Spot trading is one of the most popular trading methods in the cryptocurrency market. It allows traders to buy and sell digital assets in real-time without using leverage. As Bybit continues to expand its spot trading offerings, more traders are looking for effective strategies to maximize their profits.

In this guide, we will explore the best spot trading strategies on Bybit in 2025. This includes detailed insights into day trading, swing trading, and essential risk management techniques. Whether you are a beginner or an experienced trader, understanding these strategies can significantly improve your chances of success.

Day Trading Strategies for Spot Market

Day trading is a short-term trading strategy where traders open and close positions within the same trading day. It requires a deep understanding of technical analysis, market trends and quick decision-making skills. Bybit spot trading provides a range of advanced tools, including real-time order books, multiple charting indicators, and high liquidity, making it an excellent platform for day traders.

Scalping Strategy

Scalping is one of the most aggressive and fast-paced trading strategies, where traders make multiple small trades throughout the day to profit from tiny price movements.

For example, a trader buys Bitcoin at $42,000 and sells it at $42,050, making a quick $50 profit per Bitcoin. This process is repeated multiple times within a day, leveraging minor price fluctuations.

Key indicators for scalping include moving averages, the relative strength index (RSI), and Bollinger Bands. However, high-frequency trading requires discipline and a reliable trading platform with low fees, making Bybit a preferred choice.

Momentum Trading

Momentum trading focuses on assets with strong trends in a specific direction. Traders enter positions when a cryptocurrency shows increased trading volume and price movement, indicating a strong trend.

For instance, if Ethereum (ETH) breaks above $3,000 with strong volume, it signals bullish momentum. A trader enters a long position, aiming to ride the trend until the momentum slows.

Key indicators for this strategy include MACD (Moving Average Convergence Divergence) and volume oscillators. However, traders must be cautious of false breakouts, which can lead to unexpected losses.

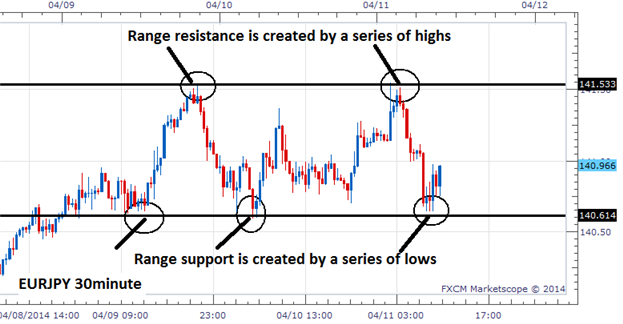

Range Trading

Range trading is effective in sideways markets where the price fluctuates within a defined range. Traders buy at support levels and sell at resistance levels to capture consistent profits.

For example, if Bitcoin is trading between $41,500 and $42,500, a trader buys at $41,500 and sells at $42,500, repeating this process as long as the price remains within the range.

The best indicators for range trading include support and resistance levels, Bollinger Bands, and the stochastic oscillator. However, traders must be aware of potential breakouts that could disrupt the established range.

Best Practices for Day Trading on Bybit

Successful day trading requires proper risk management, disciplined execution, and the ability to react quickly to market movements. Bybit’s trading tools, including stop-loss orders and automated bots, help traders execute precise trades. To avoid emotional trading, traders should set clear entry and exit points and stick to their strategies without deviation.

Swing Trading Techniques

Swing trading is a medium-term strategy that involves holding positions for several days or weeks to capitalize on larger price movements. Unlike day trading, swing traders rely on both technical and fundamental analysis to predict price trends.

Trend Following Strategy: Riding Market Momentum

The trend-following strategy is one of the most commonly used approaches in swing trading. It involves identifying a strong ongoing trend and entering a trade in the same direction to maximize profits.

For example, Bitcoin has been in a steady uptrend from $38,000 to $45,000 over two weeks, forming higher highs and higher lows. A swing trader spots this trend and buys Bitcoin at $40,000, setting a price target of $47,000 while placing a stop-loss at $39,000 to protect against potential trend reversals.

Key Indicators for Trend Following:

- Moving Averages – The 50-day and 200-day moving averages help confirm a strong trend. If the 50-day MA crosses above the 200-day MA, it signals a bullish trend. Conversely, if the 50-day MA moves below the 200-day MA, it indicates a bearish trend.

- Trendlines – Drawing trendlines on a price chart helps traders visualize the overall direction of the market.

- Average Directional Index (ADX) – ADX values above 25 indicate a strong trend, while values below 20 suggest a weak or sideways market.

Potential Risks of Trend Following:

- Trend Reversals: Trends do not last forever. If a trend suddenly reverses, traders could face significant losses.

- Fake Signals: A sudden price spike may look like a trend but could be a false breakout. Using multiple indicators helps filter out misleading signals.

Fibonacci Retracement Strategy: Predicting Market Corrections

Fibonacci retracement is a powerful tool used to identify potential levels of support and resistance after a significant price movement. It is based on key Fibonacci levels, such as 23.6%, 38.2%, 50%, and 61.8%, which help traders predict where the price may retrace before continuing its original trend.

Example of Fibonacci Retracement in 2025:

Ethereum (ETH) rallies from $2,500 to $3,200. After reaching $3,200, the price starts pulling back, and a trader uses the Fibonacci retracement tool to identify possible entry points. The 50% retracement level ($2,850) aligns with a previous support zone, suggesting a strong buying opportunity.

The trader enters a long position at $2,850 with a take-profit target of $3,500 and a stop-loss at $2,750 to protect against further declines.

Best Practices for Using Fibonacci Retracement:

- Combine Fibonacci Levels with Other Indicators – The best Fibonacci retracement trades align with RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and volume analysis to confirm entry points.

- Look for Confluence Zones – If multiple indicators (such as trendlines and moving averages) align with a Fibonacci level, it strengthens the probability of a successful trade.

- Avoid Over-Reliance on Fibonacci – The retracement tool is a guide, not a guarantee. Always use stop-loss orders to manage risk.

Risks of Fibonacci Trading:

- Incorrect Retracement Levels: Misidentifying retracement levels can lead to premature entries and losses.

- Market Volatility: During highly volatile periods, price movements may breach Fibonacci levels before reversing.

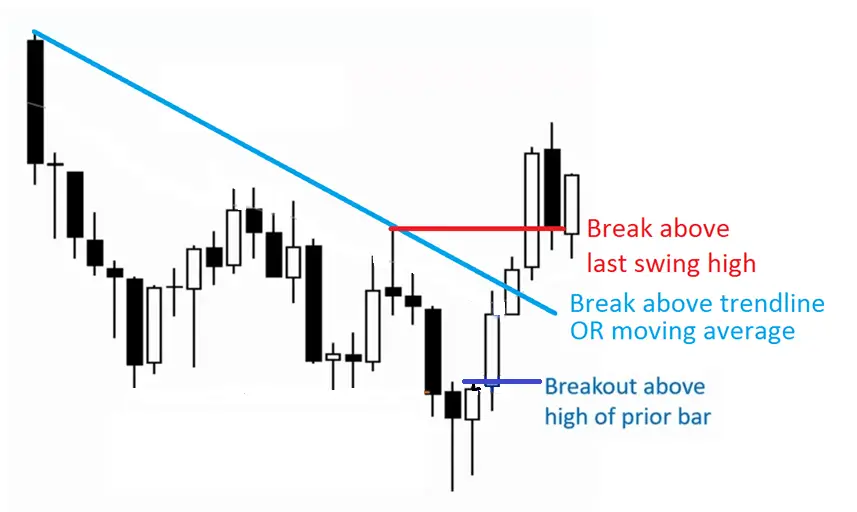

Breakout Trading Strategy: Capturing Explosive Moves

Breakout trading is one of the most profitable spot trading strategies in swing trading. It involves entering a trade when the price breaks through a key resistance or support level with high volume, signaling a strong movement in the breakout direction.

Example of Breakout Trading in 2025:

Solana (SOL) has been consolidating between $85 and $90 for two weeks. Traders closely monitor the resistance level at $90. Suddenly, a surge in buying volume pushes SOL above $90 to $92, confirming a breakout. A trader enters a long position at $92, setting a take-profit target at $105 and a stop-loss at $87 to minimize risk.

Key Indicators for Breakout Trading:

- Volume Spike – A breakout is more reliable when accompanied by increased trading volume.

Bollinger Bands – When Bollinger Bands tighten, it indicates low volatility, often preceding a breakout. - MACD (Moving Average Convergence Divergence) – A MACD crossover can confirm a strong breakout signal.

Avoiding False Breakouts:

- Wait for Confirmation: Many traders enter trades too early. Waiting for a retest of the breakout level before entering reduces false breakout risks.

- Use Stop-Loss Orders: Setting a stop-loss just below the breakout level prevents large losses if the breakout fails.

- Check Market Sentiment: If overall market conditions are bearish, breakouts may fail more frequently.

Risk Management in Bybit Spot Trading

Risk management is a fundamental aspect of spot trading strategies on Bybit that helps traders protect their capital and minimize potential losses. Even the most experienced traders face losing trades, but effective risk management ensures long-term profitability.

Position Sizing

Proper position sizing is essential for managing risk. Traders should never risk more than 1-2% of their portfolio on a single trade.

For example, if a trader has $10,000 in their Bybit account, they should risk no more than $200 per trade to avoid significant losses.

Stop-Loss and Take-Profit Orders

Setting stop-loss and take-profit levels helps traders lock in profits and limit losses.

For instance, if a trader buys Bitcoin at $40,000, they might set a stop-loss at $38,500 (a 3.75% loss) and a take-profit at $42,000 (a 5% gain). This approach ensures that they exit the trade at predefined levels, reducing emotional decision-making.

Diversification

Diversification reduces risk by spreading capital across multiple assets instead of focusing on a single cryptocurrency.

For example, rather than investing $10,000 entirely in Bitcoin, a trader allocates $4,000 to Bitcoin, $3,000 to Ethereum, and $3,000 to Solana. This approach minimizes exposure to a single asset’s volatility.

Managing Emotional Trading

Emotional trading is one of the most common reasons traders lose money. To avoid making impulsive decisions, traders should stick to a well-defined trading plan.

Common mistakes include fear of missing out (FOMO), overtrading, and revenge trading. Maintaining a disciplined approach and using Bybit’s automated trading features can help traders execute their strategies without being influenced by emotions.

Conclusion

Bybit spot trading offers numerous opportunities for traders to profit from cryptocurrency price movements. By implementing effective strategies such as day trading, swing trading, and risk management, traders can improve their success rate and minimize losses.

Bybit’s advanced trading tools, high liquidity, and low fees make it one of the best platforms for spot trading in 2025. Whether you are a beginner or an experienced trader, having a solid trading plan and managing risks effectively will be the key to long-term profitability.

For those looking to enhance their trading performance, continuously learning, refining spot trading strategies on Bybit, and staying informed about market trends will be essential in achieving success.