What Is MEXC Risk Control and Why Does It Matter?

Risk management is the backbone of any reputable crypto exchange, and MEXC takes it seriously with its MEXC risk control framework.

Understanding MEXC Risk Control Basics

MEXC risk control refers to the platform’s policies, tools, and mechanisms aimed at minimizing financial and operational risks for users. Launched in 2018 and based in Seychelles, MEXC serves over 10 million users globally, offering spot trading, futures with up to 400x leverage, and P2P services. Its risk control system monitors trades, secures funds, and enforces compliance to shield users from losses due to fraud, market volatility, or technical glitches. This guide dives deep into how it works and why it’s critical for your MEXC trading.

Why Risk Management Matters on MEXC

Crypto markets never sleep, and prices can swing wildly—think Bitcoin dropping 10% overnight. Without proper safeguards, you’re exposed to MEXC risk like liquidation or account freezes. MEXC’s risk control steps in to manage these threats, ensuring your assets stay safe even when the unexpected hits. Whether you’re a beginner or a pro, grasping this system helps you trade smarter.

How Does MEXC Risk Control Protect Your Account?

Let’s explore the specific ways MEXC risk control keeps your funds and activities secure.

Security Features Built Into MEXC Risk Control

MEXC employs a multi-layered approach to risk management:

- Two-Factor Authentication (2FA): Adds a second verification step via Google Authenticator for logins and withdrawals.

- Cold Storage: Keeps most user funds offline, away from hackers.

- SSL Encryption: Secures all data transfers on the platform.

- Anti-Phishing Codes: Lets you set a unique code to verify legit MEXC emails.

These features form a risk management list that reduces MEXC risk, giving you peace of mind.

Monitoring and Managing Abnormal Activity

MEXC’s risk control system actively scans for unusual behavior—like rapid, high-volume trades or logins from new devices. If flagged, it might trigger temporary restrictions or a control withdrawal process, requiring extra verification. While this can delay access, it’s a safeguard against unauthorized actions, ensuring your account stays protected.

How Does MEXC Handle Control Withdrawal Processes?

Withdrawals are a hotspot for risk, so MEXC risk control has strict measures in place.

What Is Control Withdrawal on MEXC?

Control withdrawal refers to MEXC’s process of pausing or reviewing withdrawal requests when the system detects potential MEXC risk. This might happen if you’re moving a large amount, using a new address, or if your account shows odd activity. The goal? To prevent fraud or errors—like sending funds to a scam address—that could cost you everything.

Steps to Manage a Controlled Withdrawal

If your withdrawal gets flagged:

- Check Your Email: MEXC will notify you of the hold and request info (e.g., KYC or a video).

- Submit Details: Provide what’s asked—ID, proof of address, or a selfie—to verify it’s you.

- Wait for Review: Processing can take 10-30 days, depending on the case.

This control withdrawal step might feel slow, but it’s part of the risk management list to ensure your funds don’t vanish. Pro tip: Use the withdrawal whitelist (set under “Security”) to pre-approve addresses and speed things up.

How Can You Use MEXC Risk Control for Safer Trading?

You’re not just a passenger—MEXC gives you tools to leverage MEXC risk control actively.

Exploring the Risk Management List for Traders

Here’s a practical risk management list you can follow:

- Set Leverage Limits: In futures, cap leverage at 5x-10x instead of 400x to lower liquidation risk.

- Enable 2FA: Turn it on for every login and withdrawal—it’s your first line of defense.

- Use Stop-Loss Orders: Protect your trades from sudden drops by setting automatic sell points.

- Monitor Margin: Keep extra funds in your futures wallet to avoid forced closures.

These steps minimize MEXC risk and align with the platform’s control systems.

Practicing with MEXC Demo Trading

Unsure about leverage or order types? MEXC’s demo trading mode lets you test strategies with 50,000 virtual USDT. Go to “Futures” > “Demo Trading,” claim your funds, and practice risk-free. It’s a hands-on way to see how MEXC risk control handles volatile scenarios without real stakes.

What Are the Risks You Should Watch Out For on MEXC?

Even with MEXC risk control, some dangers linger—knowing them keeps you ahead.

Common MEXC Risk Scenarios

MEXC’s risk notice highlights key threats:

- Market Volatility: Crypto prices can crash fast, wiping out leveraged positions.

- Technical Glitches: Rare, but possible—system bugs might delay trades or withdrawals.

- User Error: Sending funds to the wrong address or network? They’re gone for good.

These fall under MEXC risk, and while the platform mitigatates some, you’re still responsible for your moves.

How MEXC Risk Control Addresses These Issues

The platform counters with real-time monitoring and user safeguards. For example, if you’re over-leveraged in futures, MEXC risk control might force a margin call or liquidate your position to limit losses. It’s not foolproof—market crashes can outpace controls—but it’s a buffer against total ruin.

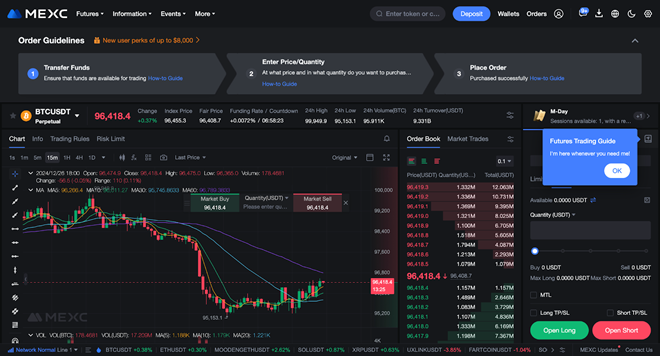

How Does MEXC Risk Control Handle Futures Trading?

Futures trading on MEXC turns up the heat with higher stakes, and MEXC risk control steps up to manage the intensity. Unlike spot trading, futures involve predicting price movements with borrowed funds, making risk management crucial. Whether you’re chasing big gains or hedging your portfolio, MEXC risk control adjusts its tools and systems to keep your trades in check, protecting you from the wild swings that futures can bring.

Managing Leverage with MEXC Risk Control

MEXC offers leverage up to 400x on futures, which means massive potential rewards but equally massive MEXC risk. With just $100, you could control a $40,000 position—an enticing prospect that demands careful handling. The MEXC risk control system tracks your margin level in real time, giving you a live view of how close you are to trouble. If your funds start running thin, it sends warnings to alert you of nearing liquidation. Should the market move too fast against you, it auto-closes positions when funds drop below the safety threshold. Want to ease in? Start with lower leverage like 10x and use demo mode to see how MEXC risk control responds to price drops or spikes—practice makes perfect here.

Avoiding Liquidation Pitfalls

Liquidation is the nightmare of futures trading—it strikes when your margin can’t cover losses, a risk that skyrockets with high leverage. To steer clear, keep extra funds in your futures wallet as a buffer against sudden dips. Setting conservative stop-losses is another smart move; they automatically sell your position before losses spiral out of hand. Watching market trends closely also helps you stay ahead of volatility. While MEXC risk control enforces limits to cap how far you can fall, it’s not a full safety net—proactive steps are your strongest defense against liquidation wiping you out.

Conclusion

Mastering risk management on MEXC means understanding MEXC risk control inside and out. This guide has walked you through its layers—from securing your account with 2FA and cold storage to navigating control withdrawal delays and futures leverage risks. MEXC’s low fees, vast trading options, and real-time safeguards make it a standout exchange, but MEXC risk like volatility and user errors still lurk. By using the risk management list—think stop-losses, demo practice, and whitelist settings—you can trade smarter and safer. Whether you’re scalping altcoins or holding long-term, MEXC risk control is your partner in keeping losses at bay. Dive in today: fund your account, test the demo, and see how far smart risk management can take your MEXC trading!