In the dynamic world of cryptocurrency and blockchain technology, Polychain Capital stands out as a prominent investment firm. Founded in 2016 by Olaf Carlson-Wee, one of Coinbase’s earliest employees, Polychain has grown into a multi-billion dollar enterprise. This article delves into Polychain’s history, investment philosophy, and notable portfolio companies.

What is Polychain Capital

Understanding what Polychain Capital embodies is essential for grasping its significance in today’s financial world. Founded in 2016, this innovative investment vehicle was established with a vision to capitalize on the burgeoning potential of blockchain technology and cryptocurrencies.

From its inception, Polychain Capital set out to differentiate itself through a rigorous investment strategy, focusing on long-term growth rather than short-term speculation. The firm’s commitment to transparency and data-driven methodologies has appealed to investors seeking stability in the often volatile crypto market.

Their approach to investing extends beyond mere asset acquisition; they actively engage with projects, ensuring that they align with their high standards of development and operational integrity. This emphasis on collaboration empowers projects to thrive while simultaneously driving returns for investors.

The Team Behind the Success:

- Olaf Carlson-Wee: Founder and CEO, bringing early crypto expertise from his time at Coinbase.

- Matt Perona: COO and CFO, with over 10 years of experience in traditional finance.

The Foundation of Polychain Capital

At its core, Polychain Capital was created to harness the transformative power of blockchain technology. The founders recognized early on that this innovative sector required a dedicated investment model that could navigate its complexities.

The firm pioneered a new category of investment funds that specifically targets digital currencies and blockchain-based projects. This foresight has enabled Polychain Capital to not only achieve significant returns but also contribute to shaping the future of finance.

With a focus on diverse sectors within the crypto ecosystem, Polychain Capital’s investments reflect a deep understanding of the various layers of this evolving landscape.

Growth Through Innovation

The journey of Polychain Capital is marked by remarkable growth and achievements. From initially securing $5 million in seed funding to becoming the first crypto fund to manage over $1 billion in assets, it exemplifies how an innovative approach can lead to success.

As the firm expanded, it began attracting investments from well-known venture capital firms such as Founders Fund and Sequoia Capital. This backing, alongside its strategic investments, provided the necessary momentum for the firm’s continuous evolution.

In recent years, Polychain Capital has maintained this trend of growth, recently achieving a valuation of $5 billion. This represents a staggering 125,000% increase from its initial valuation, illustrating the soundness of its investment strategy and the demand for its expertise in the blockchain sector.

Evolution and Milestones:

- 2016: Founded by Olaf Carlson-Wee with initial funding from top-tier investors.

- 2017: Achieved an impressive 2,303% return for investors, one of the highest in investment history.

- 2018: Became the first crypto investment firm to manage over $1 billion in assets.

- 2021: Co-led a $230 million investment in the Avalanche ecosystem.

- 2022: Valued at $5 billion, demonstrating a 125,000% growth since inception.

- 2023: Managed over $6 billion in assets and invested in over 195 projects.

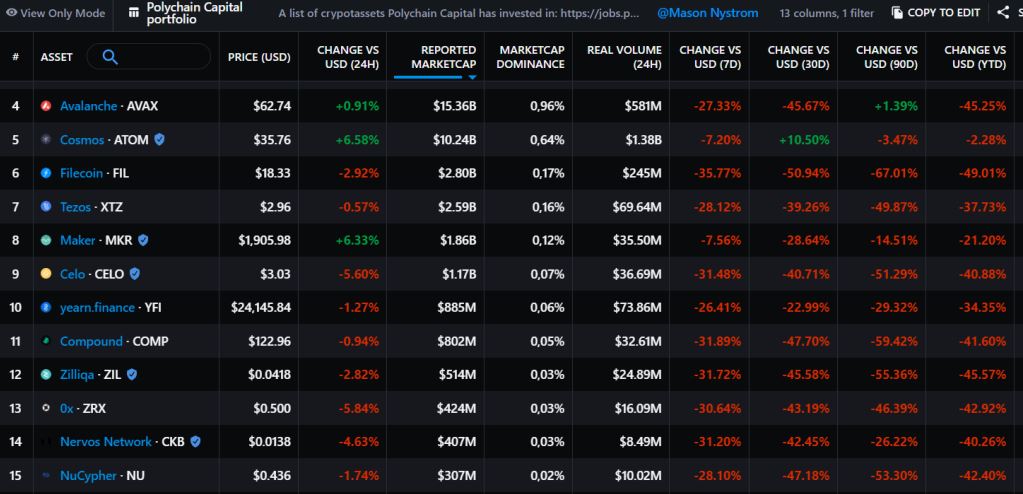

Key Portfolio Highlights

Polychain Capital has backed some of the most successful projects in the crypto space:

- Uniswap: A leading decentralized exchange (DEX) that revolutionized token swapping.

- Solana: A high-performance blockchain platform known for its speed and scalability.

- Avalanche: A platform for launching decentralized applications and enterprise blockchains.

- Arbitrum: A layer-2 scaling solution for Ethereum that improves transaction speed and cost.

- Scroll: A zk-Rollup solution for Ethereum, enhancing scalability and security.

- SPACE ID: A domain name service for Web3, simplifying identity management.

- Polyhedra Network: Building infrastructure for Web3 interoperability and privacy using zero-knowledge proofs.

- Berachain: A Cosmos-SDK-based layer-1 blockchain with a unique Proof of Liquidity consensus mechanism.

Key Projects in the Portfolio:

One of the most compelling aspects of the Polychain Capital portfolio is its selection of key projects. These investments span decentralized exchanges (DEXs), layer-1 and layer-2 blockchains, and Web3 infrastructure.

For instance, the inclusion of Uniswap—a pioneering DEX—highlights Polychain’s commitment to supporting projects that enhance decentralized governance and trading. Uniswap’s significant market presence has transformed how users interact with tokens and other digital assets.

Similarly, Polychain’s investment in Solana reflects its focus on scalability and performance in blockchain networks. Solana’s ability to support rapid transaction speeds at low costs makes it a preferred choice for developers and users alike.

Exploring Polychain Crypto Investments

When examining the overall picture of Polychain Capital’s influence, it is essential to analyze its polychain crypto investments. The firm’s strategic selections encompass a wide range of projects, each contributing uniquely to the blockchain ecosystem.

From decentralized platforms to innovative financial instruments, Polychain Capital’s investments illustrate its understanding of the diverse array of possibilities within the cryptocurrency space.

Decentralized Finance (DeFi)

One of the most significant areas of investment for Polychain Capital is decentralized finance (DeFi). This emerging sector has revolutionized traditional financial services by providing users with direct control over their assets through smart contracts.

Polychain Capital’s involvement in projects like Uniswap and Aave demonstrates its commitment to supporting DeFi innovations. These platforms empower users to trade and lend assets without intermediaries, creating a more inclusive financial system.

Layer-1 and Layer-2 Solutions

The evolution of blockchain technology has given rise to both layer-1 and layer-2 solutions, aimed at addressing scalability and transaction speed issues. Polychain Capital recognizes the importance of these advancements and has invested in noteworthy projects.

Solana, a high-performance blockchain platform, illustrates Polychain’s focus on supporting scalable solutions. Investments in layer-2 projects like Arbitrum further emphasize the firm’s commitment to enhancing the overall efficiency of blockchain networks.

Web3 Infrastructure

Web3 represents the next generation of the internet, where decentralization and user empowerment take center stage. Polychain Capital has strategically positioned itself to invest in Web3 infrastructure projects, recognizing their potential to reshape online interactions.

By backing initiatives that promote decentralized identity management, privacy solutions, and user-controlled data, Polychain Capital plays a pivotal role in driving the realization of a truly decentralized web.

Polychain Capital’s Impact on the Blockchain Ecosystem

The influence of Polychain Capital extends far beyond its portfolio. The firm’s proactive engagement with projects, coupled with its commitment to fostering innovation, positions it as a key player in the blockchain ecosystem.

Through its investments, Polychain Capital has contributed to the establishment of successful projects, driving advancements that benefit both investors and users alike.

Supporting Emerging Talent

A significant aspect of Polychain Capital’s impact is its dedication to supporting emerging talent within the blockchain space. By investing in early-stage projects, the firm provides crucial resources and mentorship to help entrepreneurs navigate the challenges of building successful ventures.

This focus on nurturing talent not only strengthens individual projects but also contributes to the overall growth of the ecosystem. As new ideas emerge and gain traction, the landscape becomes richer and more diverse.

Driving Adoption

Polychain Capital’s investments play a vital role in driving adoption of blockchain technology across various sectors. By backing projects that provide tangible solutions to real-world problems, the firm helps bridge the gap between traditional finance and decentralized alternatives.

This adoption is essential for transforming perceptions of cryptocurrency and blockchain, fostering trust among users, investors, and regulators. Polychain Capital’s efforts contribute significantly to this ongoing shift in mindset.

Fostering Community Engagement

Community engagement is another area where Polychain Capital makes a meaningful impact. The firm actively participates in discussions surrounding industry regulations, technological advancements, and best practices.

By fostering dialogues among stakeholders, including developers, investors, and policymakers, Polychain Capital helps shape the future of the blockchain ecosystem. This collaborative approach ensures that diverse perspectives are considered when navigating the industry’s complexities.

Key Strategies of Polychain Capital’s Investment Approach

The success of Polychain Capital can be attributed to its carefully crafted investment strategies. By adhering to a disciplined approach, the firm effectively manages risks while maximizing potential returns.

Rigorous Due Diligence

At the heart of Polychain Capital’s investment process is a commitment to rigorous due diligence. Each potential investment undergoes thorough analysis, assessing factors such as the project’s technology, team, market positioning, and growth potential.

This meticulous evaluation ensures that only the most promising projects are included in the Polychain Capital portfolio. By conducting comprehensive research, the firm minimizes risks and enhances the likelihood of successful outcomes.

Long-term Investment Horizon

Unlike many traditional investors who may prioritize short-term gains, Polychain Capital adopts a long-term investment horizon. This patient approach allows the firm to ride out market volatility and capitalize on the compounding effects of sustained growth.

By emphasizing long-term value creation, Polychain Capital aligns its interests with those of its portfolio companies, fostering a collaborative environment that promotes innovation and success.

Active Involvement in Projects

Another defining characteristic of Polychain Capital’s investment strategy is active involvement in projects. The firm does not merely provide capital; it seeks to engage with the teams behind its investments, offering guidance and support as needed.

This hands-on approach enables Polychain Capital to monitor progress closely, ensuring alignment with its vision and objectives. Additionally, it fosters strong relationships with project founders, facilitating open communication and collaboration.

Future Outlook for Polychain Capital and Crypto Markets

As we look to the future, the prospects for Polychain Capital and the broader cryptocurrency market are both promising and challenging. The firm stands poised to navigate the evolving landscape while continuing to drive innovation and growth in the blockchain ecosystem.

Evolving Market Dynamics

The cryptocurrency market is subject to constant change, influenced by technological advancements, regulatory developments, and shifting consumer preferences. Polychain Capital acknowledges these dynamics and remains agile in its investment strategies.

By staying attuned to emerging trends and potential disruptors, Polychain Capital can capitalize on new opportunities while mitigating risks associated with market fluctuations.

Continued Focus on Innovation

Innovation will remain a central theme for Polychain Capital as it seeks to identify projects that challenge conventional norms and push the boundaries of what’s possible within the blockchain space.

By supporting groundbreaking initiatives, the firm aims to foster a climate of creativity and experimentation, paving the way for transformative change in the financial sector.

Strengthening Industry Relationships

Building and maintaining strong relationships within the blockchain ecosystem will be paramount for Polychain Capital’s continued success. By collaborating with entrepreneurs, developers, and regulators, the firm can contribute to shaping the future of the industry.

This collaborative mindset not only enhances Polychain Capital’s investment strategies but also reinforces its position as a thought leader in the crypto landscape.

Polychain Capital’s success story is a testament to the power of foresight and deep understanding in the rapidly evolving crypto landscape. As they continue to invest in and support groundbreaking projects, their influence on the future of blockchain technology is undeniable.