BitMart is one of the most popular cryptocurrency exchanges worldwide, offering various tools and services to help investors optimize their trading strategies. However, to trade effectively, you need to understand the different order types on BitMart that supports and how to use them correctly.

This article provides a detailed explanation of each order types on BitMart, how they work, their advantages and disadvantages, and step-by-step instructions on how to place orders.

Overview of BitMart Exchange

Before diving into the different order types on BitMart, it is essential to understand what BitMart is and why it is trusted by many investors.

What is BitMart?

BitMart is a leading cryptocurrency exchange that provides a secure and diverse trading platform for investors worldwide. Founded in 2017 by Sheldon Xia, BitMart is headquartered in the Cayman Islands and has representative offices in several countries, including the United States, Hong Kong, and China.

The exchange allows trading of various digital assets, from popular coins such as Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB) to DeFi tokens, NFTs, and other potential digital assets. With over 1,000 trading pairs, BitMart offers rich investment opportunities for traders of all levels.

Why Should You Understand Different Order Types on BitMart?

Many new investors only use Market or Limit orders without knowing that other order types can help them optimize their trading strategies. Understanding different order types allows you to:

- Buy or sell coins at your desired price without excessive slippage.

- Reduce risks during strong market fluctuations by using stop-loss or take-profit orders.

- Increase trading efficiency, enabling you to execute long-term or short-term strategies effectively.

- Minimize trading costs by choosing the appropriate order type.

Types of Orders on BitMart Exchange

To trade effectively on BitMart, you need to know which order types on BitMart the exchange supports and when to use them. Below is a detailed breakdown of each order type, including how to use them.

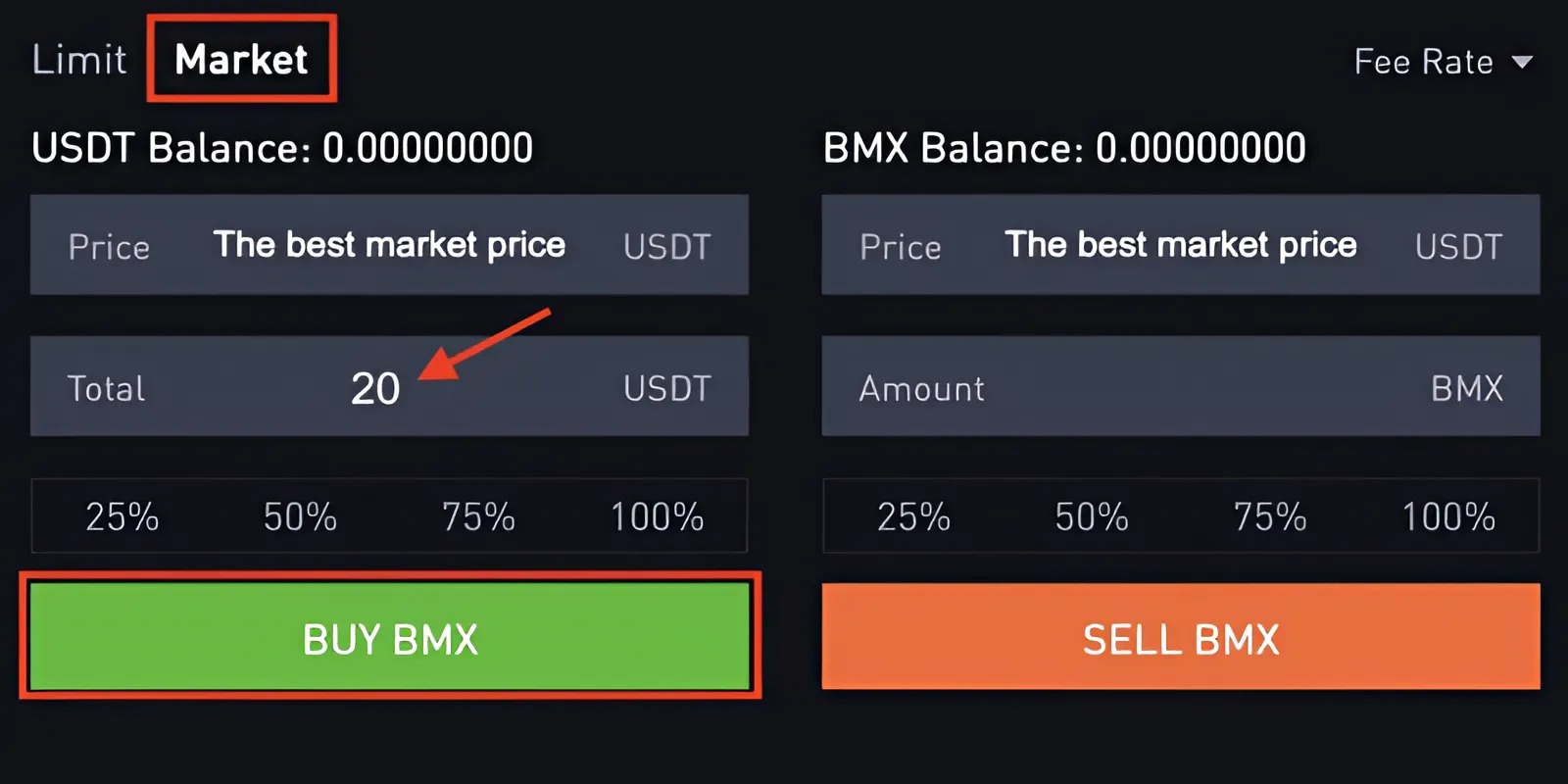

Market Order – The Fastest Execution Order

If you want to buy or sell coins immediately without worrying about the price, a market order is the right choice.

Definition of Market Order

A market order allows you to buy or sell assets immediately at the best available price on the exchange. When placing this order, you do not need to enter a desired price; instead, the system will automatically match your order with the current market price.

How Market Order Works

This order is executed based on the order book as follows:

- Buy (Market Buy): The system matches your order with the lowest sell price available in the order book.

- Sell (Market Sell): The system matches your order with the highest buy price available in the order book.

Advantages of Market Order

- Instant execution – No need to wait for price matching like a limit order.

- Suitable for volatile markets – Helps you enter or exit trades quickly.

- Easy to use – Ideal for beginners or urgent transactions.

Disadvantages of Market Order

- Slippage – If the market has low liquidity or is highly volatile, the executed price may be significantly different from your expected price.

- Higher trading fees – Market orders make you a “Taker,” which usually incurs higher fees than “Maker” orders.

- No price control – You cannot specify the price at which you want to buy or sell.

When to Use Market Orders?

- When you need to enter or exit a trade immediately.

- When the market is highly volatile, and you do not want to miss an opportunity.

- When the trading volume is high, reducing the risk of slippage.

- When you need to exit a position urgently to avoid heavy losses.

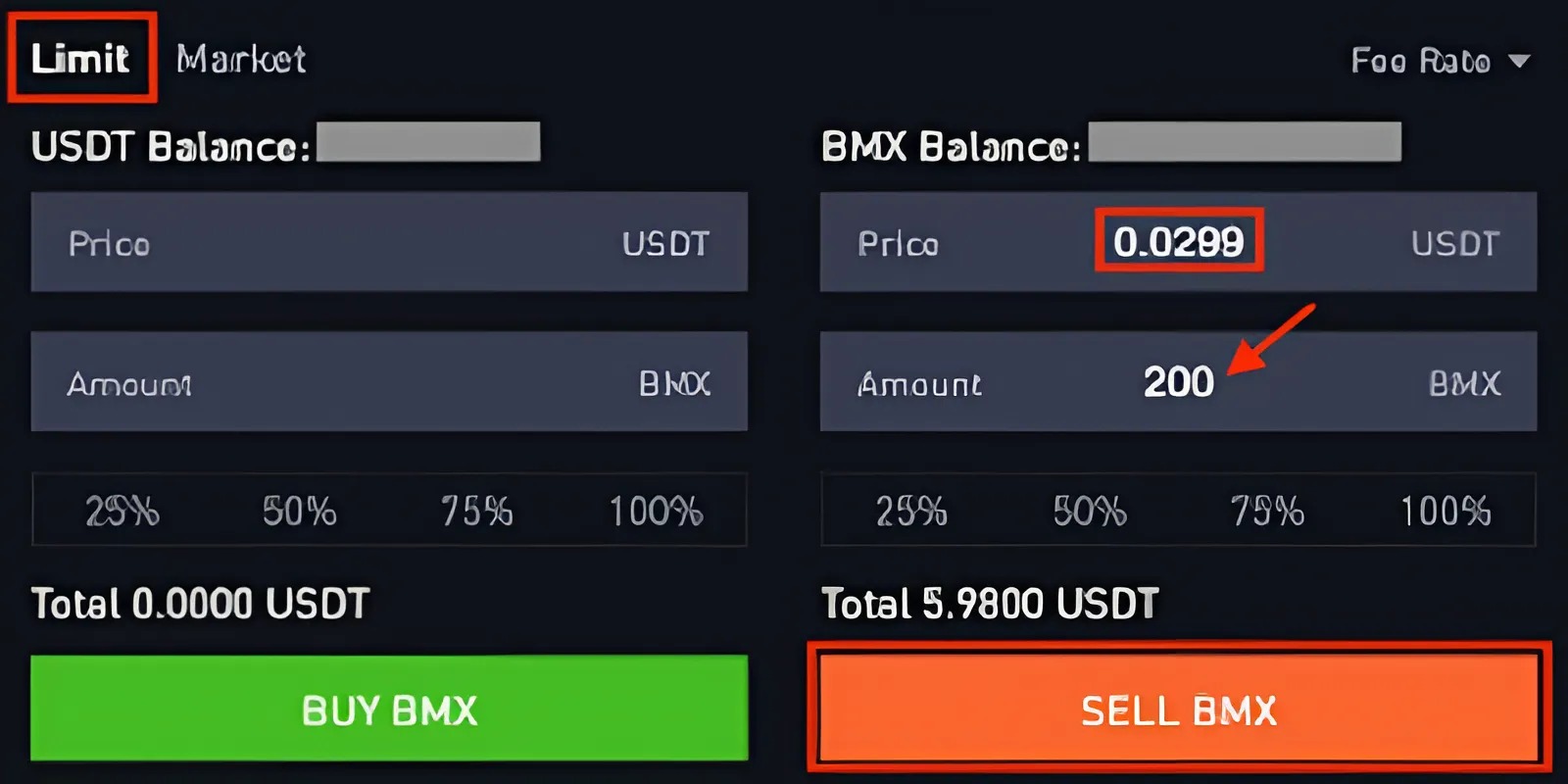

Limit Order – Better Price Control

If you do not want to buy at the current market price and prefer to wait for a better price, a limit order is the best option.

Definition of Limit Order

A limit order allows you to set a specific buy or sell price instead of executing at the current market price. The order will only be executed when the market price reaches your desired level. If the price does not reach your specified level, the order remains open in the order book until it is executed or canceled.

How Limit Order Works

When you place a limit order, it appears in the order book and waits for the market price to reach your specified price.

- Buy (Limit Buy): The order will be executed only if the market price drops to or below your specified price.

- Sell (Limit Sell): The order will be executed only if the market price rises to or above your specified price.

Advantages of Limit Order

- Better price control – You buy/sell at your desired price, avoiding slippage.

- Lower trading fees – Limit orders make you a “Maker,” which often incurs lower fees than market orders.

- Useful for long-term strategies – You can set an order and wait without constantly monitoring the market.

Disadvantages of Limit Order

- No guaranteed execution – If the price does not reach your level, your order may not be filled, and you may miss trading opportunities.

- Waiting time – If the market does not move as expected, you may need to wait longer or adjust your order.

When to Use Limit Orders?

- When you want to buy at a lower price or sell at a higher price than the market.

- When you have time to wait for the price to match and do not need an immediate transaction.

- When the market is less volatile, allowing you to set a price without experiencing significant slippage.

- When you want to save trading fees by being a “Maker.”

Stop-Limit Order – Better Risk Control

This order helps you manage risk by setting a trigger price before the order is executed.

Definition of Stop-Limit Order

A stop-limit order consists of two components:

- Stop Price: When the market price reaches this level, a limit order is triggered.

- Limit Price: The price at which you want to buy or sell after the stop order is activated.

How Stop-Limit Order Works

- Buy (Stop-Limit Buy): When the market price reaches the stop price, a limit buy order is placed.

- Sell (Stop-Limit Sell): When the market price reaches the stop price, a limit sell order is placed.

Advantages of Stop-Limit Order

- Better risk control – Helps you automate stop-loss or buy orders without monitoring the market continuously.

- Avoid buying at high or selling at low prices – You can set a limit price to prevent unfavorable execution.

Disadvantages of Stop-Limit Order

- No guaranteed execution – If the market moves too fast, the limit order may not be filled.

- Not suitable for low-liquidity markets – If there are no buyers or sellers at the limit price, the order may be missed.

When to Use Stop-Limit Orders?

- When you want to set automatic stop-loss to prevent significant losses.

- When you want to buy following an uptrend but do not want to buy immediately.

- When you cannot monitor the market continuously and want to set protective orders.

Take-Profit-Limit Order – Maximize Your Profits

Have you made a profit and want to sell when the price reaches your desired level? Use the Take-Profit-Limit order.

Definition of Take-Profit-Limit Order

A Take-Profit-Limit order is a combination of two prices:

- Take-Profit Price: When the market price reaches this level, a Limit Order will be triggered.

- Limit Price: The lowest price you are willing to sell at, preventing execution at an unfavorable price.

How the Take-Profit-Limit Order Works

- Take-Profit-Limit Buy: When the market price reaches the Take-Profit level, a Limit Buy Order is placed.

- Take-Profit-Limit Sell: When the market price reaches the Take-Profit level, a Limit Sell Order is placed.

Advantages of Take-Profit-Limit Order

- Planned Profit Taking – Helps you sell at your desired price without monitoring the market constantly.

- Prevents Selling Too Cheap – You have control over the minimum selling price instead of selling at the market price.

- Reduces Risk from Price Fluctuations – Useful for long-term trading strategies.

Disadvantages of Take-Profit-Limit Order

- No Guaranteed Execution – If the market price drops too quickly, the Limit Order may not be executed.

- Not Suitable for Low Liquidity Markets – If there are no buyers at the Limit Price, the order might remain unfulfilled.

- Works Best in Moderate Volatility – If the price moves too fast, the order may not be executed in time.

When to Use a Take-Profit-Limit Order?

- When you want to take profit automatically without tracking the market.

- When the market is likely to correct after a price increase.

- When you want to ensure a reasonable selling price instead of executing a Market Order.

- When following a long-term trading strategy and setting up orders in advance to secure profits.

How to Place an Order on BitMart

After understanding the order types on BitMart, you need to know how to place them for effective trading.

Step 1: Access and Log in to Your BitMart Account

- Log in to your BitMart account via the website or mobile app.

Step 2: Select Trading Mode

- Navigate to Spot Trading or Futures Trading.

- Search for the trading pair you want to trade (e.g., BTC/USDT).

Step 3: Choose Order Type and Place the Order

- Select the desired order type (Market, Limit, Stop-Limit, Take-Profit, etc.).

- Enter the necessary details:

- Price (for Limit Orders)

- Stop Price (for Stop-Limit Orders)

- Amount of the coin to trade

Step 4: Confirm the Order

- Click Buy or Sell to complete the transaction.

Conclusion

Understanding different order types on BitMart gives you greater control over your trades, helping you minimize risk and maximize profits. Whether you prefer instant execution with Market Orders, price precision with Limit Orders, or automated strategies with Stop-Limit and Take-Profit-Limit Orders, choosing the right tool can make a significant difference. Mastering these order types on BitMart allows you to navigate the market with confidence and optimize your trading experience.