What Are the Gemini Trading Types?

Gemini provides a dynamic trading ecosystem designed to accommodate everyone—from casual investors to seasoned professionals. Each trading type comes with unique mechanics and benefits, making Gemini a versatile platform. Here’s a breakdown of the primary Gemini trading types and what they entail.

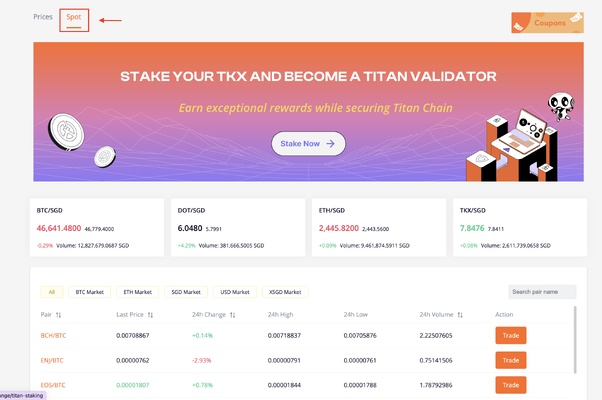

Spot Trading: The Gateway to Crypto Markets

Spot trading is the cornerstone of Gemini’s offerings, offering a simple yet effective way to buy and sell cryptocurrencies at current market prices. Trades settle almost instantly, making it a popular choice for those new to crypto or anyone seeking a low-risk entry point.

- How It Works: In spot trading, you exchange one asset for another—think Bitcoin (BTC) for U.S. dollars (USD)—based on real-time market rates. Gemini supports over 100 trading pairs, covering both crypto-to-crypto (e.g., BTC/ETH) and fiat-to-crypto (e.g., USD/BTC) transactions.

- Key Features:

- Fully funded trades: Gemini requires your account balance to cover the full trade amount, avoiding traditional margin in spot markets.

- Order variety: Choose from market orders, limit orders, or advanced options like Immediate or Cancel (IOC) and Fill or Kill (FOK).

- ActiveTrader Interface: For experienced traders, this platform offers real-time data, advanced charting, and detailed order books.

Spot trading is perfect for beginners or those who value simplicity and control. It’s accessible via Gemini’s web platform, mobile app, and APIs, making it a flexible starting point.

Gemini eOTC: Discreet Trading for Big Players

For those handling large volumes, Gemini eOTC (Electronic Over-the-Counter) offers a sophisticated solution. Designed for institutional investors and high-net-worth individuals, this trading type ensures minimal market disruption and optimal pricing for substantial trades.

- What Is Gemini eOTC?: Unlike public order books, eOTC facilitates direct trades between counterparties off-exchange. This reduces slippage and preserves market stability, ideal for large orders.

- How It Works:

- Trades are executed electronically with real-time price visibility and order tracking.

- Daily settlement occurs at a set time via a single net ticket, boosting efficiency with intraday credit.

- Available in 70 jurisdictions (excluding New York State in the U.S.), it’s offered through Gemini NuSTAR, LLC.

- Key Benefits:

- Liquidity: Partnerships with top market makers ensure competitive pricing.

- Security: Gemini’s full-reserve model and custodial status under New York Banking Law provide peace of mind.

- Voice OTC Option: A 24/7 desk offers personalized support for high-touch trading.

Gemini eOTC is a boon for asset managers, fintechs, or funds needing to move illiquid tokens or execute discreet, high-value trades.

Gemini Derivatives: High Stakes, High Rewards

For traders craving amplified exposure without owning the underlying assets, Gemini derivatives deliver through perpetual contracts. Offered via the Gemini Foundation (non-U.S.), this trading type caters to risk-takers seeking leverage and flexibility.

- What Are Gemini Derivatives?: These are perpetual contracts—futures-like instruments with no expiry—allowing traders to speculate on price movements of assets like Bitcoin or Ethereum.

- How It Works:

- Available in select regions (excluding the U.S., UK, and EU), trades occur on the ActiveTrader platform.

- Contracts are quoted and settled in GUSD, Gemini’s USD-pegged stablecoin.

- Traders can take long or short positions with leverage up to 100x on assets like BTC, ETH, and SHIB.

- Key Features:

- Leverage: Default at 20x, adjustable to 100x based on position size.

- Cross Collateral: Use multiple assets to manage risk and capital.

- Funding Payments: Periodic payments between counterparties balance positions.

In 2024, Gemini expanded its derivatives lineup with contracts like UNI/GUSD and HYPE/GUSD, catering to emerging trends. Gemini derivatives suit advanced traders willing to embrace high risk for potential high returns.

Gemini Margin Trading: Leveraging the Market

While Gemini margin trading isn’t available in the traditional spot market sense, it’s woven into the derivatives platform. This allows traders to use leverage to magnify their positions, offering a thrilling yet risky trading style.

- How It Works:

- Within derivatives, margin trading lets you control larger positions with borrowed funds via leverage (up to 100x).

- Initial and maintenance margins dictate position viability; falling below triggers liquidation.

- Why No Spot Margin?: Gemini’s spot market sticks to a full-reserve model, requiring full funding for trades—a nod to its security-first ethos.

For Gemini margin trading, the derivatives platform is your playground. It’s a high-stakes option best suited for seasoned traders who understand leverage and volatility.

How Gemini Ensures a Seamless Trading Experience

Beyond its diverse trading types, Gemini excels by prioritizing user experience and operational excellence. Here’s how it stands out:

- Intuitive Design: The mobile app and web platform are user-friendly, while ActiveTrader caters to pros with advanced tools.

- Robust APIs: Developers and algorithmic traders can integrate seamlessly with Gemini’s trading infrastructure.

- Customer Support: 24/7 assistance, including the Voice OTC Desk, ensures help is always available.

- Regulatory Compliance: As a New York Trust Company, Gemini adheres to strict standards, enhancing trust.

This blend of accessibility and professionalism makes every Gemini trading type—from spot to eOTC to derivatives—smooth and reliable.

Comparing Gemini Trading Types: Find Your Fit

Each Gemini trading type serves a unique purpose. Here’s a snapshot to help you decide:

| Trading Type | Best For | Risk Level | Key Feature |

|---|---|---|---|

| Spot Trading | Beginners, casual investors | Low | Simple, fully funded trades |

| Gemini eOTC | Institutions, large-volume traders | Low to Medium | Discreet, efficient large trades |

| Gemini Derivatives | Advanced traders, speculators | High | Leverage up to 100x, no expiry |

| Gemini Margin Trading | Experienced traders (via derivatives) | Very High | Amplified returns with leverage |

- Newbie? Spot trading is your safe bet.

- Big Spender? Gemini eOTC has you covered.

- Thrill-Seeker? Dive into derivatives and margin trading.

The Future of Trading on Gemini

Looking ahead, Gemini’s trajectory suggests even more innovation. With its 2024 derivatives expansion and ongoing enhancements to eOTC, the platform is poised to capture emerging trends like tokenized assets or decentralized finance (DeFi) integration. As the crypto market grows, expect Gemini to refine its trading types, potentially introducing new tools or expanding margin options—all while maintaining its security-first approach.

Why Gemini Stands Out

Gemini’s appeal lies in its blend of strengths:

- Security: Cold storage, multisignature tech, and SOC 2 Type II compliance safeguard your assets.

- Versatility: From spot to derivatives, there’s a trading type for every goal.

- Stablecoin Edge: GUSD integration offers stability in turbulent markets.

- Trust: Regulatory oversight as a New York Trust Company sets it apart.

Tips to Thrive with Gemini Trading Types

Maximize your Gemini experience with these strategies:

- Ease In: Begin with spot trading to build confidence.

- Master Leverage: Use stop-loss orders in derivatives to manage risk.

- Track Fees: ActiveTrader and derivatives fees vary by volume—plan wisely.

- Stay Updated: Watch for new contracts or features to seize opportunities.

Maximizing Profits with Gemini’s Unique Tools

Gemini goes beyond offering a variety of trading types by providing powerful tools designed to maximize your profits. With ActiveTrader, you gain access to real-time data and advanced order options, enabling precise and informed trading decisions. Gemini Earn allows you to lend your crypto and earn interest, serving as a perfect complement to low-risk spot trading. For those navigating volatile markets, GUSD—Gemini’s stablecoin—offers a reliable way to hedge risk, particularly in derivatives trading. Additionally, Gemini Custody provides secure storage tailored for institutional traders utilizing eOTC, ensuring peace of mind for large-scale operations. By combining these tools with strategic approaches, such as sticking to safe spot trades or diving into high-stakes derivatives, you’re well-equipped to succeed and boost your returns on the platform.

Conclusion

Gemini trading types unlock diverse opportunities for crypto enthusiasts, blending simplicity, sophistication, and high-octane potential. Whether you’re executing spot trades, leveraging Gemini eOTC, speculating with Gemini derivatives, or amplifying gains via Gemini margin trading, this platform has you covered. As of March 10, 2025, Gemini’s commitment to security and innovation makes it a standout choice.