MA10, MA30) smooth out noise; a BTC price crossing above MA30 on MEXC screams uptrend. RSI flags momentum—below 30 means oversold (buy?), above 70 means overbought (sell?). MACD tracks crossovers—a bullish signal on Chainlink’s MEXC chart could mean go time. Bollinger Bands show volatility; a tight squeeze on MX might predict a breakout. With TradingView baked in, you can layer these tools, tweaking timeframes from 1-minute scalps to 1-month holds, making MEXC a trend-spotter’s dream.

Step-by-Step Guide to Predicting MEXC Price Trends

Ready to forecast the MEXC Price Trend? Here’s a practical walkthrough using MEXC’s platform. Log into mexc.com and pick a pair—say, AVAX/USDT—from the “Markets” tab. Open the TradingView chart and set your timeframe—15M for quick trades, 1D for bigger moves. Spot patterns: a double bottom on AVAX might signal a bounce. Overlay indicators—RSI at 25 and a MACD crossover scream “buy” if volume’s spiking. Check MEXC’s order book—thin sell walls mean less resistance. Cross-reference X for sentiment; AVAX DeFi news could fuel the fire. Decide your play—spot for safety, futures for leverage—and set a price alert at $50. Monitor and tweak as the trend unfolds. This isn’t a crystal ball—it’s a calculated edge.

Strategies for Leveraging MEXC Price Trends

Predicting the MEXC Price Trend is half the game; riding it is the other. Trend-following works when BTC’s MEXC chart shows a steady MA climb—buy in and trail your stop. Breakout trading suits MX when it punches past resistance—catch it early with a limit order. Reversal plays shine with oversold RSI—like Solana dipping hard on MEXC, ripe for a snapback. Scalping fits volatile days; a 1% AVAX swing on 200x leverage nets big if you’re quick. Long-term hodling leans on fundamentals—MX’s burn cycles could mean a slow grind up. Each strategy hinges on MEXC’s low fees and fast execution, turning predictions into profits.

Challenges in Predicting MEXC Price Trends

Even with MEXC’s tools, nailing the MEXC Price Trend isn’t foolproof. Crypto’s chaos—think sudden 20% BTC drops—can shred your charts. Whale moves on MEXC, like a $50M sell-off, distort patterns in seconds. Fakeouts plague breakouts; AVAX might tease $60 then crater. External shocks—China’s latest ban or Elon’s tweets—hit MEXC’s altcoins hard and fast. Over-reliance on one indicator, like RSI, blinds you to the bigger picture. The trick? Blend tools, stay nimble, and don’t bet the farm—volatility’s a beast.

Combining MEXC Price Trend with Fundamental Analysis

The MEXC Price Trend gets sharper when paired with fundamentals. A coin like MX might show a bullish MACD on MEXC, but its burn program and staking APY (5%) add conviction—supply shrinks, demand holds. AVAX’s 4,500 TPS and DeFi tie-ins justify a breakout if the chart aligns. Chainlink’s Oracle deals plus steady volume on MEXC scream longevity over a quick pump. Macro trends matter too—rate cuts could lift BTC’s trend, while a bearish Fed tanks it. This combo turns MEXC into a dual-lens scope, blending short-term signals with long-term bets.

Real-World Examples of MEXC Price Trends

Let’s ground this in reality with MEXC Price Trend cases. In mid-2024, MX token on MEXC jumped 15% after a burn announcement—volume spiked, RSI hit 75, and MA10 crossed MA30, classic trend signals. AVAX saw a 25% rally post-DeFi integration; candlesticks formed a bull flag, and $15M daily volume on MEXC backed the move. BTC’s trend flipped bearish in late 2024—MACD diverged, volume thinned, and a Fed hike rumor on X tanked it 8%. These aren’t flukes; they’re MEXC Price Trend predictions playing out, blending tools and timing.

Tips for Mastering MEXC Price Trend Predictions

Honing your MEXC Price Trend game takes savvy habits:

- Watch X for sentiment—Solana’s NFT hype can tip you off.

- Use MEXC’s alerts—set $60 for AVAX to catch the break.

- Test trends on MEXC’s futures demo—no-risk practice.

- Blend timeframes—1H RSI with 1D MA catches the full picture.

- Track volume spikes—$20M on MX means something’s brewing.

These moves sharpen your trend-chasing edge on MEXC.

Conclusion

The MEXC Price Trend is your compass in crypto’s stormy seas, guiding you through volatility with data and grit. MEXC’s toolkit—TradingView charts, low fees, and 2,800+ pairs—makes it a trader’s paradise for spotting and riding trends. From AVAX breakouts to MX burns, blending technicals, fundamentals, and savvy timing turns predictions into paydays. Jump into MEXC, decode the trends, and seize the market—because in crypto, those who see the wave coming surf it best.